United States Microcontroller Market Size, Share, and COVID-19 Impact Analysis, By Product (8-bit, 16-bit, and 32-bit), By Type (Peripheral Interface Controller (PIC), ARM, 8051, TriCore, and Others), and United States Microcontroller Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Microcontroller Market Insights Forecasts to 2033

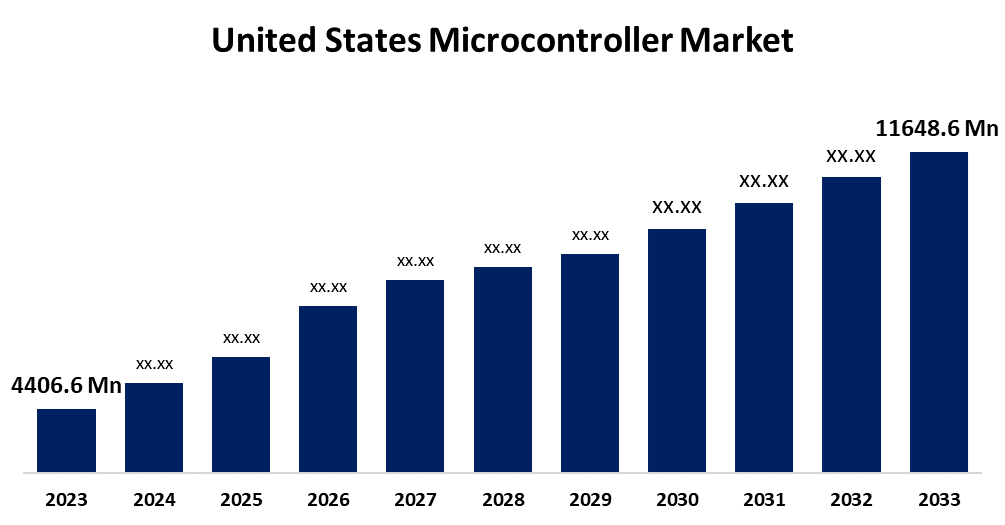

- The U.S. Microcontroller Market Size was Valued at USD 4406.6 Million in 2023

- The United States Microcontroller Market Size is Growing at a CAGR of 10.21% from 2023 to 2033

- The USA Microcontroller Market Size is Expected to Reach USD 11648.6 Million By 2033

Get more details on this report -

The USA Microcontroller Market Size is Anticipated to Exceed USD 11648.6 Million By 2033, Growing at a CAGR of 10.21% from 2023 to 2033. The U.S. Microcontroller Market is increasing at a brisk pace, spearheaded by innovations in IoT, automotive electronics, and industrial automation, with escalating demand for power-efficient, high-performance MCUs in smart devices and embedded systems.

Market Overview

The industry devoted to the creation, production, and use of microcontrollers (MCUs), which are small integrated circuits with a processor, memory, and input/output peripherals, is known as the U.S. Microcontroller Market. These MCUs are crucial for automating electronic devices in a variety of industries, allowing for precise control, energy efficiency, and real-time processing in a range of applications. Moreover, the US microcontroller Market is on the cusp of growth with expanding 5G networks, rising usage of edge computing, and growing demand for artificial intelligence (AI)-based embedded systems. Growth in electric vehicles (EVs), smart grids, and industrial IoT (IIoT) applications also fuels the market, while ultra-low-power MCU developments improve energy efficiency and device lifespan. Furthermore, in January 2024, Texas Instruments (TI) launched new semiconductors aimed at enhancing automotive safety and intelligence. The AWR2544 77GHz millimeter-wave radar sensor chip is the world's first satellite radar architecture, allowing for greater autonomy through enhanced sensor fusion and decision-making in ADAS. TI's new software-programmable driver chips, DRV3946-Q1 integrated contactor driver and DRV3901-Q1 integrated squib driver for pyro fuses, provide integrated diagnostics and enable functional safety for battery management and powertrain systems.

Report Coverage

This research report categorizes the market for the US microcontroller market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. microcontroller market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA microcontroller market.

United States Microcontroller Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4406.6 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.21% |

| 2033 Value Projection: | USD 11648.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | Broadcom, Zilog, Inc., Analog Devices, Texas Instruments Incorporated, Infineon Technologies AG, Qualcomm Technologies, Microchip Technology Inc., NXP Semiconductors, Renesas Electronics Corporation, STMicroelectronics and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The USA microcontroller market is influenced by accelerating innovation in semiconductor technology, surging use of automation in smart factories, and expanding demand for networked medical devices. Evolving autonomous vehicle technologies, better cybersecurity in embedded systems, and the rising use of MCU-based sensors in wearable electronics also drive the growth of the market, which guarantees greater efficiency and performance across sectors. Moreover, for instance, in February 2023, Microchip Technology Inc., a global leader in providing smart, connected, and secure embedded control solutions, announced to investment $880M to expand silicon carbide (SiC) and silicon (Si) production capacity within its Colorado Springs, Colo. factory over the next few years.

Restraining Factors

The US microcontroller market is restrained by high production costs, supply chain disruptions, shortage of semiconductors, and sophisticated integration issues that impede use in small industries in spite of rising demand for automation and IoT applications.

Market Segmentation

The U.S. United States microcontroller market share is classified into product and type.

- The 32-bit segment accounted for the largest share of the US microcontroller market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of product, the United States microcontroller market is divided into 8-bit, 16-bit, and 32-bit. Among these, the 32-bit segment accounted for the largest share of the United States microcontroller market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is powered by its higher processing capability, power efficiency, and high-end functionality. Growing use in automotive electronics, industrial automation, IoT devices, and consumer electronics drives demand, as industries seek high-performance MCUs for real-time data processing and sophisticated applications.

- The ARM segment accounted for a substantial share of the U.S. microcontroller market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of type, the U.S. microcontroller market is divided into peripheral interface controller (PIC), ARM, 8051, TriCore, and others. Among these, the ARM segment accounted for a substantial share of the U.S. microcontroller market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is driven by its high performance, low energy usage, and pervasive usage across automotive, industrial, and consumer electronics. Its scalability, powerful security capabilities, and IoT-friendly compatibility only augment its reign as the go-to option for advanced embedded systems today.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA microcontroller market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Broadcom

- Zilog, Inc.

- Analog Devices

- Texas Instruments Incorporated

- Infineon Technologies AG

- Qualcomm Technologies

- Microchip Technology Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- STMicroelectronics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Renesas Electronics Corporation, a leading provider of advanced semiconductor solutions, released the industry's first general-purpose 32-bit RISC-V-based microcontrollers (MCUs) using an internally developed CPU core. While numerous MCU suppliers have recently entered investment partnerships to further develop RISC-V products, Renesas has already developed and validated a new RISC-V core in-house, which is now used in a commercial product and shipped worldwide. The new R9A02G021 family of MCUs offers embedded systems designers a direct path to creating a broad variety of power-aware, cost-effective applications based on the open-source instruction set architecture (ISA).

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US microcontroller market based on the below-mentioned segments:

United States Microcontroller Market, By Product

- 8-bit

- 16-bit

- 32-bit

United States Microcontroller Market, By Type

- Peripheral Interface Controller (PIC)

- ARM

- 8051

- TriCore

- Others

Need help to buy this report?