United States Liquid Waste Management Market Size, Share, and COVID-19 Impact Analysis, By Category (CWT and Onsite Facilities), By Waste Type (Residential, Commercial, and Industrial), By Source (Municipal, Textile, Pulp & Paper, Iron & Steel, Automotive, Pharmaceutical, Oil & Gas, and Others), By Services (Collection, Transportation/Hauling, Treatment, and Disposal/Recycling), and United States Liquid Waste Management Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Liquid Waste Management Market Insights Forecasts to 2033

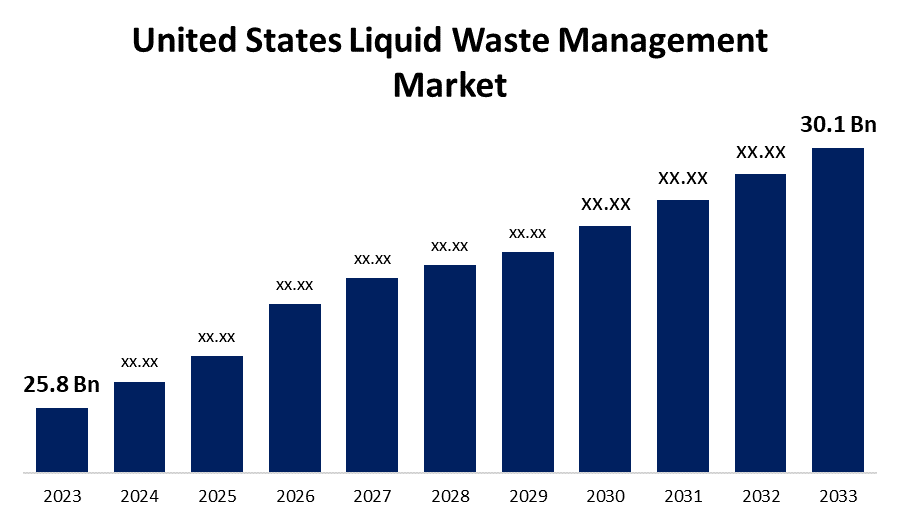

- The U.S. Liquid Waste Management Market Size was valued at USD 25.8 Billion in 2023.

- The Market is growing at a CAGR of 1.55% from 2023 to 2033

- The U.S. Liquid Waste Management Market Size is expected to reach USD 30.1 Billion by 2033

Get more details on this report -

The United States Liquid Waste Management Market is anticipated to exceed USD 30.1 Billion by 2033, growing at a CAGR of 1.55% from 2023 to 2033. The growing industrial manufacturing sector, government initiatives, and increasing concerns over the environmental impact of industrial wastewater discharge are driving the growth of the liquid waste management market in the US.

Market Overview

Liquid waste management is the process and practice of preventing the release of contaminants, hazardous liquid byproducts, and hazardous chemicals into water bodies or drainage systems. Transforming wastewater into suitable effluent that may be dumped on land, in rivers, or in the ocean is the main goal of liquid waste treatment. Contamination by liquid waste is very significant as it contaminates the air, land, and water, which has negative effects on both humans and animals. As a result, careful handling is crucial to limiting the risk of crop damage, disease transmission, etc. The growing water crises and emphasis on treating emerging contaminates provide lucrative market opportunities for liquid waste management. Researchers have created a cheap and environmentally friendly method to use sunlight to break out contaminated liquid waste. Industries' waste management expenses are anticipated to decrease substantially by using innovative technology.

Report Coverage

This research report categorizes the market for the US liquid waste management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States liquid waste management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US liquid waste management market.

