United States Medical Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, In-vitro Diagnostics, Minimally Invasive Surgery, Wound Management, Diabetes Care, Ophthalmic Devices, Dental Devices, Nephrology, General Surgery, and Others), By End User (Hospitals and ASCs, Clinics, and Others), and United States Medical Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Medical Devices Market Insights Forecasts to 2033

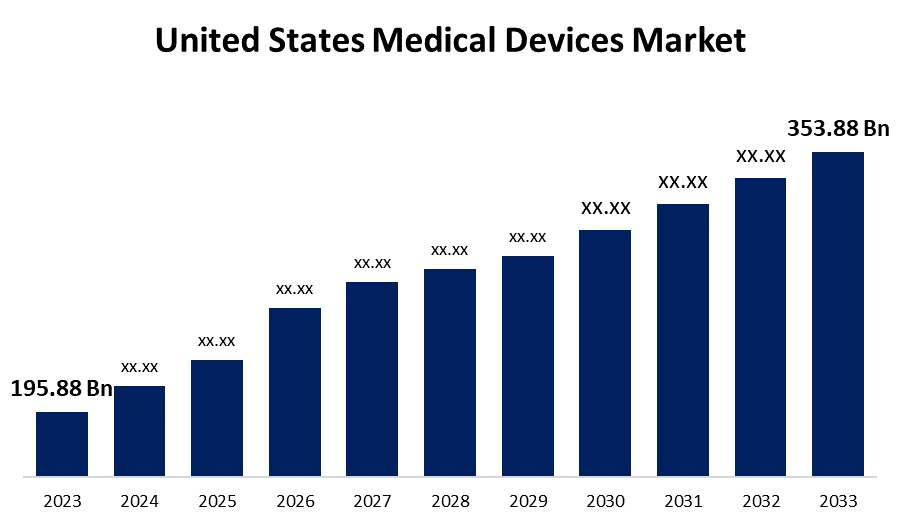

- The United States Medical Devices Market Size was valued at USD 195.88 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.09% from 2023 to 2033

- The United States Medical Devices Market Size is Expected to reach USD 353.88 Billion by 2033

Get more details on this report -

The United States Medical Devices Market is anticipated to exceed USD 353.88 Billion by 2033, growing at a CAGR of 6.09% from 2023 to 2033.

Market Overview

Any appliance, machinery, software, material, or other item that can be used alone or in combination by people for medical purposes as specified by the manufacturer is considered a medical device. In vitro diagnostic devices are included in the category of medical devices. These medical instruments are used for testing bodily fluids, tissue, and blood samples; examples of these include lateral flow, pregnancy tests, and blood glucose levels. Medical devices also include implantable ones, like cardiac pacemakers, which are usually inserted into the body and may or may not need external power sources to function. The elderly population in the United States has grown significantly over time. According to a demographic research estimate released by the University of Washington in July 2021, since the dawn of the twenty-first century, it has been anticipated that every American-born will live to be at least 100 years old. Age-related conditions including cataracts, chronic obstructive pulmonary disease, hypertension, osteoarthritis, diabetes, depression, and dementia are becoming more common as the population becomes older. The government, healthcare organizations, and patients themselves are placing an increasing focus on the prompt and regular treatment of patients due to the rising incidence and financial burden of chronic and lifestyle diseases. Thus, several national and local healthcare organizations have aggressively pushed the identification and treatment of common diseases through awareness campaigns and initiatives.

Report Coverage

This research report categorizes the market for the United States medical devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical devices market.

United States Medical Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 195.88 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.09% |

| 023 – 2033 Value Projection: | USD 353.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End User |

| Companies covered:: | Argon Medical Devices, Inc, Abbott Laboratories, Johnson & Johnson Services, Inc., Stryker, Becton, Dickinson, and Company, Boston Scientific Corporation, Danaher, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Large industry participants are actively funding the creation of cutting-edge technologies through research and development. It is anticipated that the availability of potential gadgets nearing completion of development will increase demand for these devices. For example, Cook Medical was granted a U.S. FDA Breakthrough Designation in January 2022 for a novel drug-eluting stent for below-the-knee (BTK) use in the treatment of patients suffering from chronic limb-threatening ischemia (CLTI). With a focus on research and development, American producers of medical devices are changing their approach to market products that are improved by emerging technologies. As a result, it is anticipated that growing R&D expenditures and innovative technology will speed up the production of these devices, driving market expansion. For instance, GlucoTrack Inc. declared in October 2022 that it would be expanding its product pipeline as part of a new research and development initiative for a long-term continuous glucose monitor (CGM).

Restraining Factors

The whole cost of gadgets, including acquisition and maintenance expenses, is higher. Certain advanced healthcare devices come with several parts that need to be replaced regularly, such as cameras, batteries, chips, sensors, and other accessories, in addition to capital-intensive equipment.

Market Segmentation

The United States medical devices market share is classified into type and end-users.

- The other segment is expected to hold the largest market share through the forecast period.

The United States medical devices market is segmented by type into orthopedic devices, cardiovascular devices, diagnostic imaging, in-vitro diagnostics, minimally invasive surgery, wound management, diabetes care, ophthalmic devices, dental devices, nephrology, general surgery, and others. Among them, the other segment is expected to hold the largest market share through the forecast period. The increased prevalence of chronic illnesses in the nation and the developing need for palliative and rehabilitation care equipment in homecare settings in the United States are blamed for the dominance.

- The hospitals and ASCs segment dominates the market with the largest market share over the predicted period.

The United States medical devices market is segmented by end user into hospitals and ASCs, clinics, and others. Among them, the hospitals and ASCs segment dominates the market with the largest market share over the predicted period. The increased demand and use of healthcare devices in these settings is mostly caused by the growing patient population with chronic and life-threatening diseases, which is leading to a higher hospitalization rate in the United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States medical devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Argon Medical Devices, Inc

- Abbott Laboratories

- Johnson & Johnson Services, Inc.

- Stryker

- Becton, Dickinson, and Company

- Boston Scientific Corporation

- Danaher

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, the increased demand and use of healthcare devices in these settings is mostly caused by the growing patient population with chronic and life-threatening diseases, which is leading to a higher hospitalization rate in the United States.

- In January 2023, A robotic track system that automates the processing of lab specimens was recently introduced by BD, this might potentially reduce the amount of manual labor and result in wait times.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Medical Devices Market based on the below-mentioned segments:

United States Medical Devices Market, By Type

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- In-vitro Diagnostics

- Minimally Invasive Surgery

- Wound Management

- Diabetes Care

- Ophthalmic Devices

- Dental Devices

- Nephrology

- General Surgery

- Others

United States Medical Devices Market, By End-User

- Hospitals and ASCs

- Clinics

- Others

Need help to buy this report?