United States Medical Drones Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fixed-Wing Drone, Hybrid Drone, and Rotor Drone), By Application (Blood Transfer, Drugs/Pharmaceutical Transfer, Vaccination Programs, and Others), and United States Medical Drones Market Insights, Industry Trend, Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Medical Drones Market Insights Forecasts to 2033

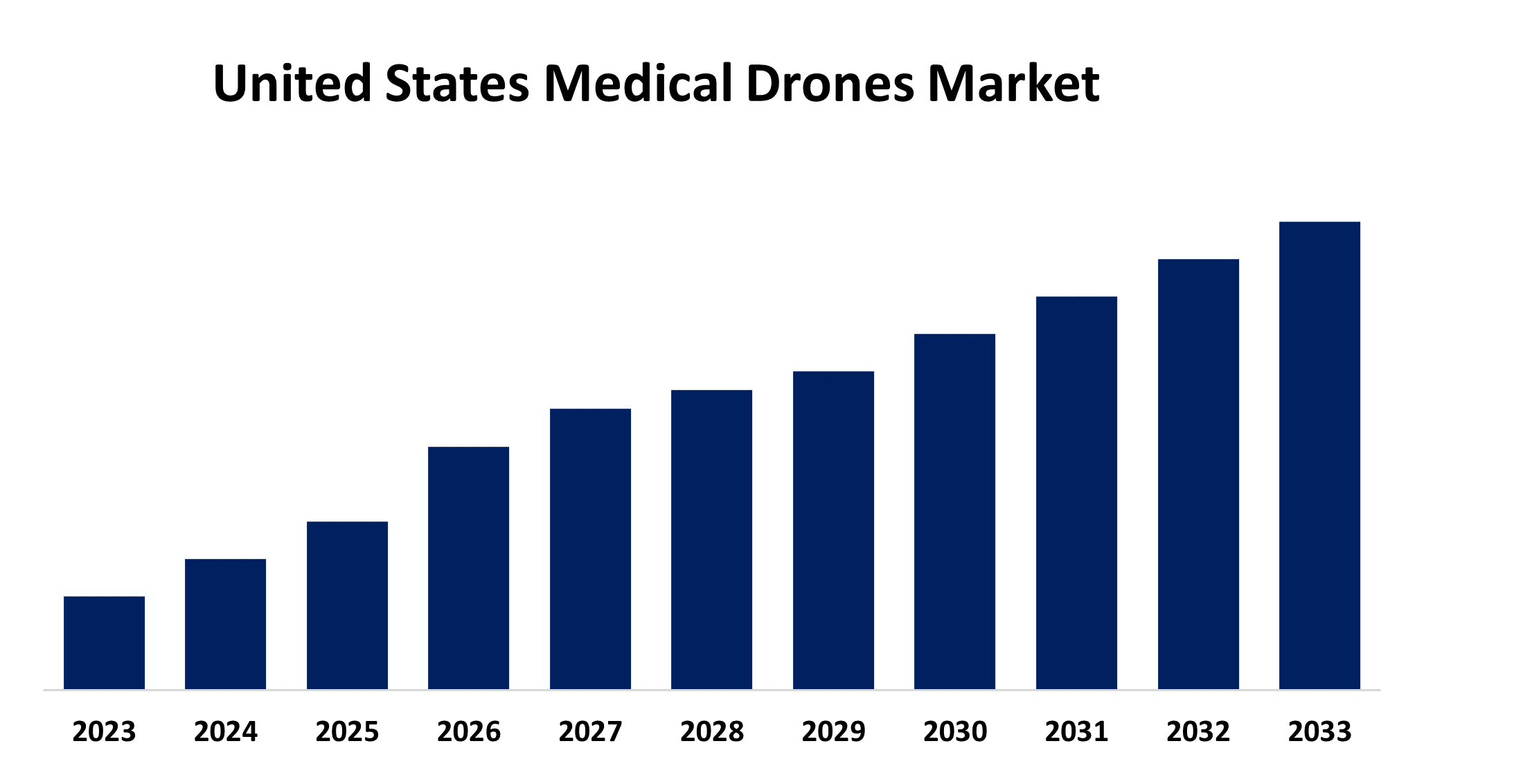

- The Market Size is Growing at a CAGR of 22.91% from 2023 to 2033

- The United States Medical Drones Market Size is Expected to hold a significant share by 2033

Get more details on this report -

United States Medical Drones Market is anticipated to hold a significant share by 2033, growing at a CAGR of 22.91% from 2023 to 2033.

