United States Luxury Travel Market Size, Share, and COVID-19 Impact Analysis, By Type (Customized & Private Vacations, Luxury Trains, Safari & Adventure, Culinary Travel & Shopping, and Others), By Age Group (21-30 Years, 31-40 Years, 41-60 Years, and 60 and Above), By Booking Mode (Direct Booking, Concierge Services, and Online Travel Agencies (OTAs)), and USA Luxury Travel Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Luxury Travel Market Insights Forecasts to 2033

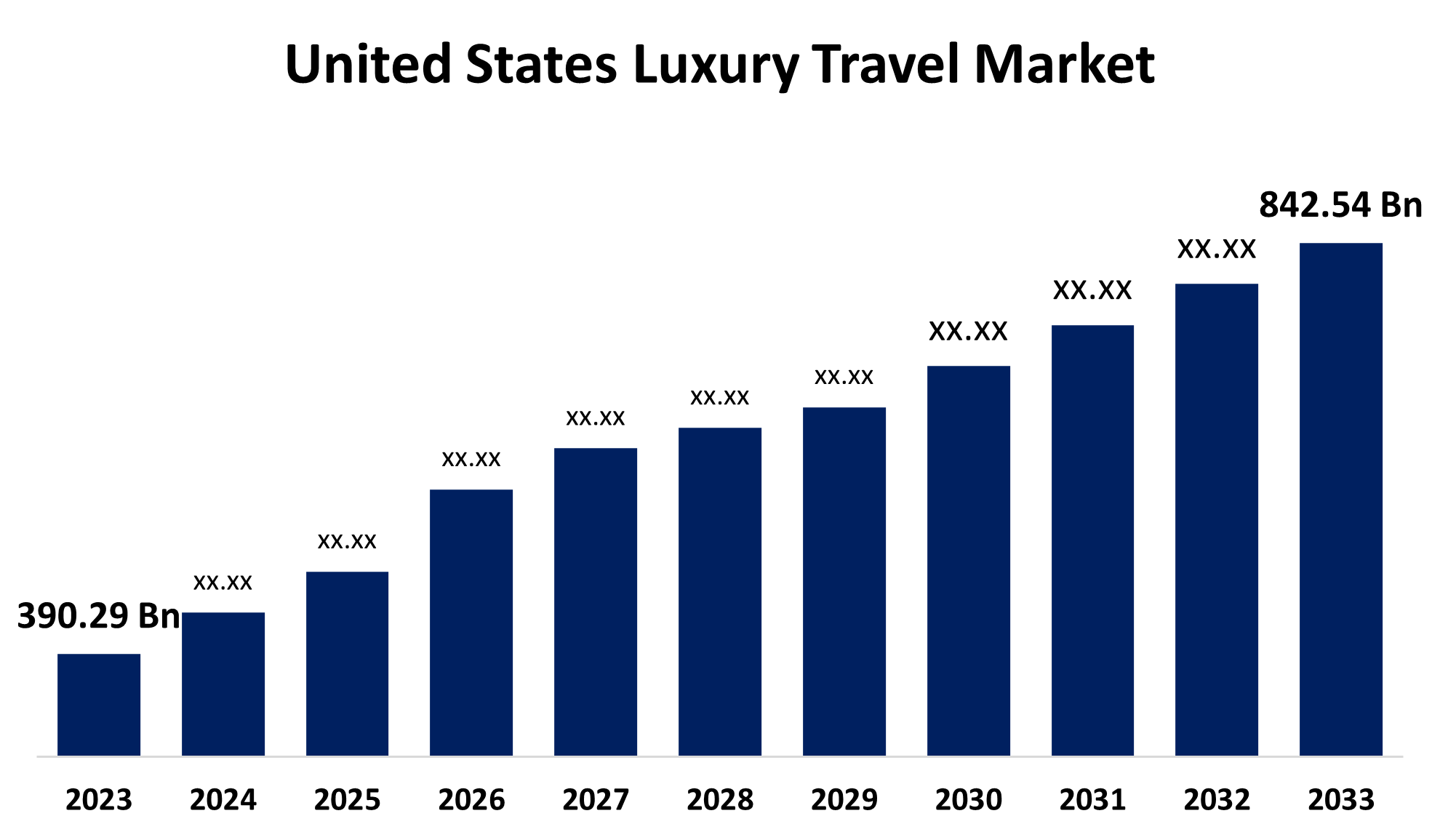

- The United States Luxury Travel Market Size was estimated at USD 390.29 billion in 2023.

- The Market Size is Growing at a CAGR of 8.00% from 2023 to 2033

- The USA Luxury Travel Market Size is Expected to Reach USD 842.54 billion by 2033

Get more details on this report -

The United States Luxury Travel Market Size is Expected to Reach USD 842.54 billion by 2033, Growing at a CAGR of 8.00% from 2023 to 2033.

