U.S. Microprocessor Market Size, Share, and COVID-19 Impact Analysis, By Architecture Type (ARM MPU, x64, x86, and MIPS), By Application (Smartphones and Personal Computers), and U.S. Microprocessor Market Insights, Industry Trend, Forecasts to 2033.

Industry: Semiconductors & ElectronicsThe United States Microprocessor Market Insights Forecasts to 2033

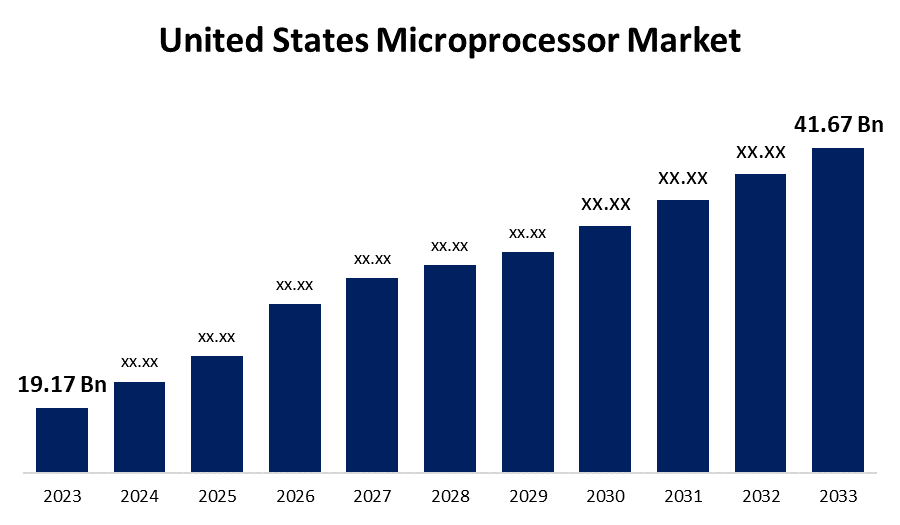

- The U.S. Microprocessor Market Size was valued at USD 19.17 Billion in 2023.

- The Market is growing at a CAGR of 8.07% from 2023 to 2033

- The U.S. Microprocessor Market Size is Expected to Reach USD 41.67 Billion by 2033

Get more details on this report -

The U.S. Microprocessor Market is Anticipated to Exceed USD 41.67 Billion by 2033, growing at a CAGR of 8.07% from 2023 to 2033.

Market Overview

A computer cannot function without a microprocessor, as it is a crucial component of computer architecture necessary for performing tasks. It is a device that can be programmed to process input by conducting arithmetic and logical operations to generate the intended output. Put simply, a microprocessor is a compact digital device that retrieves instructions from memory, interprets and carries them out, and provides outcomes. Microprocessors are ICs that act as the CPU of a computer system, carrying out intricate instructions and handling arithmetic and logical tasks. They are distinct from regular ICs because they are specifically created for general computing purposes, whereas microcontrollers combine a microprocessor core with additional components like memory, input/output ports, and timers, forming a self-contained system for embedded devices and applications. Anticipated market growth is expected as microprocessors are increasingly being used in consumer electronics such as PCs, smartphones, and laptops. A microprocessor, a single integrated circuit containing millions of tiny components like transistors, diodes, and resistors, operates in harmony. This microchip carries out tasks such as storing data, keeping track of time, and communicating with external devices. These integrated circuits are used in a variety of electronic gadgets such as tablets, servers, smartphones, and embedded devices.

Report Coverage

This research report categorizes the market for the US microprocessor market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States microprocessor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. microprocessor market.

United States Microprocessor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.17 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.07% |

| 2033 Value Projection: | USD 41.67 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Architecture Type, By Application |

| Companies covered:: | Advanced Micro Devices, Inc, Intel Corporation, Marvell Semiconductor Components Industries, LLC, Toshiba Electronic Devices & Storage Corporation, Texas Instruments Incorporated, Microchip Technology Inc., Nvidia Corporation, MediaTek Inc., Broadcom Inc., Qualcomm Technologies, Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market growth is anticipated to be driven by the increasing demand for smartphones and tablets in a short period of time. A microprocessor improves the smartphone's performance by increasing its speed and efficiency. The speed at which a smartphone operates is directly related to the microprocessor's performance. Furthermore, the introduction of 'smart' gadgets has led to an increase in the number of integrated circuits needed for advanced technologies like touch screen monitors, flat screens, and Bluetooth in devices such as digital cameras, televisions, laptops, and wearables.

Restraining Factors

Market growth is expected to be hindered by factors like high manufacturing costs of microprocessor ICs, costly circuit design, rising sales of affordable mobile devices, decreasing sales of PCs, and expensive raw materials.

Market Segmentation

The US microprocessor market share is classified into product type and automation type.

- The ARM MPU segment is expected to hold a significant market share through the forecast period.

The United States microprocessor market is segmented by architecture type into ARM MPU, x64, x86, and MIPS. Among these, the ARM MPU segment is expected to hold a significant market share through the forecast period. This trend is being fueled by the growing use of ARM processors in smartphones and personal computers. The ARM architecture offers various advantages such as simplified design, power efficiency, and easy operation. Its outstanding energy efficiency makes it a perfect fit for portable and low-power embedded devices such as notebooks and smartphones. Also, continuous improvements in ARM architecture have enabled these processors to provide better computing performance than x86 processors.

- The personal computers segment is expected to dominate the US microprocessor market during the projected period.

Based on the application, the United States microprocessor market is divided into smartphones and personal computers. Among these, the personal computers segment is expected to dominate the US microprocessor market during the projected period. Microprocessors dominate the market due to their numerous advantages like improved storage, upgraded memory, enhanced logical functionalities, increased capability for operating system tasks, and lower power usage, making them popular in personal computer usage. Moreover, prominent companies in the industry are constantly launching new products with cutting-edge technologies to capture a large portion of the PC market, thereby driving the segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States microprocessor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advanced Micro Devices, Inc

- Intel Corporation

- Marvell Semiconductor Components Industries, LLC

- Toshiba Electronic Devices & Storage Corporation

- Texas Instruments Incorporated

- Microchip Technology Inc.

- Nvidia Corporation

- MediaTek Inc.

- Broadcom Inc.

- Qualcomm Technologies, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, AMD introduced AMD Embedded+, a new architectural solution that integrates AMD Ryzen Embedded processors with Versal adaptive SoCs on a single board to provide scalable and energy-efficient solutions for ODM partners, reducing time-to-market. Approved by AMD, the Embedded+ integrated computer platform allows ODM customers to decrease qualification and construction durations for quicker time-to-market without using extra hardware and R&D resources.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Microprocessor Market based on the below-mentioned segments:

United States Microprocessor Market, By Architecture Type

- ARM MPU

- x64

- x86

- MIPS

United States Microprocessor Market, By Application

- Smartphones

- Personal Computers

Need help to buy this report?