United States LNG Engine Market Size, Share, and COVID-19 Impact Analysis, By Type (Spark-ignited, Diesel-ignited, Direct Gas Injection), By End Use (Marine, Power Generation), and United States LNG Engine Market Insights Forecasts 2023 – 2033

Industry: Energy & PowerUnited States LNG Engine Market Insights Forecasts to 2033

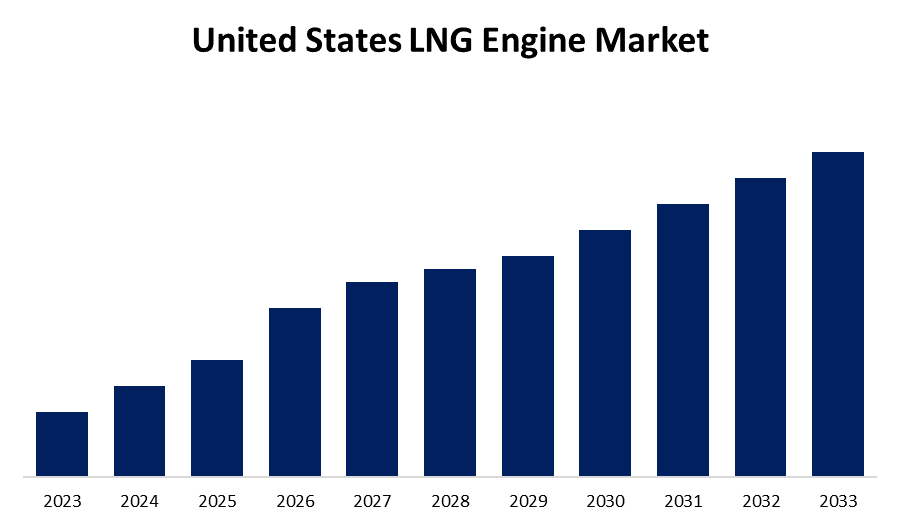

- The Market Size is Growing at a CAGR of 12.59% from 2023 to 2033.

- The United States LNG Engine Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States LNG Engine Market size is expected to Hold a Significant Share by 2033, at a CAGR of 12.59% during the forecast period 2023 to 2033.

Market Overview

LNG, or liquefied natural gas, is natural gas that has been cooled to approximately -162 degrees Celsius (-260 degrees Fahrenheit). This cooling process reduces the natural gas to a liquid state, making it easier to transport and store. LNG is odorless, colorless, and non-toxic, making it a safe and versatile fuel source. LNG engines are specifically designed to operate on liquefied natural gas. These engines use the energy released by burning LNG to generate power, which can then be used to propel vehicles, drive machinery, or generate electricity. LNG engines are classified into spark ignition engines, compression ignition engines, and dual-fuel engines based on the combustion process and the proportion of LNG and air/fuel mixture used. The expansion of LNG export infrastructure and increased production capacity have significantly contributed to the market's growth. Furthermore, advancements in LNG engine technology, combined with government incentives to encourage the use of cleaner fuels, have accelerated the integration of LNG engines into a variety of industries, including transportation and power generation. This confluence of factors highlights the strong and rising trajectory of the United States LNG engine market, indicating a strategic alignment with both economic and environmental purpose.

Report Coverage

This research report categorizes the market for the United States LNG engine market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States LNG engine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States LNG engine market.

United States LNG Engine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.59% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End Use and COVID-19 Impact Analysis. |

| Companies covered:: | Cummins Inc., Caterpillar Inc., Wärtsilä Corporation, MAN Energy Solutions SE, General Electric (GE), Siemens Energy, Rolls-Royce Holdings plc, INNIO Waukesha Gas Engines, Shell Gas & Power Developments B.V., Kawasaki Heavy Industries, Ltd. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The surge in the US LNG engine market is primarily driven by a growing emphasis on environmental sustainability and stringent regulatory measures aimed at lowering greenhouse gas emissions. The surge in the United States LNG engine market is driven by the country's abundant and economically competitive natural gas resources. Propelled by the shale gas revolution, the United States has tapped into vast natural gas reserves made available through advanced extraction techniques such as hydraulic fracturing. The remarkable growth of the United States LNG engine market is being driven by a strategic expansion of LNG export capacity. In a forward-thinking move, the country has made significant investments in the development of LNG export terminals, increasing its ability to supply liquefied natural gas to international markets. The dynamic approach of the United States LNG engine market is heavily influenced by continuous technological advancements in LNG engine technology. Continuous research and development efforts have resulted in innovations that improve the efficiency, performance, and reliability of LNG engines.

