United States Masterbatch Market Size, Share, and COVID-19 Impact Analysis, By Type (White, Black, Additive, Color, Others), By End Users (Packaging, Building & Construction, Consumer Goods, Automotive, Textile, and Others), and United States Masterbatch Market Insights Forecasts 2023 – 2033

Industry: Specialty & Fine ChemicalsUnited States Masterbatch Market Insights Forecasts to 2033

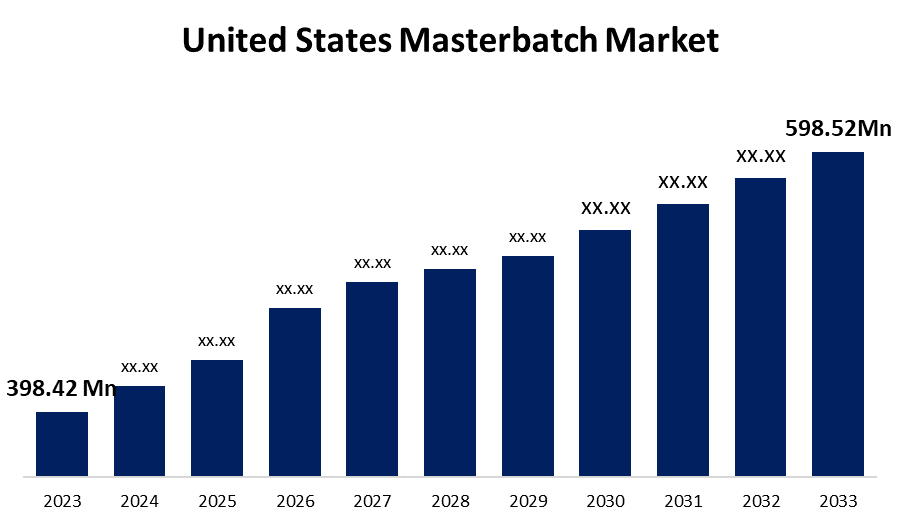

- The United States Masterbatch Market Size was valued at USD 398.42 Million in 2023

- The Market Size is Growing at a CAGR of 4.15% from 2023 to 2033.

- The United States Masterbatch Market Size is Expected to Reach USD 598.52 Million by 2033.

Get more details on this report -

The United States Masterbatch Market size is expected to reach USD 598.52 Million by 2033, at a CAGR of 4.15% during the forecast period 2023 to 2033.

Market Overview

Masterbatch is a dense polymeric blend containing encapsulated additives. It is used in the plastics industry to modify the scattering, versatility, and taste of basic polymers. They are used to add color and improve polymers' beneficial properties such as anti-fog, antistatic, antilocking, UV stabilization, and fire retardancy. They are a concentrated mixture of additives and colors that have been heated in a carrier gum and then cooled and granulated. Masterbatch is displayed in both fluid and solid forms. In particular, the automotive industry is a major driver of the masterbatch market, especially in the United States. With an increasing emphasis on the use of plastic in automotive manufacturing, the benefits of weight reduction, design flexibility, and cost-effectiveness make plastics an appealing option for automakers. Furthermore, masterbatch enhances the performance and aesthetics of plastic components, adding to the overall quality and appeal of vehicles. In short, the masterbatch market's growth can be attributed to its diverse applications and the benefits it provides to industries such as packaging, construction, and automotive.

Report Coverage

This research report categorizes the market for the United States masterbatch market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States masterbatch market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States masterbatch market.

United States Masterbatch Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 398.42 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.15% |

| 2033 Value Projection: | USD 598.52 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End Users |

| Companies covered:: | Clariant AG, Avient Corporation, Ampacet Corporation, Cabot Corporation, RTP Company, Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Given their ability to improve the aesthetic appeal, functionality, and shelf-life of products, masterbatches are in high demand in the United States packaging industry. The development and adoption of biodegradable masterbatches not only address environmental concerns about plastic use, but also open up new growth opportunities for the masterbatch market, catering to rising consumer demand for sustainable and eco-friendly packaging solutions. The United States masterbatch market is currently experiencing significant growth, driven primarily by rising demand in the construction industry. Furthermore, the introduction of biodegradable masterbatches has sparked a revolution in the construction industry. These eco-friendly masterbatches provide the same benefits as traditional ones but in a more environmentally sustainable way. This development is a response to growing environmental concerns about plastic use. Increased demand for these biodegradable variants drives the growth of the masterbatch market in the forecast period.

Restraining Factors

Masterbatches are primarily made up of polymers, pigments, and additives. Prices for these components fluctuate due to a variety of factors, including changes in crude oil prices, supply chain disruptions, and geopolitical tensions. These fluctuations can have a direct impact on the cost of producing masterbatches, affecting manufacturers' overall profitability in the market.

Market Segment

- In 2023, the black segment accounted for the largest revenue share over the forecast period.

Based on type, the United States masterbatch market is segmented into white, black, additive, color, and others. Among these, the black segment has the largest revenue share over the forecast period. One of the primary reasons for the increase in demand for black masterbatches is their widespread application in industries such as automotive, packaging, electronics, and construction. Black masterbatches are widely used in the production of automotive components, cables, wires, and packaging materials due to their ability to provide high-quality color and opacity while also improving mechanical properties. In the automotive industry, black masterbatches are preferred for their UV resistance, thermal stability, and durability. These properties make black masterbatches an excellent choice for manufacturing a variety of automotive parts such as dashboards, bumpers, and interior components. The versatility and multifaceted benefits of black masterbatches make them an essential component in a variety of industries. As the demand for high-quality, visually appealing products grows, so will the demand for black masterbatches, driving innovation and advancements in their formulation and application.

- In 2023, the packaging segment is witnessing significant growth over the forecast period.

Based on end users, the United States masterbatch market is segmented into packaging, building & construction, consumer goods, automotive, textile, and others. Among these, the packaging segment is witnessing significant growth over the forecast period. Masterbatches play an important and diverse role in the packaging industry. They not only add vibrant colors but also enhance and improve the properties of plastic packaging materials. These versatile additives have applications in a variety of packaging formats, including flexible packaging, rigid packaging, and films. The demand for color masterbatches has increased significantly in recent years, due to the growing need for visually appealing and captivating packaging solutions. The e-commerce boom has accelerated the expansion of the packaging sector in the masterbatch market. E-commerce packaging materials must be long-lasting, visually appealing, and capable of protecting products during transportation. Furthermore, the packaging industry is experiencing a significant shift toward sustainability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States masterbatch market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Clariant AG

- Avient Corporation

- Ampacet Corporation

- Cabot Corporation

- RTP Company, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, Ampacet, a leading provider of innovative packaging solutions, announced the highly anticipated launch of PET UVA. This ground-breaking masterbatch is specifically designed to provide superior UV light protection for packaging contents. PET UVA protects packaged foods and beverages, extending their shelf life and significantly reducing waste. Ampacet's commitment to sustainability is further demonstrated by its UVA in PP and PE offerings, which provide a comprehensive range of UV protection solutions for a variety of packaging materials.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Masterbatch Market based on the below-mentioned segments:

United States Masterbatch Market, By Type

- White

- Black

- Additive

- Color

- Others

United States Masterbatch Market, By End Users

- Packaging

- Building & Construction

- Consumer Goods

- Automotive

- Textile

- Others

Need help to buy this report?