United States Motor Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Third-Party Liability Coverage, Collision, and Comprehensive), By Application (Personal Vehicles and Commercial Vehicles), and the United States Motor Insurance Market Insights Forecasts 2023 - 2033.

Industry: Banking & FinancialUnited States Motor Insurance Market Insights Forecasts to 2033

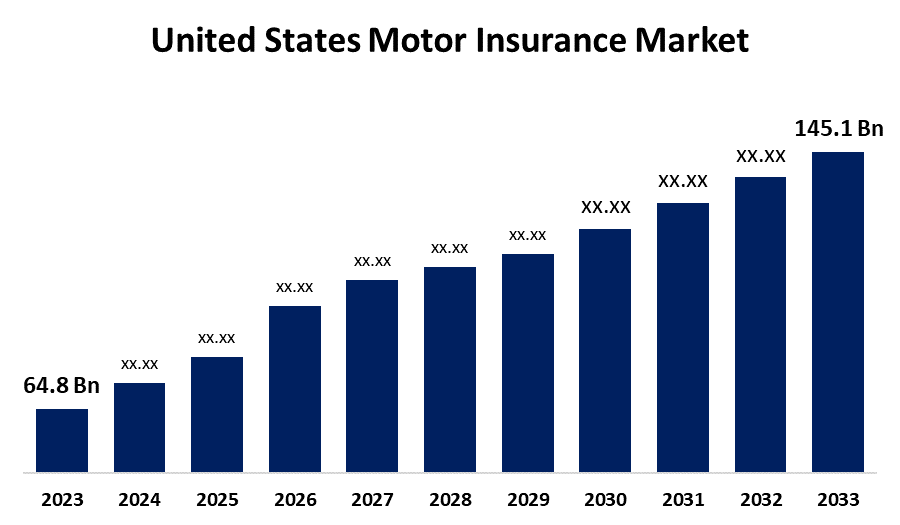

- The United States Motor Insurance Market Size was valued at USD 64.8 Billion in 2023

- The Market Size is Growing at a CAGR of 8.39% from 2023 to 2033.

- The United States Motor Insurance Market Size is Expected to Reach USD 145.1 Billion by 2033.

Get more details on this report -

The United States Motor Insurance Market Size is Expected to reach USD 145.1 Billion by 2033, at a CAGR of 8.39% during the forecast period 2023 to 2033.

Market Overview

The US car insurance market pertains to the insurance sector that specializes in offering protection for vehicles. This consists of various types of vehicles, like delivery vans, trucks, taxis, and company cars, among others. Motor insurance policies provide coverage for a range of risks such as accidents, theft, vandalism, and liability for property damage or bodily injury resulting from the insured vehicle. Around half of the premiums in the U.S. insurance industry come from the non-life insurance sector. The automotive industry is poised for major transformation with the rise of autonomous vehicles (AVs) expected to drive a move away from individual ownership towards shared transportation. The significant transformation of the automotive sector is likely to impact various other industries such as insurance, city planning, infrastructure, and supply chain management. Non-life insurers experiencing low growth and profits are concentrating on innovation and disruption by showing keen interest in new technologies such as telematics, the Internet of Things (IoT), and blockchain to address their challenges. The market for auto insurance exists to provide vehicle owners with financial stability and peace of mind by shifting the risk of possible losses to insurance providers. The obligation for motor insurance in many countries is the primary driving force behind the automobile insurance sector. Governments frequently enforce rules requiring drivers to carry minimum liability coverage to safeguard other people in the event of an accident.

Report Coverage

This research report categorizes the market for the United States motor insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States motor insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States motor insurance market.

United States Motor Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 64.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.39% |

| 2033 Value Projection: | USD 145.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 164 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coverage Type, By Application |

| Companies covered:: | State Farm, Geico, Progressive, Liberty Mutual Insurance Group, Travelers Companies Inc., Berkshire Hathaway Inc., American International Group (AIG), Old Republic International Corp., Nationwide Mutual Group, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The demand for motor insurance has a significant impact on the overall economic development of the country. Commercial cars are in high demand as a result of corporate expansion and increasing economic activity, which increases the need for insurance coverage. Changes in laws regarding vehicle and insurance features can have an immediate impact on the market. Stricter laws regarding liability coverage, compliance requirements, and safety standards can affect firms' decisions to obtain insurance. Trends in accident frequency and severity, which are influenced by weather patterns, driver behavior, and road conditions, directly affect insurance rates.

Restraining Factors

Rising claim-related costs such as medical bills, vehicle repairs, and legal fees can drive up rates, discouraging companies from taking out or extending insurance policies. Compliance with changing regulations, such as safety standards and insurance mandates, can lead to increased costs and administrative burdens for insurers. Loss of trust among insurers due to insurance disputes, claim denials or unhappy customers can hinder the growth of the market.

Market Segment

The United States Motor Insurance Market share is classified into coverage type and application.

- The third-party liability coverage segment is expected to hold the largest market share through the forecast period.

Based on coverage type, the United States motor insurance market is segmented into third-party liability coverage, collision, and comprehensive. Among these, the third-party liability coverage segment is expected to hold the largest market share through the forecast period. This coverage type's primary advantage is that it pays for any harm done to a third party, including property loss, disability, or death. In the event of third-party liability coverage, both the financial and legal needs are met. One of the main factors contributing to the growing need for third-party liability insurance is the likelihood of auto accidents resulting in harm to third parties.

- The personal vehicles segment is expected to hold the largest market share through the forecast period.

Based on application, the United States motor insurance market is segmented into personal vehicles and commercial vehicles. Among these, the personal vehicles segment is expected to hold the largest market share through the forecast period. The enormous number of private automobiles on the planet has raised the demand for auto insurance. As a result of the easy financing and EMI choices, personal vehicles are becoming more and more affordable, which in turn is driving up demand for auto insurance. In the upcoming years, it is anticipated that the rapidly increasing popularity of electric vehicles will have a major effect on the growth of the global auto insurance industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States motor insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- State Farm

- Geico

- Progressive

- Liberty Mutual Insurance Group

- Travelers Companies Inc.

- Berkshire Hathaway Inc.

- American International Group (AIG)

- Old Republic International Corp.

- Nationwide Mutual Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Travelers Companies, Inc. completed the purchase of Corvus Insurance Holdings, Inc., a premier managing general underwriter for cyber insurance distinguished by its state-of-the-art proprietary technology.

- In August 2023, the cyber counterintelligence company SpearTip was acquired by Zurich Holding Company of America. SpearTip is an expert in providing prompt, proactive services that shield customers from online dangers.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Motor Insurance Market based on the below-mentioned segments:

United States Motor Insurance Market, By Coverage Type

- Third-Party Liability Coverage

- Collision

- Comprehensive

United States Motor Insurance Market, By Application

- Personal Vehicles

- Commercial Vehicles

Need help to buy this report?