United States Medical Tapes and Bandages Market Size, Share, and COVID-19 Impact Analysis, By Product (Medical Tapes, Surgical Tapes, Dressings, Medical Bandages, and Others), By Application (Surgical Wound, Traumatic Wound, Ulcer, Sports Injury, Burn Injury, and Others), By End Use (Hospitals, Ambulatory Surgery Centers, Clinics, and Others), and U.S. Medical Tapes and Bandages Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Medical Tapes and Bandages Market Insights Forecasts to 2033

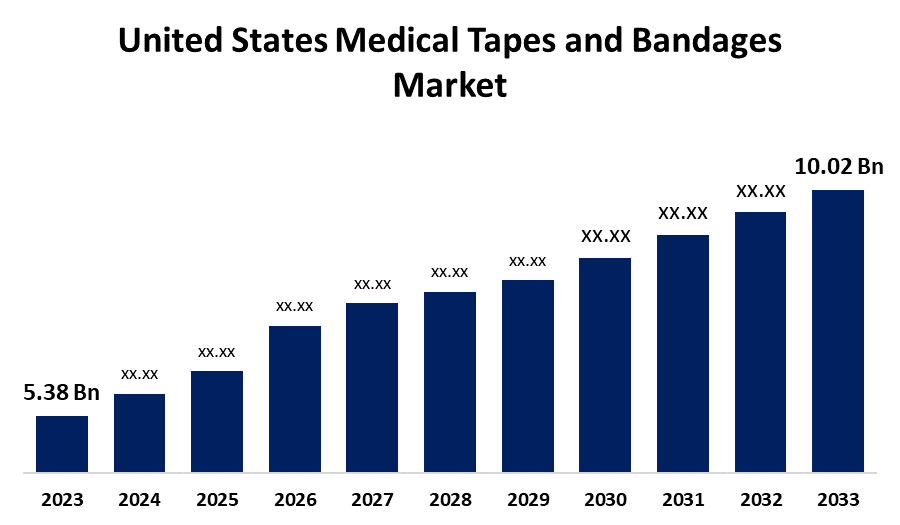

- The United States Medical Tapes and Bandages Market Size Was Estimated at USD 5.38 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.42% from 2023 to 2033

- The USA Medical Tapes and Bandages Market Size is Expected to Reach USD 10.02 Billion by 2033

Get more details on this report -

The United States Medical Tapes and Bandages Market Size is Estimated to reach USD 10.02 Billion by 2033, Growing at a CAGR of 6.42% from 2023 to 2033.

Market Overview

The market for medical tapes and bandages used in wound care, surgery, and injury management is referred to as the United States medical tapes and bandages market. These items provide protection, support, and healing for various medical conditions, including burns, diabetic foot ulcers, pressure ulcers, and trauma wounds. The need for medical tapes and bandages changes in response to societal trends and healthcare needs. The rise in severe injuries and accidents is a significant factor driving this demand. These products are essential for stabilizing wounds, preventing bleeding, providing emergency first aid, and promoting the healing process. Additionally, to meet the healthcare demands arising from this alarming trend, manufacturers, policymakers, and healthcare practitioners must collaborate to ensure a consistent supply of high-quality medical tapes and bandages. Furthermore, government initiatives contribute to market growth. For instance, in March 2025, antimicrobial bandages are among the advanced wound care products for which the Centers for Medicare & Medicaid Services (CMS) has expanded reimbursement guidelines.

Report Coverage

This research report categorizes the market for the U.S. medical tapes and bandages market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US medical tapes and bandages market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA medical tapes and bandages market.

Driving Factors

The medical tapes and bandages market is growing due to the occurrence of both acute and chronic wounds, as well as an increase in surgical operations. In addition, the market for medical tapes and bandages in the US is anticipated to grow as a result of the rising number of sports injuries and auto accidents. Additionally, the U.S. medical tapes and bandages market is expanding rapidly, largely due to the country's increasing surgical operation volume. Furthermore, the need for efficient wound care solutions, such as bandages and medical tapes, is fueled by factors including an aging population and improvements in surgical techniques. The increasing in cosmetic surgery is a significant factor in this expansion.

Restraining Factors

The market for medical tapes and bandages in the US is hindered by factors such as growing raw material costs, strict FDA regulations, restricted reimbursement policies, skin irritation issues, and competition from cutting-edge wound care solutions.

Market Segmentation

The U.S. medical tapes and bandages market share is classified into product, application, and end use.

- The dressing segment accounted for the largest market share in 2023 and is estimated to grow at the fastest CAGR of 6.51% during the projected period.

Based on the product, the U.S. medical tapes and bandages market is classified into medical tapes, surgical tapes, dressings, medical bandages, and others. Among these, the dressing segment accounted for the largest market share in 2023 and is estimated to grow at the fastest CAGR of 6.51% during the projected period. This market is broad, including a range of dressings to treat various wounds, injuries, and illnesses. The increasing incidence of chronic wounds, including diabetic ulcers and pressure sores, is a result of the increased prevalence of disorders, including diabetes, obesity, and cardiovascular diseases.

- The surgical wound segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the U.S. medical tapes and bandages market is divided into surgical wound, traumatic wound, ulcer, sports injury, burn injury, and others. Among these, the surgical wound segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The surgical wound segment is expanding due in large part to the rising number of elective and emergency procedures. The demand for efficient wound care products, such as bandages and medical tapes, is growing as surgical operations become more frequent.

- The hospitals segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the end use, the U.S. medical tapes and bandages market is divided into hospitals, ambulatory surgery centers, clinics, and others. Among these, the hospitals segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period. The demand for medical tapes and bandages is growing due to the rise in ER visits brought on by mishaps, injuries, and other pressing health concerns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. medical tapes and bandages market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smith+Nephew

- Mölnlycke Health Care AB

- 3M

- McKesson Medical-Surgical Inc.

- Baxter

- DuPont

- Fabco

- MedWay Group

- AERO Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, Vomaris Innovations, Inc. made a significant advancement in consumer wound care when it announced the release of its FDA-approved PowerHeal bioelectric bandage for over-the-counter (OTC) usage. The PowerHeal bandage offers a special bioelectric solution that significantly speeds up healing and lowers infection risk with unparalleled efficacy, in contrast to traditional wound care treatments.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. medical tapes and bandages market based on the below-mentioned segments:

U.S. Medical Tapes and Bandages Market, By Product

- Medical Tapes

- Surgical Tapes

- Dressings

- Medical Bandages

- Others

U.S. Medical Tapes and Bandages Market, By Application

- Surgical Wound

- Traumatic Wound

- Ulcer

- Sports Injury

- Burn Injury

- Others

U.S. Medical Tapes and Bandages Market, By End Use

- Hospitals

- Ambulatory Surgery Centers

- Clinics

- Others

Need help to buy this report?