United States Lubricants Market Size, Share, and COVID-19 Impact Analysis, By Application (Automotive and Industrial), By Product Type (Engine oil and Greases) and United States Lubricants Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Lubricants Market Insights Forecasts to 2033

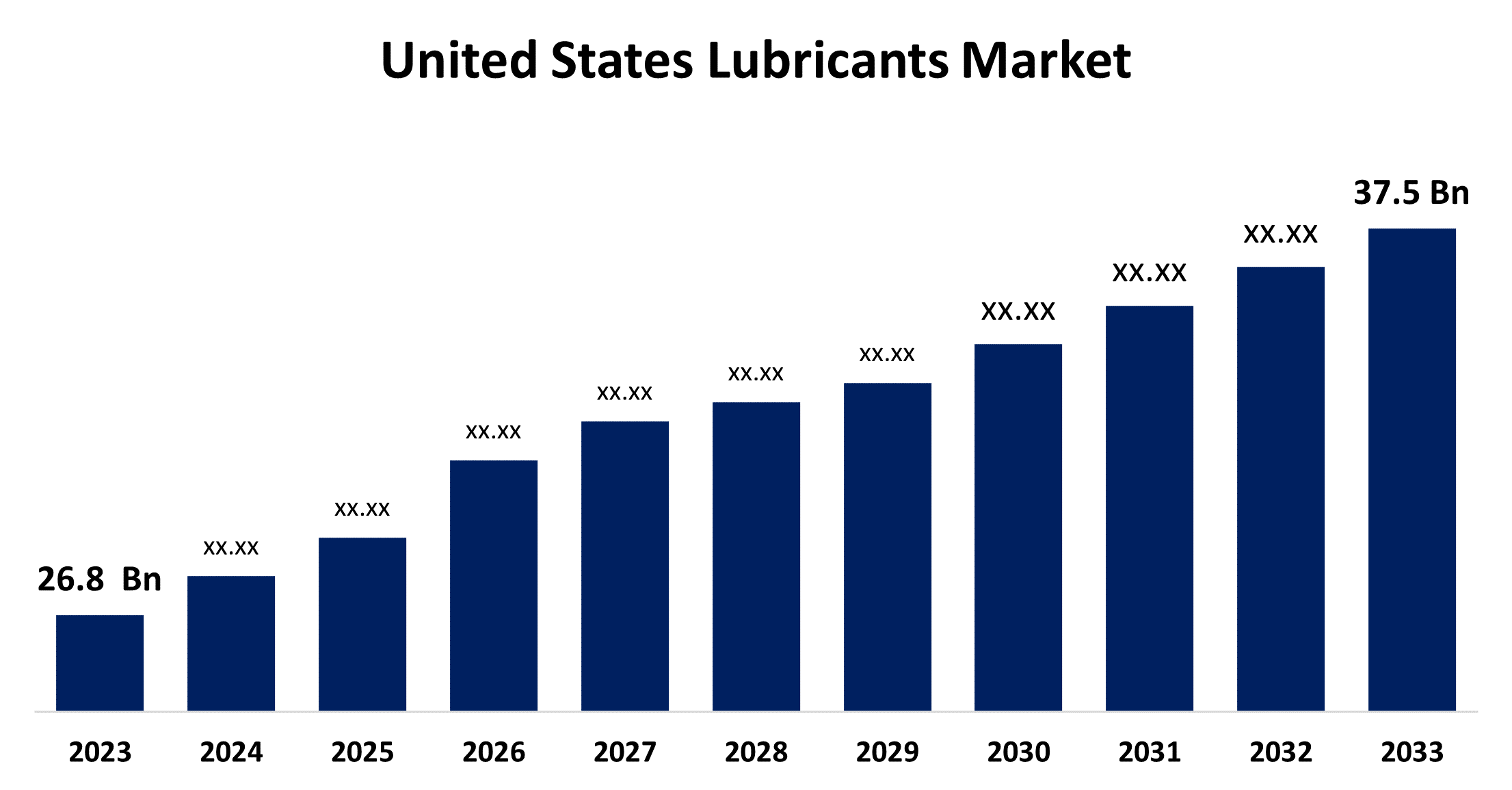

- The United States Lubricants Market Size was valued at USD 26.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.42% from 2023 to 2033

- The U.S Lubricants Market Size is Expected to reach USD 37.5 Billion by 2033

Get more details on this report -

The United States Lubricants Market Size is anticipated to exceed USD 37.5 Billion by 2033, growing at a CAGR of 3.42% from 2023 to 2033.