Market Overview

Drones are sometimes known as unmanned aerial vehicles, or UAVs. The speed and versatility of UAV technology offer nearly infinite possibilities for providing relief and medical supplies to individuals in remote or hazardous areas. UAVs could be used in the healthcare sector in a variety of ways. They consist of prehospital emergency care, surveillance, and accelerated laboratory diagnostic testing. As of right now, UAVs are capable of delivering AEDs, blood supplies, and immunizations. Drones could be used to deliver supplies and medication to patients who are receiving care at home as opposed to in a hospital. Critical healthcare supplies like blood, vaccines, prescription medications, first aid supplies, and medical samples have all been transported in part by drones. When it comes to responding to emergencies, medical deliveries can reach distant or otherwise unreachable locations faster than ambulances. The increasing demand for medical drone applications and expedited medication delivery is driving growth in the US medical drone industry. The US medical drone market is also being driven by advancements in current technologies. The strong demand for drones for medical applications is the main driver of the market's rapid rise. Furthermore, growing pressure from authorities to concentrate on enabling medical services through the advancement of current technologies is driving the US medical drone market.

Report Coverage

This research report categorizes the market for the United States medical drones market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical drones market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical drones market.

United States Medical Drones Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 22.91% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Zipline International Inc., Volansi, Inc., Flirtey, Matternet, Vayu Inc., VillageReach, Alphabet, Inc., The Boeing Company, DJI United States, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States' robust economic standing and the existence of an advanced healthcare system are driving market expansion. The need for high-quality healthcare services is rising as a result of the nation's GDP boom and rising per capita income. Good government reimbursement practices are driving up the cost of healthcare for patients and enhancing the quality of care provided, both of which are driving up market expansion. Leading authorities are concentrating more on developing current technologies to help with medical services. The rise in the development of smart healthcare systems which aid in real-time analysis and monitoring of patients to send alerts and notifications ensures giving effective treatment to patients. Medical drones are seeing a rise due to healthcare players' increasing focus on deploying cutting-edge equipment in hospitals to provide patients with high-quality care. Due to its ability to help healthcare facilities cover a large region and provide patients with on-demand healthcare, medical drones are in great demand.

Restraining Factors

Though, as of legal limitations, operational limitations, approvals, and commercial and industrial usage, OEMs and end users have encountered a variety of obstacles. The necessary licenses and BVLOS flight operations have been authorized by the US. However, a lack of unified air traffic management prevents all aerial platforms from operating securely in controlled airspace. Reducing the operational challenges and drone-related incidents that BVLOS aircraft encounter is an important matter. Furthermore, one of the major market barriers to the increasing number of remotely flown drones for medical delivery applications is the lack of qualified pilots for end-users performing BVLOS flight operations.

Market Segmentation

The United States medical drones market share is classified into product type and application.

- The rotor drone segment is expected to hold the largest market share through the forecast period.

The United States medical drones market is segmented by product type into fixed-wing drones, hybrid drone, and rotor drone. Among them, the rotor drone segment is expected to hold the largest market share through the forecast period. This is attributed to rotor drones being in high demand for monitoring and surveillance, sterilization of public spaces, medical supplies, effective vertical take-off and landing (VTOL) capabilities, and restricted space operation.

- The blood transfer segment dominates the market with the largest market share over the predicted period.

The United States medical drones market is segmented by application into blood transfer, drugs/pharmaceutical transfer, vaccination programs, and others. Among them, the blood transfer segment dominates the market with the largest market share over the predicted period. Drones are used to transport blood samples between medical facilities. Additionally, drones can cover a three-hour journey in just fifteen minutes. They are therefore essential in providing blood to patients in an emergency. Furthermore, blood is required for all major treatments, including childbirth. Many trauma emergency patients die when blood is withheld from them. This will increase the need for quick blood supplies, which will grow the drone business. Given that it is now simpler to deliver vaccines to remote areas, it is anticipated that another market segment, vaccination programs, will expand successfully shortly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States medical drones market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zipline International Inc.

- Volansi, Inc.

- Flirtey

- Matternet

- Vayu Inc.

- VillageReach

- Alphabet, Inc.

- The Boeing Company

- DJI United States

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2021, Draganfly Inc., a Canadian provider of UAV hardware and software, and Coldchain Delivery Systems, a vaccine and medical supply chain management (SCM) company in the U.S. government, teamed to provide pandemic services, including stadium decontamination and pandemic drones.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States medical drones market based on the below-mentioned segments:

United States Medical Drones Market, By Product Type

- Fixed-Wing Drone

- Hybrid Drone

- Rotor Drone

United States Medical Drones Market, By Application

- Blood Transfer

- Drugs/Pharmaceutical Transfer

- Vaccination Programs

- Others

Need help to buy this report?