United States Micro LED Market Size, Share, and COVID-19 Impact Analysis, By Application (Smartwatch, Near-To-Eye Devices, Television, Smartphone & Tablet, Monitor & Laptop, Head-Up Display, and Digital Signage), By End-User (Consumer Electronics, Automotive, Aerospace & Defense, and Others), and United States Micro LED Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Micro LED Market Insights Forecasts to 2033

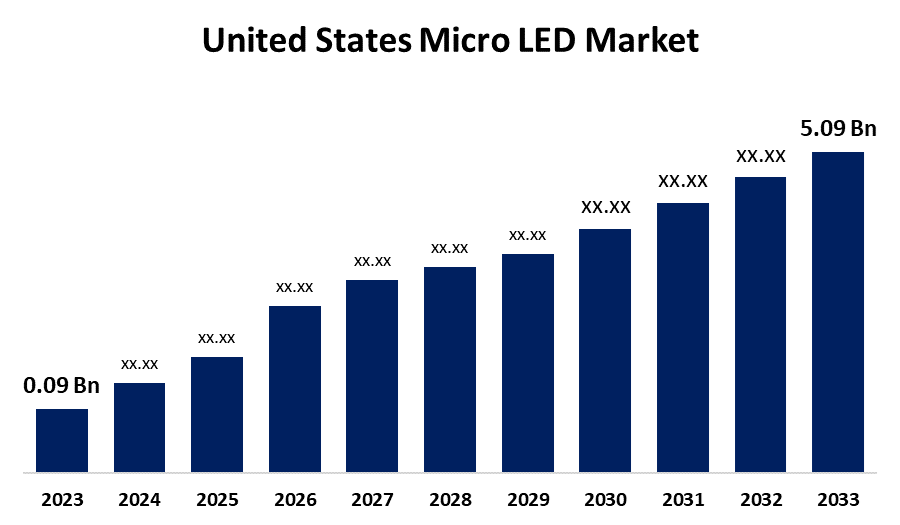

- The U.S. Micro LED Market Size was Valued at USD 0.09 Billion in 2023

- The United States Micro LED Market Size is Growing at a CAGR of 49.71% from 2023 to 2033

- The USA Micro LED Market Size is Expected to Reach USD 5.09 Billion By 2033

Get more details on this report -

The USA Micro LED Market Size is Anticipated to Exceed USD 5.09 Billion By 2033, Growing at a CAGR of 49.71% from 2023 to 2033. The U.S. Micro LED Market is Growing at a very fast rate due to technology growth, increased consumer demand for high-resolution screens, and greater usage in consumer electronics, automotive, and aerospace applications for future-generation display technologies.

Market Overview

The United States micro LED market is the industry dedicated to the creation, production, and implementation of micro LED display technology in the U.S. It includes high-resolution, energy-saving displays applied in consumer electronics, automotive, aerospace, healthcare, and commercial use. Moreover, the growth of the United States micro LED Market is driven by the increasing demand for high-resolution screens, improved manufacturing processes, and growing use in consumer electronics and automotive sectors. R&D investment, miniaturization technology, and energy-efficient solutions are required to open new avenues in AR/VR, healthcare, and next-generation display technologies. For instance, In June 2024, Samsung Electronics America introduced new models to its MICRO LED line, the MS1B (89", 101" class) and MS1C (114" class screen size). The latest display technology from Samsung, MICRO LED offers infinite depth, unimaginable color, and stunning brightness. Furthermore, LG Business Solutions introduced its MicroLED display technology to the United States for the first time at InfoComm 2019 in Orlando, Fla. During the show, LG also unveiled new curved LED and 130-inch LED screens and demonstrated its transparent color LED film technology.

Report Coverage

This research report categorizes the market for the US micro LED market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. micro LED market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA micro LED market.

United States Micro LED Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.09 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 49.71% |

| 2033 Value Projection: | USD 5.09 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Application, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Alphabet, Inc., Plessey Semiconductors, eLux, Inc., VueReal, Shoei Electronic Materials, Inc. (Nanosys), VerLase Technologies, Lumiode and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States micro LED market's growth potential is in emerging uses outside consumer electronics, including wearable medical devices, smart home interfaces, and military-grade displays. Furthermore, the development in mass transfer technology, growing miniaturization, and rising investments by tech leaders are propelling cost reductions and manufacturing scalability, fueling mainstream adoption across sectors. Moreover, the United States Micro LED market is poised for explosive growth, fueled by unrelenting innovation, strategic consolidations, and increasing consumer appetite for ultra-high-quality displays. As global leaders boost their international footprints and streamline manufacturing efficiency, Micro LED technology will transform industries with unparalleled brightness, longevity, and energy efficiency for next-generation applications.

Restraining Factors

The United States micro LED market is constrained by high manufacturing expenses, complicated fabrication processes, restricted mass production scalability, and fierce competition from OLED and LCD technologies, which delay widespread acceptance even though it offers benefits.

Market Segmentation

The United States Micro LED market share is classified into application and end-user.

- The television segment accounted for the largest share of the US Micro LED market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of application, the United States micro LED market is divided into smartwatch, near-to-eye devices, television, smartphone & tablet, monitor & laptop, head-up display, and digital signage. Among these, the television segment accounted for the largest share of the United States Micro LED market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is driven by increasing demand for ultra-high-definition screens, higher brightness, and energy efficiency. As audiences demand premium visual experiences, Micro LED TVs are becoming more popular thanks to extended lifespan, greater contrast, and growing adoption by top electronics brands.

- The consumer electronics segment accounted for a substantial share of the U.S. Micro LED market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of end-user, the U.S. micro LED market is divided into consumer electronics, automotive, aerospace and defense, and others. Among these, the consumer electronics segment accounted for a substantial share of the U.S. Micro LED market in 2023 and is anticipated to grow at a rapid pace during the projected period. This growth is attributed to the increasing need for high-res screens in smartwatches, smartphones, TV sets, and AR/VR headsets. As technology players invest in Micro LED technology, its use in future consumer products keeps gaining traction, improving the performance of screens and power consumption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA micro LED market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alphabet, Inc.

- Plessey Semiconductors

- eLux, Inc.

- VueReal

- Shoei Electronic Materials, Inc. (Nanosys)

- VerLase Technologies

- Lumiode

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Samsung Electronics Canada unveiled its new QLED, MICRO LED, OLED, and Lifestyle display lineups. The reveal also marked the beginning of the Samsung AI screen era with the launch of a new AI processor. Besides offering enhanced picture and sound quality, the new lineups offer consumers AI-driven features safeguarded by Samsung Knox that highlight inspiring and empowering individual lifestyles.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US Micro LED market based on the below-mentioned segments:

United States Micro LED Market, By Application

- Smartwatch

- Near-To-Eye Devices

- Television

- Smartphone and Tablet

- Monitor and Laptop

- Head-Up Display

- Digital Signage

United States Micro LED Market, By End-User

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Others

Need help to buy this report?