Market Overview

Lubricant is a substance that is used to control (more often to reduce) friction and wear of the surfaces in contact with the bodies in relative motion. The goal of any lubrication approach is to separate the rubbing surfaces by a lubricant layer, which prevents (or at least minimizes) direct contact with the bodies. By choosing the appropriate lubricant, the friction and wear of the materials can be controlled. Lubricants are used within many industries, from automotive to food production to reduce friction, reduce contamination, protect against corrosion, and prevent wear and tear. Lubricants are majorly used in automotive and industrial sectors and account for 90% share of the market. The introduction of electric vehicles and the changing emission regulations are enhancing the growth of the automobile industry. Premium lubricants are expected to be the primary factor for market expansion. Further strategic partnerships and collaborations are improving brand recognition and investment in new product development. Manufacturing companies are developing OEM parts and after-sales services, which could offer further growth opportunities in the near future. Consumers are paying attention to the improvement of vehicle performance and innovation and premium products and alternative brands. Future growth will be strongly influenced by the number of automobiles manufactured and kilometers driven by each vehicle.

Report Coverage

This research report categorizes the market for the US lubricants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing US lubricants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of US lubricants market.

United States Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 26.8 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.42% |

| 2033 Value Projection: | USD 37.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Product Type |

| Companies covered:: | BP Plc (Castrol), Royal Dutch Shell Plc, ExxonMobil Corporation, Chevron, Valvoline, Philips 66 Lubricants, Ashland Inc., Petro-Canada Lubricants, ConocoPhilips, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The lubricants function to enhance performance, reduce emissions, and extend equipment life in the automotive industry Thus, there growing demand for high-performance lubricants which leads to enhancing the lubricant market. Further, the development of synthetic lubricants and bio-based alternatives are driving the market expansion. There is a growing industrial manufacturing demand for vehicles, particularly in emerging economies, that leads to enhancing the market demand for lubricants in the automotive industry. Owing to the above factors, there is rising market growth in the US lubricants market. Further, the rising awareness regarding maintenance, the long life of machinery, and the benefits of using quality industrial lubricants are in demand in the market.

Restraining Factors

As the crude oil demand rises due to increasing environmental concerns hampering the market growth. Further, the adoption of electric vehicles is expected to slow the growth of the automobile industry ultimately leading to restrain the market of lubricants.

Market Segmentation

The United States Lubricants Market share is classified into application and product type.

- The automotive segment dominates the market with the largest share of United States lubricants market during the forecast period.

The United States lubricants market is segmented by application into automotive and industrial. Among these, the automotive segment dominates the market with the largest share of the United States lubricants market during the forecast period. Lubricating oils are used for friction reduction between vehicle components and absorb heat generated by the moving parts. Thus, the rising use of lubricants in automotive sectors leads to driving the market in the automotive segment.

- The engine oil segment is expected to grow at the fastest CAGR during the forecast period.

The United States lubricants market is segmented by product type into engine oil and greases. Among these, the engine oil segment is expected to grow at the fastest CAGR during the forecast period. Lubricants have a low coefficient of friction, minimizing wear and tear on mechanical components that move a lot and use less fuel. This helps to keep engine parts clean, smoothen functioning, and provide optimum combustion efficiency. Thus, various functioning of lubricants in automotive sectors leads to driving the market in the engine oil segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US lubricants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BP Plc (Castrol)

- Royal Dutch Shell Plc

- ExxonMobil Corporation

- Chevron

- Valvoline

- Philips 66 Lubricants

- Ashland Inc.

- Petro-Canada Lubricants

- ConocoPhilips

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2021, Shell Rotella unveils a portfolio of carbon-neutral engine oils in the U.S. Shell Rotella will offer customers carbon-neutral lubricants for heavy-duty engines in North America.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Lubricants Market based on the below-mentioned segments:

United States Lubricants Market, By Application

- Automotive

- Industrial

United States Lubricants Market, By Product Type

- Engine oil

- Greases

Need help to buy this report?