United States Medical Device Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Service (Product Design and Development Services, Quality Assurance Services, Regulatory Affairs Services, Contract Manufacturing, and Others), By Application (Cardiology, Diagnostic Imaging, IVD, Orthopedic, General & Plastic Surgery, and Others), and U.S. Medical Device Outsourcing Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited States Medical Device Outsourcing Market Insights Forecasts to 2033

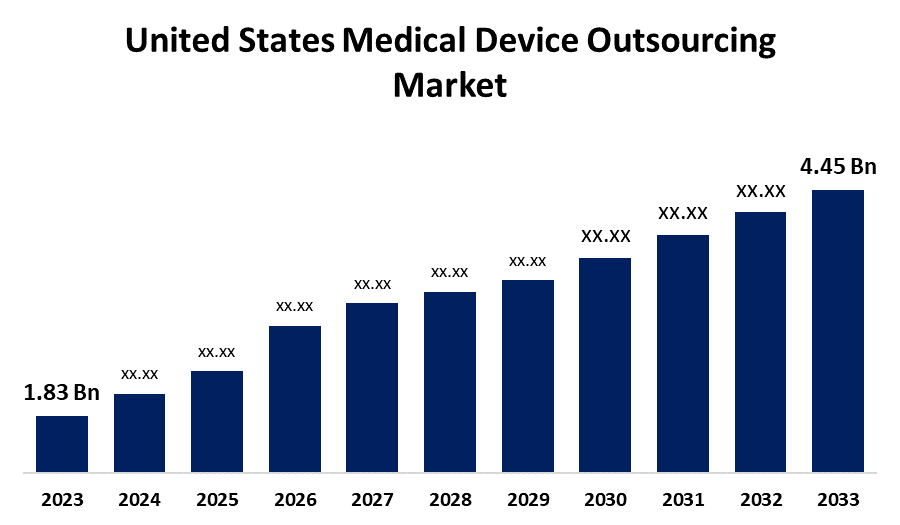

- The United States Medical Device Outsourcing Market Size Was Estimated at USD 1.83 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.29% from 2023 to 2033

- The USA Medical Device Outsourcing Market Size is Expected to Reach USD 4.45 Billion by 2033

Get more details on this report -

The United States Medical Device Outsourcing Market Size is expected to reach USD 4.45 billion by 2033, growing at a CAGR of 9.29% from 2023 to 2033

Market Overview

In the United States medical device outsourcing markets, medical device manufacturers engage outside vendors to manage particular tasks like design, production, or regulatory support to ensure that they may concentrate on their core competencies. The rising demand for non-invasive medical equipment is driving the expansion of the US medical device outsourcing market. The increased desire to minimize product costs and complexity boosts the adoption rate of outsourcing. Additionally, the industry is expanding due to the growing need for reasonably priced gadgets. The United States medical device outsourcing market is growing because of more strict FDA requirements that force manufacturers to seek specialized compliance support. For instance, in February 2024, the demand for regulatory consulting services increased when the U.S. FDA completed aligning ISO 13485 with the Quality System Regulation (QSR) to emphasize risk management and quality assurance. Furthermore, outsourcing is becoming more and more important for market access due to the Medical Device Single Audit Program (MDSAP), which drives quality audits and regulatory applications.

Report Coverage

This research report categorizes the market for the U.S. medical device outsourcing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US medical device outsourcing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA medical device outsourcing market.

United States Medical Device Outsourcing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.83 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 9.29% |

| 023 – 2033 Value Projection: | USD 4.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Service, By Application |

| Companies covered:: | SGS SA, Laboratory Corporation of America Holdings, Eurofins Scientific, Pace Analytical Services, Inc., TÜV SÜD, Jabil Inc., Flex Ltd., Plexus Corp., West Pharmaceutical Services, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The United States vodka market is expanding due to the need for sophisticated medical equipment due to the disease's increasing incidence has increased medical device manufacture. Outsourcing is becoming more and more necessary as a result of the need to reduce manufacturing costs and complexity. Medical device outsourcing is becoming more and more necessary for cosmetic procedures to reduce complexity and enhance safety. Additionally, government initiatives and funding for R&D in the pharmaceutical and healthcare industries encourage manufacturing firms to use innovative technologies. In addition, the market is expanding as a result of the increasing use of outsourcing in the production of medical equipment.

Restraining Factors

The market for medical device outsourcing in the United States poses significant challenges in handling private data, such as patient information and product designs, and is at risk for illegal attacks while being developed. Additionally, medical device outsourcing can pose cyber threats, but implementing data security measures and risk assessment can help overcome these limitations.

Market Segmentation

The U.S. medical device outsourcing market share is classified into service and application.

- The contract manufacturing segment accounted for the largest market share of 40.28% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the service, the U.S. medical device outsourcing market is divided into product design and development services, quality assurance services, regulatory affairs services, contract manufacturing, and others. Among these, the contract manufacturing segment accounted for the largest market share of 40.28% in 2023 and is expected to grow at a significant CAGR during the forecast period. The segment's rise can be attributed to the growing complexity of medical devices, more FDA regulations, and mounting cost pressures. Additionally, segmental growth is being accelerated by the growing demand for customized medical items, such as 3D-printed orthopedic implants and surgical instruments.

- The cardiology segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the U.S. medical device outsourcing market is classified into cardiology, diagnostic imaging, IVD, orthopedic, general & plastic surgery, and others. Among these, the cardiology segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The rise in the outsourcing of cardiovascular devices is ascribed to the rising demand for these devices driven on by the increased frequency of cardiovascular illnesses (CVDs). Additionally, the need for outsourcing medication research and manufacture is driven by the high complexity of cardiovascular devices and the requirement for specific technical skills.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. medical device outsourcing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SGS SA

- Laboratory Corporation of America Holdings

- Eurofins Scientific

- Pace Analytical Services, Inc.

- TÜV SÜD

- Jabil Inc.

- Flex Ltd.

- Plexus Corp.

- West Pharmaceutical Services, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Flex Ltd. expanded its assistance for healthcare clients in bringing medical products to market more quickly and effectively by announcing the opening of a new product introduction (NPI) center close to Boston. This center reduces risk and speeds up commercialization by streamlining the whole product development process, from design verification and production transfer to prototype and preclinical builds.

Market Segment

- This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. medical device outsourcing market based on the below-mentioned segments

U.S. Medical Device Outsourcing Market, By Service

- Product Design and Development Services

- Quality Assurance Services

- Regulatory Affairs Services

- Contract Manufacturing

- Others

U.S. Medical Device Outsourcing Market, By Application

- Cardiology

- Diagnostic Imaging

- IVD

- Orthopedic

- General & Plastic Surgery

- Others

Need help to buy this report?