United States Medical Tubing Market Size, Share, and COVID-19 Impact Analysis, By Material (Polyvinyl Chloride (PVC), Silicone, Polyolefin, Thermoplastic Elastomers (TPE), and Others), By Application (Bulk Disposable Tubing, Catheterization, Drug Delivery Systems, and Others), and United States Medical Tubing Market Insights Forecasts to 2033

Industry: HealthcareUnited States Medical Tubing Market Insights Forecasts to 2033

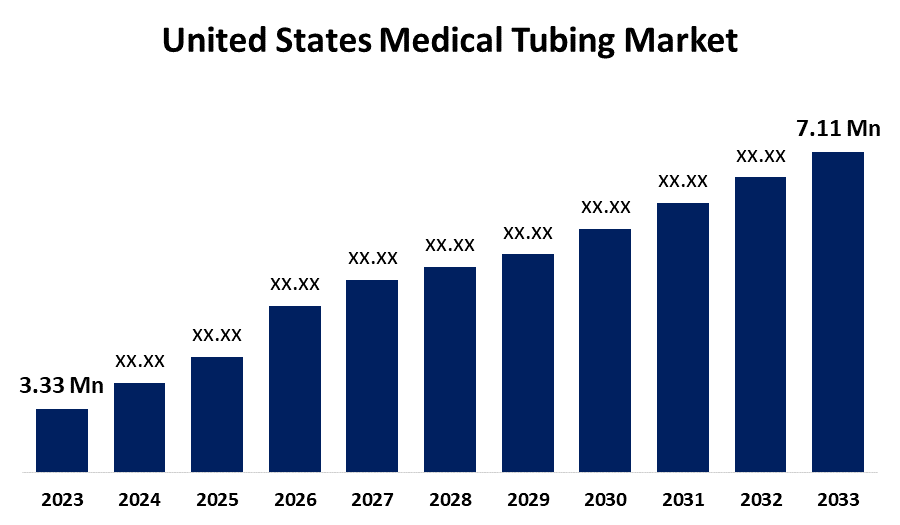

- The US Medical Tubing Market Size was valued at USD 3.33 Million in 2023.

- The Market is growing at a CAGR of 7.88% from 2023 to 2033

- The US Medical Tubing Market Size is Expected to Reach USD 7.11 Million by 2033

Get more details on this report -

The US Medical Tubing Market is Anticipated to Exceed USD 7.11 Million by 2033, growing at a CAGR of 7.88% from 2023 to 2033.

Market Overview

Medical tubing is created for different purposes to help healthcare providers deliver fluids and devices, as well as to enable the movement of gas and liquids. It is now the most common and relied-upon tool in the modern healthcare and medical sector. The rise in medical issues like heart, stomach, and bladder problems has fueled the expansion of the medical tubing industry. The increasing elderly population and hospitalizations in the U.S. are the main factors driving the market. Medical tubes must possess top-notch physical attributes like opacity, versatility, and static resistance. Transparent tubing is necessary for applications involving fluid delivery as it allows for simple monitoring of fluid flow and prevents the formation of air bubbles. Plastic plays a crucial role as a primary material in producing medical tubes used for tasks like gathering biopsy samples, holding stents, and placing vascular catheters. Recent technological progress has improved manufacturing operations, leading to an increase in market expansion. Cutting-edge extrusion technologies are used to produce braided tubing, tapered tubing, and para tubing, eliminating the need to assemble multiple tubes.

Report Coverage

This research report categorizes the market for the United States medical tubing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States medical tubing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States medical tubing market.

United States Medical Tubing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.33 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.88% |

| 2033 Value Projection: | USD 7.11 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Material, By Application |

| Companies covered:: | Hitachi Cable America Inc, NewAge Industries Inc., Spectrum Plastics Group, Bentec Medical, Kent Elastomer Products, The Hygenic Company, LLC, Nordson Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Minimal invasive procedures are more secure compared to conventional open surgeries. These methods are gradually taking the place of traditional surgeries because they pose fewer risks. Specialized medical tubes are commonly utilized in minimally invasive procedures, consequently, fueling the demand for medical tubing. Minimally invasive techniques are both cost-effective and more comfortable in comparison to traditional surgical procedures. These methods are commonly utilized in medical fields such as general surgery, urology, gynecology, cardiology, gastroenterology, interventional radiology, neurosurgery, plastic surgery, and pulmonology. Devices such as catheters and guidewires are crucial in medical procedures.

Restraining Factors

The range of applications for medical tubing is restricted due to limited material compatibility. Certain medical procedures and devices need particular material characteristics like biocompatibility, chemical resistance, and high flexibility.

Market Segment

The U.S. medical tubing market share is classified into material and application.

- The silicone segment is expected to hold the largest market share through the forecast period.

The US medical tubing market is segmented by material into polyvinyl chloride (PVC), silicone, polyolefin, thermoplastic elastomers (TPE), and others. Among these, the silicone segment is expected to hold the largest market share through the forecast period. Due to its popularity in medical use. It does not harm living tissues, and patients do not experience any allergic reactions. Silicon tubing promotes segment growth by offering gaskets, sealing, and secure fluid transfer capabilities. Top-quality silicon tubing for medical devices is produced through a continuous vulcanization and extrusion technique.

- The bulk disposable tubing segment is expected to hold the largest market share through the forecast period.

The US medical tubing market is segmented by application into bulk disposable tubing, catheterization, drug delivery systems, and others. Among these, the bulk disposable tubing segment is expected to hold the largest market share through the forecast period. Bulk disposable items include urological supplies, surgical tools, syringes, and needles, among other things. The increasing worries about controlling the spread of infectious diseases are fueling the growth of this segment. Moreover, the increased occurrence of arthritis, cancer, and cardiovascular diseases has led to a rise in the use of a wide range of surgical instruments, such as trocars and inflators.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States medical tubing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi Cable America Inc

- NewAge Industries Inc.

- Spectrum Plastics Group

- Bentec Medical

- Kent Elastomer Products

- The Hygenic Company, LLC

- Nordson Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2022, Zeus Industrial Products introduced its PTFE Sub-Lite-Wall multi-lumen tubing as a new addition to its product line for steerable catheters.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States medical tubing market based on the below-mentioned segments:

United States Medical Tubing Market, By Material

- Polyvinyl Chloride (PVC

- Silicone

- Polyolefin

- Thermoplastic Elastomers (TPE)

- Others

United States Medical Tubing Market, By Application

- Bulk Disposable Tubing

- Catheterization

- Drug Delivery Systems

- Others

Need help to buy this report?