United States Liquid Coffee Market Size, Share, and COVID-19 Impact Analysis, By Type (Flavored and Unflavored), By End-User (Household, Food Service Industry, and Food Processing Industry), and United States Liquid Coffee Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited States Liquid Coffee Market Insights Forecasts to 2033

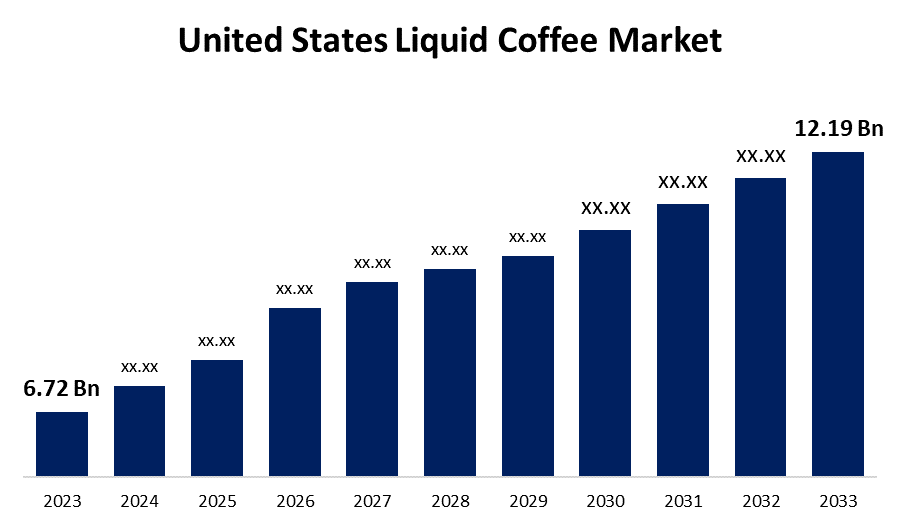

- The United States Liquid Coffee Market Size was valued at USD 6.72 Billion in 2023

- The Market Size is Growing at a CAGR of 6.14% from 2023 to 2033

- The U.S Liquid Coffee Market Size is Expected to reach USD 12.19 Billion by 2033

Get more details on this report -

The United States Liquid Coffee Market Size is anticipated to Exceed USD 12.19 Billion by 2033, Growing at a CAGR of 6.14% from 2023 to 2033. The growing need for portable and ready-to-drink coffee options, the population in metropolitan regions, the demand for new-generation cafes, and an increase in the disposable income of young consumers are driving the growth of the liquid coffee market in the United States.

Market Overview

Liquid Coffee is a beverage prepared from roasted coffee beans renowned for its aroma and rich flavor. The caffeine content in the coffee has a stimulating effect on humans. People most commonly drink coffee to increase mental alertness. Drinking caffeinated coffee throughout the day seems to increase alertness and thinking skills. Caffeine can also improve alertness after sleep deprivation. It is possibly effective for diabetes, cancer, heart disease, high blood pressure, dementia, and many other conditions. Consumers are becoming more health-conscious than ever before, however. According to data from McKinsey, half of US consumers reported “wellness” as a top daily priority in their lives. The growing demand for coffee pods and capsules is an ever-increasing trend in the US coffee industry. Coffee capsules have gained high levels of popularity in the last decades due to their convenience of use, flavor choices, and consistent extraction quality. NatureWorks and IMA Coffee developed biopolymer coffee pods that offer excellent brewing performance and use eco-friendly, biodegradable materials.

Report Coverage

This research report categorizes the market for the US liquid coffee market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid coffee market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US liquid coffee market.

United States Liquid Coffee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 6.72 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.14% |

| 023 – 2033 Value Projection: | USD 12.19 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-User |

| Companies covered:: | The Kraft Heinz Company, Eight O’ Clock Coffee Company, The J.M. Smucker Company, All American Coffee LLC, F. Gavina & Sons, Inc., Keurig Dr Pepper Inc., Coffee Beanery, Costa Coffee, Four Barrel Coffee, Gloria Jean’s Coffees, and Others key vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The coffee consumption rate has increased in the US by 5% since 2015. According to NCAUSA’s survey, US adults consume an average of 1.87 cups of coffee every day. The strong popularity of specialty coffee across various age groups has driven the market demand for liquid coffee as it is shaping consumer preferences in the US. The increasing demand for coffee pods and capsules significantly contributes to the market growth. Further, the rising demand for ready-to-drink coffee as an instant energy drink is becoming more popular among the working and young age population. The launch of various new products of coffee by the market players in the US is also contributing to market growth for liquid coffee.

Restraining Factors

The high cost of coffee owing to the high production costs, marketing, advertising costs, cost of raw materials, shipping, and distribution costs. The fluctuation in coffee bean prices due to weather conditions and international demand. Further, supply chain issues, pandemic shutdowns, and labor disputes have tremendously raised coffee prices in the US.

Market Segmentation

The United States Liquid Coffee Market share is classified into type and end-user.

- The flavored coffee segment is witnessing the highest CAGR growth in the US liquid coffee market during the forecast period.

The United States liquid coffee market is segmented by type into flavored and unflavored. Among these, the flavored coffee segment is witnessing the highest CAGR growth in the US liquid coffee market during the forecast period. There is a rising trend of trying new flavors and the availability of variants of flavored coffee. The increasing emphasis on producing unique and authentic flavors attracts customers and boosts sales. The increasing demand for flavored coffee among professionals and office workers has driven the market demand for flavored liquid coffee.

- The food service industry dominates the market with the largest market share through the forecast period.

The United States liquid coffee market is segmented by end-user into household, food service industry, and food processing industry. Among these, the food service industry dominates the market with the largest market share through the forecast period. There is an increased popularity of liquid coffee in food service industries such as hotels, restaurants, motels, cafes, takeaway outlets, fast food restaurants, and food delivery kiosks. The wide range of establishments including hotels, restaurants, and food delivery kiosks with growing consumer inclination towards consumption of instant liquid coffee is propelling market demand in the food services industry segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US liquid coffee market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Kraft Heinz Company

- Eight O’ Clock Coffee Company

- The J.M. Smucker Company

- All American Coffee LLC

- F. Gavina & Sons, Inc.

- Keurig Dr Pepper Inc.

- Coffee Beanery

- Costa Coffee

- Four Barrel Coffee

- Gloria Jean’s Coffees

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, Keurig Dr Pepper Inc. and BLK & Bold Specialty Beverages announced the launch of BLK & Bold coffees in K-Cup pods for the Keurig brewing system.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Liquid Coffee Market based on the below-mentioned segments:

United States Liquid Coffee Market, By Type

- Flavored

- Unflavored

United States Liquid Coffee Market, By End-User

- Household

- Food Service Industry

- Food Processing Industry

Need help to buy this report?