United States Liquid Waste Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 25.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.55% |

| 2033 Value Projection: | USD 30.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Category, By Waste Type, By Source, By Services |

| Companies covered:: | Veolia, Clean Harbors, Clean Water Environmental, Waste Management Solutions, Covanta Holding Corporation, Stericycle, Inc., DC Water, Republic Services, Inc., US Ecology, Inc., Hazardous Waste Experts, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Heavy metals and chemical elements, such as lead, arsenic, and mercury, are found in effluent from the industrial sector which are generally harmful to the environment. Thus, the growing environmental concerns in industrial waste discharge are driving up the US liquid waste management market. Expanding the nation's infrastructure for wastewater management is a top priority for the US government. Furthermore, new, strict laws restrict the concentration of chemicals and harmful substances in wastewater discharge for both the commercial and industrial sectors which leads to drives the market demand.

Restraining Factors

Liquid garbage is also more difficult to collect and process than solid waste. Additionally, piping system buildup causes liquid waste treatment plants to lose efficiency over time. These factors are anticipated to restrain the market for liquid waste management.

Market Segmentation

The United States Liquid Waste Management Market share is classified into category, waste type, source, and services.

- The CWT segment accounted for the largest revenue share of the US liquid waste management market in 2023.

The United States liquid waste management market is segmented by category into CWT and onsite facilities. Among these, the CWT segment accounted for the largest revenue share of the US liquid waste management market in 2023. Centralized treatment plants are used to treat wastewater from manufacturing and production plants and supply large municipal or regional areas. 34 billion gallons of wastewater are treated daily by centralized waste treatment facilities, which are the primary wastewater treatment plants, according to the U.S. EPA.

- The residential segment dominates the market with the largest market share in 2023.

The United States liquid waste management market is segmented by waste type into residential, commercial, and industrial. Among these, the residential segment dominates the market with the largest market share in 2023. The liquid waste generated from the residential segment including cooking, cleaning, washing, and bathing is effectively conveyed to treatment facilities by way of a sewage network. The U.S. EPA reports that more than 75% of the nation's population is connected to adequate wastewater treatment facilities which is responsible for driving the market.

- The municipal segment dominates the US liquid waste management market with the largest revenue share in 2023.

Based on the source, the U.S. liquid waste management market is divided into municipal, textile, pulp & paper, iron & steel, automotive, pharmaceutical, oil & gas, and others. Among these, the municipal segment dominates the US liquid waste management market with the largest revenue share in 2023. The wastewater produced by regular human activity in homes, workplaces, and other commercial structures is included in the municipal source category. The increasing wastewater generation from the municipal segment drives the market growth.

- The treatment segment held the largest revenue share of the US liquid waste management market in 2023.

Based on the services, the U.S. liquid waste management market is divided into collection, transportation/hauling, treatment, and disposal/recycling. Among these, the treatment segment held the largest revenue share of the US liquid waste management market in 2023. The three main stages of liquid waste treatment at wastewater treatment plants are primary, secondary, and tertiary treatment with additional pre-treatment procedures. The advancement of new infrastructure and treatment technologies for wastewater treatment facilities are driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. liquid waste management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Veolia

- Clean Harbors

- Clean Water Environmental

- Waste Management Solutions

- Covanta Holding Corporation

- Stericycle, Inc.

- DC Water

- Republic Services, Inc.

- US Ecology, Inc.

- Hazardous Waste Experts

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Ridgewood Infrastructure LLC a leading infrastructure investor in the U.S., announced the acquisition of Waste Resources Management ("WRM"), a mission-critical provider of liquids and wastewater collection, treatment, and disposal serving the commercial and industrial market.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Liquid Waste Management Market based on the below-mentioned segments:

US Liquid Waste Management Market, By Category

- CWT

- Onsite Facilities

US Liquid Waste Management Market, By Waste Type

- Residential

- Commercial

- Industrial

US Liquid Waste Management Market, By Source

- Municipal

- Textile

- Pulp & Paper

- Iron & Steel

- Automotive

- Pharmaceutical

- Oil & Gas

- Others

US Liquid Waste Management Market, By Services

- Collection

- Transportation/Hauling

- Treatment

- Disposal/Recycling

Need help to buy this report?