United States LNG Infrastructure Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquefaction Terminal and Regasification Terminal), By End User (Heavy-Duty Vehicles, Electric Power Generation and Marine Transport), and U.S. LNG Infrastructure Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerUnited States LNG Infrastructure Market Insights Forecasts to 2033

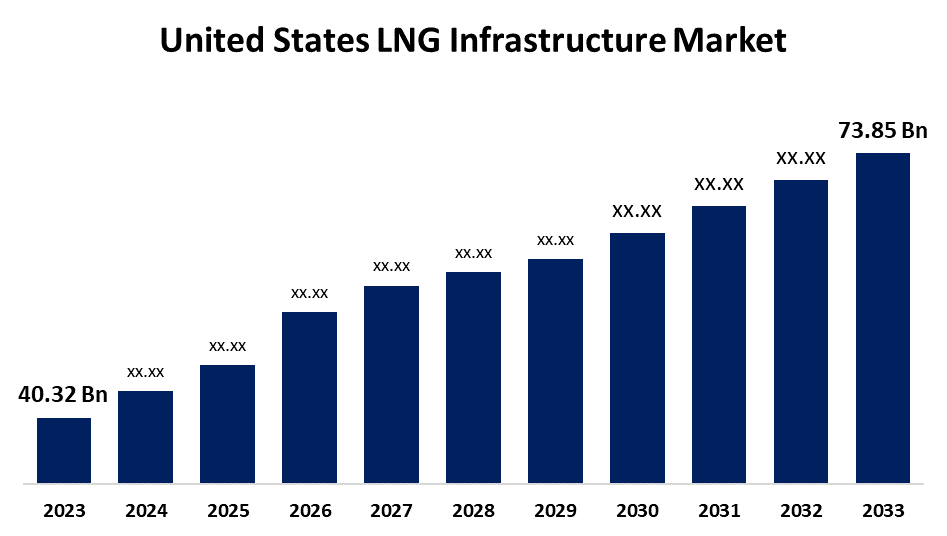

- The United States LNG Infrastructure Market Size was valued at USD 40.32 Billion in 2023.

- The Market Size is growing at a CAGR of 6.24% from 2023 to 2033

- The United States LNG Infrastructure Market Size is Expected to Reach USD 73.85 Billion by 2033

Get more details on this report -

The U.S. LNG Infrastructure Market is Anticipated to Exceed USD 73.85 Billion by 2033, growing at a CAGR of 6.24% from 2023 to 2033.

Market Overview

LNG is when natural gas is cooled to a liquid form at around -260° Fahrenheit so it can be transported and stored. The liquid state of natural gas takes up about 600 times less space than its gaseous state. This method allows for the transportation of natural gas to areas where pipelines are not available. Turning natural gas into liquid form is a method to transport natural gas over long distances when pipelines are not a viable option. Markets located too distant from production areas utilize LNG to gain access to natural gas since they cannot be directly connected to pipelines. Natural gas can be transported to terminals worldwide in specialized tankers in its condensed liquid state. LNG is transformed back into gas at these terminals before being moved through pipelines to distribution companies, industrial users, and power plants. The biggest natural gas producer in the world is the United States. Natural gas accounts for approximately one-third of the United States' total energy consumption, mainly used for heating and power generation. Although most natural gas in the United States is transported through pipelines in its gaseous state, the increasing global demand for natural gas has led to the adoption of liquefied natural gas (LNG) in the international market.

Report Coverage

This research report categorizes the market for the US LNG infrastructure market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States LNG infrastructure market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. LNG infrastructure market.

United States LNG Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 40.32 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.24% |

| 2033 Value Projection: | USD 73.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 168 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Chiyoda Corporation, Bechtel Corporation, McDermott International Inc, Dominion Energy Inc., Sempra Energy, Cheniere Energy Inc., TOTAL SA, Freeport LNG, Dow Chemical Company, Mitsubishi Corp., Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The rise in LNG production plays a crucial role in fueling the growth of the LNG infrastructure market in the US. The rise in availability of coalbed methane, shale gas, and tight gas has led to natural gas becoming one of the quickest-growing fossil fuels in the US. As per the IEA, the US is projected to account for 22% of the world's natural gas production by 2022, producing 890bcm. Although there is an increase in US domestic demand and natural gas production, over half of the extra natural gas produced is forecasted to be turned into LNG for export to nations with little to no domestic natural gas production to meet demand.

Restraining Factors

The current trade dispute between the US and China is impeding the growth of the LNG infrastructure market in the US.

Market Segmentation

The US LNG infrastructure market share is classified into type and end user.

- The liquefaction terminal segment is expected to hold a significant market share through the forecast period.

The United States LNG infrastructure market is segmented by type into liquefaction terminals and regasification terminals. Among these, the liquefaction terminal segment is expected to hold a significant market share through the forecast period. High worldwide demand for cleaner energy sources has led to a significant rise in LNG exports from the United States. This has prompted investments in liquefaction facilities, essential for converting natural gas to its liquid state for exporting.

- The electric power generation segment is expected to dominate the US LNG infrastructure market during the projected period.

Based on the end user, the United States LNG infrastructure market is divided into heavy-duty vehicles, electric power generation, and marine transport. Among these, the electric power generation segment is expected to dominate the US LNG infrastructure market during the projected period. Natural gas consumption is extensively contributed by the electric power generation industry. LNG is being used more often as a cleaner replacement for coal and other fossil fuels in power plants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States LNG infrastructure market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chiyoda Corporation

- Bechtel Corporation

- McDermott International Inc

- Dominion Energy Inc.

- Sempra Energy

- Cheniere Energy Inc.

- TOTAL SA

- Freeport LNG

- Dow Chemical Company

- Mitsubishi Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, Gulfstream LNG Development submitted a mid-sized greenfield LNG export project to the DOE for approval, proposing to export 4 million metric tons of LNG annually to both FTA and non-FTA countries.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States LNG Infrastructure Market based on the below-mentioned segments:

United States LNG Infrastructure Market, By Type

- Liquefaction Terminal

- Regasification Terminal

United States LNG Infrastructure Market, By End User

- Heavy-Duty Vehicles

- Electric Power Generation

- Marine Transport

Need help to buy this report?