Market Overview

The U.S. luxury travel market refers to the segment of the travel industry focused on high-end, premium, or exclusive travel experiences. It typically includes services and products that are tailored to affluent travelers who seek personalized, comfortable, and indulgent vacations. The increase in high-net-worth individuals, a growing desire for individualized, distinctive experiences, and rising disposable income are the primary drivers of the luxury travel sector in the United States. Additionally, demand has been further fueled by the growing significance of sustainable tourism, as upscale tourists often look for eco-friendly vacation plans and lodgings without sacrificing comfort and first-rate service. In addition, this market boom has been greatly aided by the quick rise of upscale services like private villas, luxury boats, and chartered planes. Furthermore, ongoing development in digital platforms makes it easier to arrange upscale, customized adventures, but travel preferences are also influenced by health and safety concerns.

Report Coverage

This research report categorizes the market for the U.S. luxury travel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. luxury travel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. luxury travel market.

United States Luxury Travel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 390.29 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.00% |

| 2033 Value Projection: | USD 842.54 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Age Group, By Booking Mode |

| Companies covered:: | Abercrombie & Kent USA, Lindblad Expeditions, Scott Dunn Ltd., Kensington Tours Ltd., Pique Travel Design, The Luxury Travel Agency, Brownell Travel, All Roads North, Tully Luxury Travel Inc., Black Tomato, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The US luxury travel market is driven by wealthy tourists looking for comfort and convenience, who have more money to spend on private excursions, luxury cruises, upscale resorts, and customized services. Additionally, the growing demand from high-net-worth individuals for upscale, personalized travel experiences is driving the luxury travel industry in the United States. This shift away from mass tourism and toward distinctive experiences, like cultural tours and private yacht charters, encourages leisure and personal development. Furthermore, technological developments that provide easy reservations and customized experiences have also increased demand for high-end travel options. In addition, due to longer life expectancies and better health, more people are traveling, particularly retired workers, and leisurely beach vacations and mild fitness regimens are assuming the place of soft adventure tourism.

Restraining Factors

The USA luxury travel market faces challenges due to its high cost, luxury travel experiences may only be available to a select group of wealthy tourists. Many potential clients may be put off by the expensive prices of private transportation, upscale lodging, and exclusive activities.

Market Segmentation

The U.S. luxury travel market share is classified into the type, age group, and booking mode.

- The customized & private segment accounted for the largest share of 24.58% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the U.S. luxury travel market is divided into customized & private vacations, luxury trains, safari & adventure, culinary travel & shopping, and others. Among these, the customized & private segment accounted for the largest share of 24.58% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to the demand for customized travel experiences, which is rising in the luxury travel sector due to wealthy customers looking for one-of-a-kind, customized trips, highlighting the value of personalization.

- The 41-60 years segment accounted for the highest share of 35.42% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the age group, the U.S. luxury travel market is divided into 21-30 years, 31-40 years, 41-60 years, and 60 and above. Among these, the 41-60 years segment accounted for the highest share of 35.42% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is expanding due to their disposable wealth, distinct holiday preferences, and emphasis on premium, exclusive services, this generation is becoming more and more interested in luxury travel experiences. In addition, the increased availability of age-specific packages, ease of booking, and an increasing emphasis on wellness and immersive travel are all contributing factors to the rise in popularity of the luxury travel sector.

- The direct booking segment accounted for the largest share of 45% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the booking mode, the U.S. luxury travel market is divided into direct booking, concierge services, and online travel agencies (OTAs). Among these, the direct booking segment accounted for the largest share of 45% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing because direct bookings are still quite popular in the luxury travel sector, because of the growing confidence in online booking systems, and the demand for a smooth booking process.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. luxury travel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abercrombie & Kent USA

- Lindblad Expeditions

- Scott Dunn Ltd.

- Kensington Tours Ltd.

- Pique Travel Design

- The Luxury Travel Agency

- Brownell Travel

- All Roads North

- Tully Luxury Travel Inc.

- Black Tomato

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, the Luxurist, the first all-inclusive luxury travel ecosystem in the world, announced its official debut. In the B2B premium travel sector, the Luxurist seeks to set a new standard by providing luxury travel advisors with a strong planning ecosystem and intelligent backend infrastructure.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. luxury travel market based on the below-mentioned segments:

United States Luxury Travel Market, By Type

- Customized & Private Vacations

- Luxury Trains

- Safari & Adventure

- Culinary Travel & Shopping

- Others

United States Luxury Travel Market, By Age Group

- 21-30 Years

- 31-40 Years

- 41-60 Years

- 60 and Above

United States Luxury Travel Market, By Booking Mode

- Direct Booking

- Concierge Services

- Online Travel Agencies (OTAs)

Need help to buy this report?