United States Mobile Virtual Network Operator Market Size, Share, and COVID-19 Impact Analysis, By Type (Business, Discount, M2M, Media, Migrant, and Retail), By Operational Model (Full MVNO and Reseller MVNO), and United States Mobile Virtual Network Operator Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologyUnited States Mobile Virtual Network Operator Market Insights Forecasts to 2033

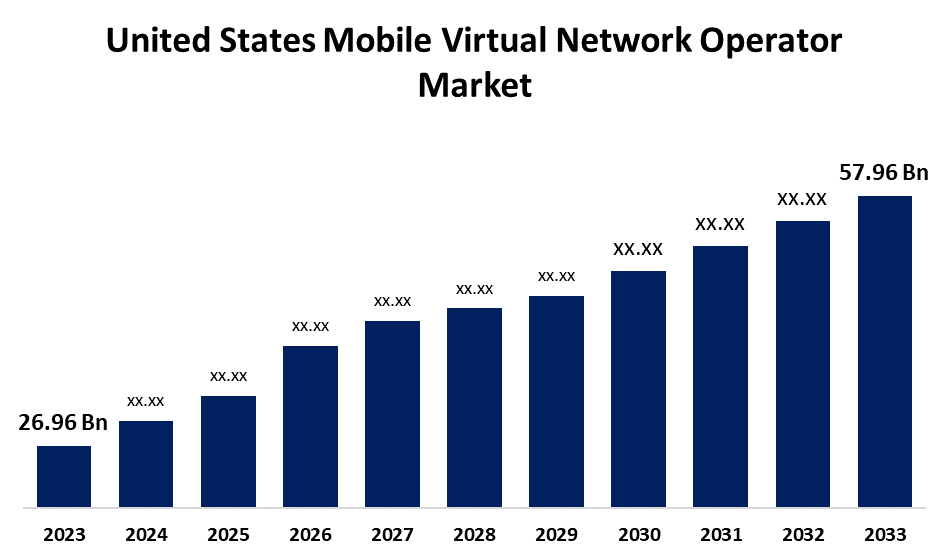

- The U.S. Mobile Virtual Network Operator Market Size was Valued at USD 26.96 Billion in 2023

- The United States Mobile Virtual Network Operator Market Size is Growing at a CAGR of 7.95%from 2023 to 2033

- The USA Mobile Virtual Network Operator Market Size is Expected to Reach USD 57.96 Billion by 2033

Get more details on this report -

The USA Mobile Virtual Network Operator Market Size is anticipated to Exceed USD 57.96 Billion by 2033, Growing at a CAGR of 7.95% from 2023 to 2033. The U.S. MVNO market is expanding steadily, driven by demand for affordable, flexible mobile plans and growing smartphone usage. Discount and reseller segments lead the market, supported by innovative services, 5G adoption, and strategic partnerships with major network operators.

Market Overview

The United States mobile virtual network operator (MVNO) market is the industry that consists of firms that provide mobile services without having wireless infrastructure. MVNOs, instead, rent network capacity from large carriers such as Verizon, AT&T, or T-Mobile and resell it under their own brand name, typically catering to niche markets by offering competitive rates or unique services. Moreover, the U.S. MVNO industry is driven by expanding demand for low-cost mobile services, rising smartphone penetration, and the convenience of no-contract plans. 5G network expansion improves service quality, and eSIM technology makes it easy to switch providers. Strategic partnerships with top carriers also boost MVNOs, enabling them to target niche consumer segments with customized offerings. Moreover, key players in the U.S. MVNO market innovate by offering AI-driven customer support (Gigs), seamless multi-network switching (Google Fi), online-only prepaid plans (Mint Mobile), and integrating Wi-Fi with cellular networks (Xfinity Mobile), enhancing affordability, flexibility, and service quality. For instance, AT&T is an American multinational telecommunications service provider. AT&T provides satellite TV, optical fiber, mobile phones, fixed line, and the internet. AT&T has different data plans for prepaid clients; the customized plans take into consideration the customers' usage of data, providing them with internet services at a competitive price, beginning from USD 25 monthly.

United States Mobile Virtual Network Operator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 26.96 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.95% |

| 2033 Value Projection: | USD 57.96 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Operational Model, and COVID-19 Impact Analysis |

| Companies covered:: | TRACFONE, Comcast Corporation, DISH Network L.L.C., FreedomPop, Red Pocket Mobile, DataXoom, Verizon, AT&T, Cricket Wireless LLC, Virgin Plus, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The U.S. MVNO market is driven by the surge in data-centric applications, increasing demand for personalized mobile services, and the appeal of contract-free flexibility. Businesses entering the telecom space use MVNO models to offer branded services. Enhanced customer experiences, niche targeting, and competitive bundling strategies also support the market’s continued expansion across diverse user demographics. Moreover, FreedomPop is an MVNO and U.S. wireless service provider. FreedomPop provides IP mobile services, broadband devices, and mobile phones. FreedomPop provides unlimited 5G data plans for as low as USD 10/month. To cater to America's growing senior citizen population, FreedomPop entered into a partnership with veteran NBA player Julius Erving in March 2024 to serve as the company's brand ambassador. With this endeavor, the firm hopes to win over mature consumers to its lower-priced plan offerings.

Restraining Factors

High competition from smartphones and laptops, limited computing power for intensive tasks, and shorter upgrade cycles restrain the U.S. mobile virtual network operator market. Additionally, saturation in key consumer segments affects growth.

Market Segmentation

The United States mobile virtual network operator market share is classified into type and operational model.

- The discount segment accounted for the largest share of the US mobile virtual network operator market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of type, the United States mobile virtual network operator market is divided into business, discount, M2M, media, migrant, and retail. Among these, the discount segment accounted for the largest share of the United States mobile virtual network operator market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This dominance is driven by the segment's focus on cost-conscious consumers, offering affordable mobile plans through wholesale network access agreements with major telecom providers. The rising demand for budget-friendly mobile services and increasing competition among telecom providers have further propelled the growth of discount MVNOs.

- The reseller MVNO segment accounted for a substantial share of the U.S. mobile virtual network operator market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the operational model, the U.S. mobile virtual network operator market is divided into full MVNO and reseller MVNO. Among these, the reseller MVNO segment accounted for a substantial share of the U.S. mobile virtual network operator market in 2023 and is anticipated to grow at a rapid pace during the projected period. This prominence is due to its low-cost entry model, allowing companies to offer branded mobile services without owning network infrastructure. Reseller MVNOs benefit from rapid market entry and scalability, making them attractive to businesses seeking to expand their service offerings with minimal operational investment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA mobile virtual network operator market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TRACFONE

- Comcast Corporation

- DISH Network L.L.C.

- FreedomPop

- Red Pocket Mobile

- DataXoom

- Verizon

- AT&T

- Cricket Wireless LLC

- Virgin Plus

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Mediacom Communications introduced its new mobile phone offering, Mediacom Mobile, along with Verizon. The company has created the service to go along with the Mediacom Xtream Internet service, with the goal of delivering a high-speed and trustworthy internet service through value-priced residential data plans.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US mobile virtual network operator market based on the below-mentioned segments:

United States Mobile Virtual Network Operator Market, By Type

- Business

- Discount

- M2M

- Media

- Migrant

- Retail

United States Mobile Virtual Network Operator Market, By Operational Model

- Full MVNO

- Reseller MVNO

Need help to buy this report?