U.S. Mutual fund Market Size, Share, and COVID-19 Impact Analysis, By Fund Type (Equity, Bond, Hybrid, and Money Market), By Investor Type (Households and Institutions), and U.S. Mutual fund Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUnited States Mutual Fund Market Insights Forecasts to 2033

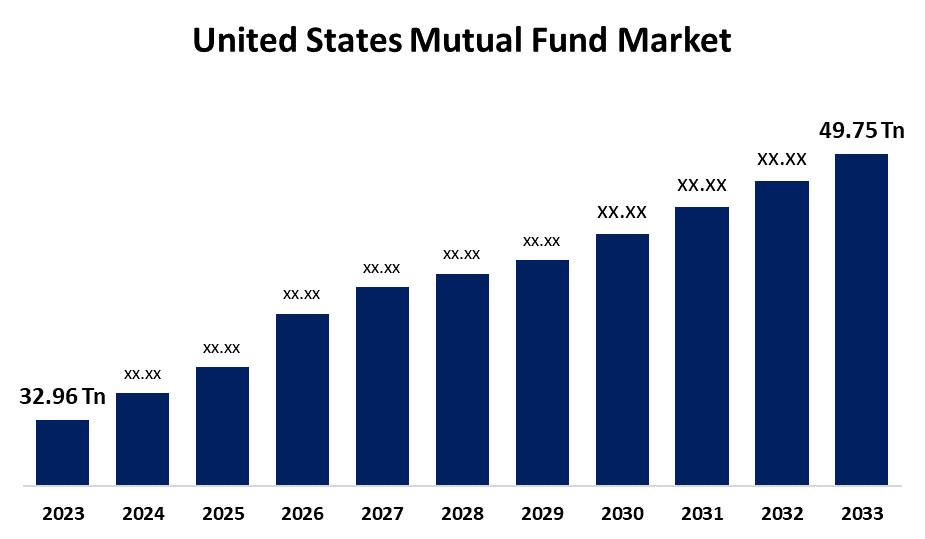

- The U.S. Mutual Fund Market Size Was Valued at USD 32.96 Trillion in 2023.

- The Market is Growing at a CAGR of 4.20% from 2023 To 2033

- The U.S. Mutual Fund Market Size is Expected to Reach USD 49.75 Trillion by 2033

Get more details on this report -

The U.S. Mutual Fund Market Size is Anticipated to Exceed USD 49.75 Trillion by 2033, Growing at a CAGR of 4.20% from 2023 to 2033.

Market Overview

Mutual funds are collective investment schemes that are overseen by skilled financial professionals. They are listed on stock markets and offer investors the opportunity to invest in a variety of assets that have been carefully chosen for the fund. The combination of investments is managed by a skilled fund manager, and the objectives and assets of the fund are specified in the prospectus. Market growth relies on various factors including increased market liquidity, a rising portion of financial savings in total household savings, and an increasing investor pool due to increased awareness. The rankings of the top mutual funds in the U.S. News use both expert opinions and data from the funds to evaluate over 4,500 mutual funds. Rankings are based on different well-known fund rating systems that monitor the past and present performance, risk, and other factors of funds to provide investors with insight into each fund's overall approach and excellence. The reach of digital technology in the mutual fund industry has grown, allowing investors in both Smart Cities and Small Towns to utilize Systematic Investment Plans (SIPs) as well as different types of funds like Equity Funds, Bond Funds, Index Funds, Sector Funds, Commodity Funds, and Debt Oriented Schemes through Demat CDSL, NSDL accounts, and SIP accounts.

Report Coverage

This research report categorizes the market for the US mutual fund market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States mutual fund market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. mutual fund market.

United States Mutual Fund Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 32.96 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.20% |

| 2033 Value Projection: | USD 49.75 Trillion |

| Historical Data for: | 2020-2022 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 142 |

| Segments covered: | By Fund Type, By Investor Type and COVID-19 Impact Analysis. |

| Companies covered:: | BlackRock, The Vanguard Group, State Street Global Advisors, Fidelity Investments, J.P. Morgan Asset Management, BNY Mellon Investment Management, PIMCO, UBS, Allianz, Amundi, Other Key Vendors. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

In 2021, the United States represented 25% of the total worldwide mutual funds. When looking at the global scale, the US market accounts for nearly 25% of all funds, showcasing its impressive size. US mutual funds include various asset types, including stocks, bonds, market capitalizations, sectors, industries, and investment styles. The money is actively overseen to generate short and long-term profits. US Funds consists of numerous major corporations across different sectors such as automotive, tech, healthcare, and the web.

Restraining Factors

Challenges in the market include transaction risks, interest rate and principal amount fluctuations, and the availability of alternative investment choices. These barriers might hinder the efficient operation of the market and cause doubts for investors.

Market Segmentation

The US mutual fund market share is classified into fund type and investor type.

- The equity segment is expected to hold a significant market share through the forecast period.

The United States mutual fund market is segmented by fund type into equity, bond, hybrid, and money market. Among these, the equity segment is expected to hold a significant market share through the forecast period. Mutual funds are Investment Funds in which multiple investors combine their funds to invest in a variety of securities like stocks, bonds, commodities, or industry-specific sectors. The mutual fund sector has experienced substantial digital expansion, reaching out to retail investors in both smart cities and small towns through the use of SIPs and Demat accounts provided by CDSL, NSDL, and SIP accounts. Equity Funds, such as growth funds, income funds, and sector funds, focus on investing in stocks.

- The household segment is expected to dominate the US mutual fund market during the projected period.

Based on the investor type, the United States mutual fund market is divided into households and institutions. Among these, the household segment is expected to dominate the US mutual fund market during the projected period. Households, along with individual investors, generally own a large portion of mutual fund assets because they commonly contribute to retirement accounts (such as 401(k)s and IRAs), education savings plans, and personal investment accounts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States mutual fund market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BlackRock

- The Vanguard Group

- State Street Global Advisors

- Fidelity Investments

- J.P. Morgan Asset Management

- BNY Mellon Investment Management

- PIMCO

- UBS

- Allianz

- Amundi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, EnCap Investments L.P. (EnCap) revealed that BlackRock Alternatives (BlackRock) will acquire Jupiter Power LLC (Jupiter) through a fund managed by its Diversified Infrastructure business. Jupiter is a top U.S. operator and developer of stand-alone, utility-scale battery energy storage systems.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Mutual Fund Market based on the below-mentioned segments:

United States Mutual Fund Market, By Fund Type

- Equity

- Bond

- Hybrid

- Money Market

United States Mutual Fund Market, By Investor Type

- Households

- Institutions

Need help to buy this report?