United States Military Aviation Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Fixed-Wing Aircraft, Rotorcraft), and United States Military Aviation Market Insights, Industry Trend, Forecasts to 2033

Industry: Aerospace & DefenseUnited States Military Aviation Market Insights Forecasts to 2033

- The U.S. Military Aviation Market Size was Valued at in 2023

- The United States Military Aviation Market Size is Growing at a CAGR of 4.68% from 2023 to 2033

- The USA Military Aviation Market Size is Expected to Reach USD 35.7 Billion by 2033

Get more details on this report -

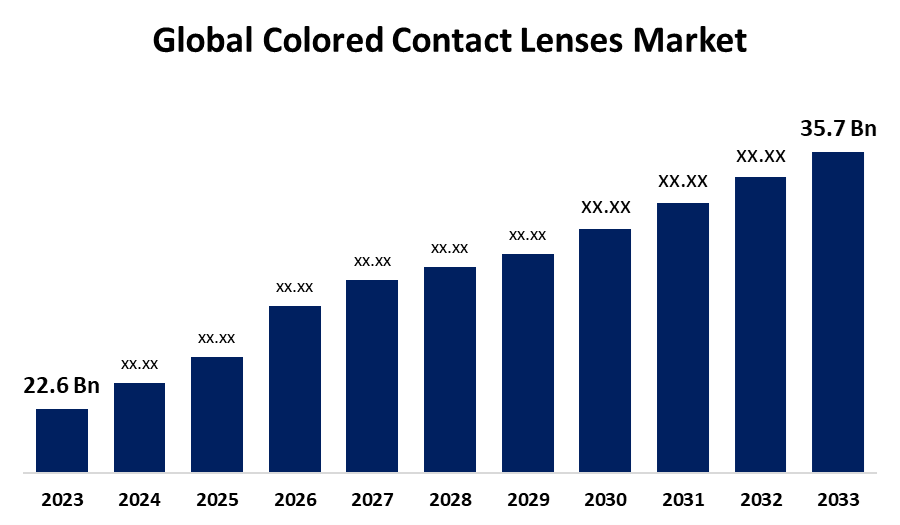

The USA military aviation market size is anticipated to exceed USD 35.7 Billion by 2033, growing at a CAGR of 4.68% from 2023 to 2033. The US military aviation market is growing owing to increased defense budgets, fleet renewal, and new technologies.

Market Overview

The U.S. military aviation industry includes the development, manufacturing, maintenance, and acquisition of military aircraft, such as fighter aircraft, transport aircraft, helicopters, unmanned aerial vehicles, or drones, and surveillance aircraft. It includes defense contractors, government organizations, and technology companies backing national defense, combat missions, reconnaissance, and logistics. Defense budgets, advancements in technology, and changing military tactics drive the market. Moreover, the USA military aviation market is driven by growing defense expenditures, escalating geopolitical tensions, and demand for cutting-edge combat and surveillance aircraft. Advances in stealth, AI, and autonomous technologies boost operational efficiency. Modernization initiatives, fleet replacement due to ageing, and increased demand for unmanned aerial vehicles (UAVs) fuel growth further. Strategic military alliances and ongoing research in hypersonic and next-generation aircraft also propel growth.

Report Coverage

This research report categorizes the market for the US military aviation market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. military aviation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA military aviation market.

United States Military Aviation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 22.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.68% |

| 2033 Value Projection: | USD 35.7 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft Type, and COVID-19 Impact Analysis |

| Companies covered:: | Airbus SE, Lockheed Martin Corporation, Northrop Grumman Corporation, The Boeing Company, Leonardo S.p.A, Textron Inc., and Other Key Players |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The U.S. military aviation market is propelled by ongoing fleet modernization, increasing investment in next-generation aircraft, and the rising demand for unmanned aerial systems. Enhanced defense strategies focus on stealth, hypersonic, and AI-powered aviation technologies. Geopolitical uncertainties drive the procurement of advanced fighter jets and reconnaissance aircraft. Additionally, innovation in avionics, cyber defense, and autonomous operations strengthens market growth, ensuring superior air dominance and mission readiness for future military operations.

Restraining Factors

High development and acquisition expenses, tight regulatory clearances, and long production lead times constrain the US military aviation market. Budgetary pressures, supply chain disruptions, and integration of new technologies further affect growth. Furthermore, geopolitical realignments and changing warfare techniques affect defense expenditure priorities.

Market Segmentation

The US military aviation market share is classified into aircraft type.

- The fixed-wing aircraft segment accounted for the largest share of the US military aviation market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of aircraft type, the United States military aviation market is divided into fixed-wing aircraft and rotorcraft. Among these, the fixed-wing aircraft segment accounted for the largest share of the United States military aviation market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of their crucial role in the fighting, reconnaissance, transport, and strategic defense missions. Fighter aircraft, bombers, and transport planes are well-funded for modernization, with emphasis on air superiority, long-range capabilities, and tactical operations compared to rotorcraft.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA military aviation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

Airbus SE

Lockheed Martin Corporation

Northrop Grumman Corporation

The Boeing Company

Leonardo S.p.A

Textron Inc.

Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, A possible USD 8.5 billion sale of CH-47 Chinook helicopters, engines, and equipment to Germany was authorized by the US State Department.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US military aviation market based on the below-mentioned segments

United States Military Aviation Market, By Aircraft Type

- Fixed-Wing Aircraft

- Rotorcraft

Need help to buy this report?