Restraining Factors

Changes in regulations, such as stricter emission limits or the implementation of new standards, can have an impact on market dynamics and necessitate additional investments to comply. Regulatory uncertainty can pose challenges for industry participants, potentially slowing market growth. The limited availability of LNG bunkering facilities, as well as the need for significant infrastructure investments, could hamper the widespread adoption of LNG engines in the marine industry.

Market Segment

- In 2023, the spark-ignited segment accounted for the largest revenue share over the forecast period.

Based on type, the United States LNG engine market is segmented into the spark-ignited, diesel-ignited, and direct gas injection. Among these, the spark-ignited segment has the largest revenue share over the forecast period. Spark-ignited LNG engines have gained popularity due to their efficiency, low emissions, and versatility in a variety of applications. These engines are suitable for a wide variety of applications, including transportation and power generation. The growing emphasis on environmental sustainability has driven up demand for spark-ignited LNG engines, which emit fewer nitrogen oxides and particulate matter than diesel-ignited engines. Furthermore, the maturity of spark-ignited engine technology and its compatibility with existing infrastructure have aided its dominance. As the market evolves, the spark-ignited segment is expected to maintain its dominance throughout the forecast period. Strengthen the position of spark-ignited LNG engines as the preferred option in the United States. The market's continued emphasis on lowering emissions and increasing energy efficiency is consistent with the inherent benefits of spark-ignited engines, reinforcing their dominance and driving further growth in this segment.

- The power generation segment is witnessing significant CAGR growth over the forecast period.

Based on end use, the United States LNG engine market is segmented into marine, and power generation. Among these, the power generation segment is witnessing the largest CAGR growth over the forecast period. LNG engines in power generation have several advantages, including lower emissions, increased efficiency, and improved grid reliability. The shift toward reducing environmental impact and meeting stringent emission standards has accelerated the use of LNG engines in power plants across the United States. As the demand for renewable and cleaner energy rises, LNG engines provide a flexible and dependable alternative to intermittent renewable sources, ensuring a steady power supply. This trend is expected to continue during the forecast period, with the power generation segment remaining dominant. The ongoing focus on decarbonization, combined with advancements in LNG engine technology designed specifically for power generation applications, contributes to LNG engines' continued growth and dominance in the US power generation sector. LNG engines, with their capacity to adapt to changing energy landscapes, are leading the way toward environmentally friendly and resilient power production solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States LNG engine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cummins Inc.

- Caterpillar Inc.

- Wärtsilä Corporation

- MAN Energy Solutions SE

- General Electric (GE)

- Siemens Energy

- Rolls-Royce Holdings plc

- INNIO Waukesha Gas Engines

- Shell Gas & Power Developments B.V.

- Kawasaki Heavy Industries, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, EcoTech Solutions, a major player in the US LNG engine market, unveiled its ground-breaking LNG engine technology, signaling a significant step forward in the industry. The innovative engine incorporates advanced features such as intelligent fuel management systems and improved emission control mechanisms, establishing it as a leader in the pursuit of cleaner and more efficient energy sources. EcoTech Solutions' commitment to technological advancement aligns with the growing demand for cutting-edge solutions in the dynamic LNG engine market, which addresses environmental concerns while optimizing performance.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States LNG engine market based on the below-mentioned segments:

United States LNG Engine Market, By Type

- Spark-ignited

- Diesel-ignited

- Direct Gas Injection

United States LNG Engine Market, By End Use

- Marine

- Power Generation

Need help to buy this report?