United States Nasopharyngeal Swabs Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Swab, Transport Media, and UTM/VTM Kits), By End-User (Clinical Laboratories, Hospitals & Clinics, and Others), and United States Nasopharyngeal Swabs Market Insights Forecasts to 2033

Industry: HealthcareUnited States Nasopharyngeal Swabs Market Insights Forecasts to 2033

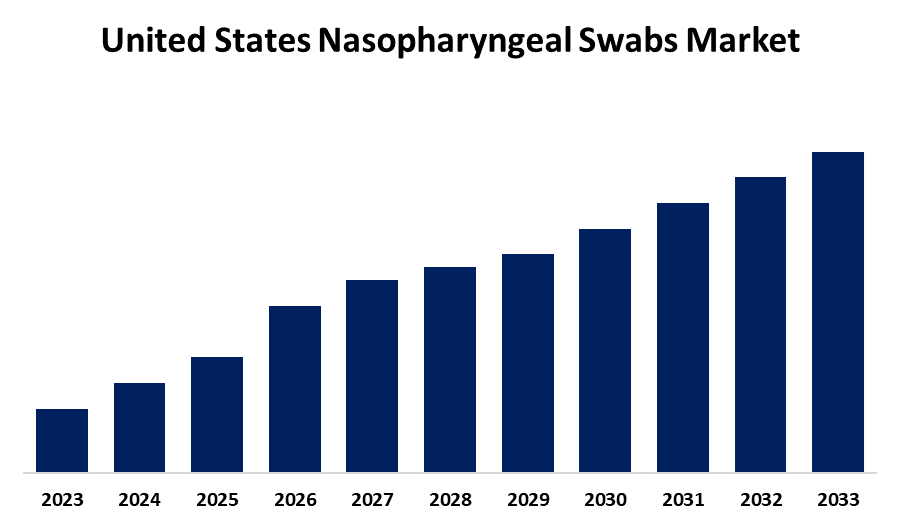

- The Market is growing at a CAGR of 4.2% from 2023 to 2033

- The US Nasopharyngeal Swabs Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Nasopharyngeal Swabs Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.2% from 2023 to 2033.

Market Overview

A nasopharyngeal swab is a diagnostic specimen collection that is collected on a swab from the nasal passages, specifically the nasopharynx. These swabs are essential in diagnosing and identifying respiratory infections caused by both viral and bacterial pathogens, including influenza, and COVID-19, among others. The samples collected from the swab usually require laboratory investigation to detect the presence of any pathogens, therefore treatment and infection control measures can be executed. Furthermore, increased cases of respiratory infections along with growing awareness among people and healthcare providers have triggered demand for reliable diagnostic tools. In addition, government initiatives to expand capabilities in testing and improve health infrastructure further accelerated the growth in the market. The acceleration of diagnostics test approval by the FDA from using a nasopharyngeal swab has streamlined more choices for access to testing. Improvements in the design and materials used for the swab have led to better accuracy in sample collection and patient comfort. Nasopharyngeal swabs are now being used in home test kits, providing consumers with greater accessibility. These factors, along with continuous advances in molecular diagnostics and research, will be seen as pillars in shaping the future growth trajectory of the market for nasopharyngeal swabs in the United States.

Report Coverage

This research report categorizes the market for the United States nasopharyngeal swabs based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States nasopharyngeal swabs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States nasopharyngeal swabs market sub-segment.

United States Nasopharyngeal Swabs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Thermo Fisher Scientific Inc., Copan Diagnostics Inc., BD (Becton, Dickinson and Company), Puritan Medical Products Company LLC, Medical Wire & Equipment Co. Ltd., Hardy Diagnostics, Mölnlycke Health Care, Roche Diagnostics Corporation, Abbott Laboratories, Qiagen N.V. and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the market in nasopharyngeal swabs is mainly due to the increasing prevalence of respiratory infections, including viral infections such as COVID-19 and influenza, where proper testing is highly significant. Further fueling the growth of this market is the expansion of diagnostic testing in healthcare settings and the increased attention to early detection of diseases and infection control. Other drivers of growth in the market are government actions to improve testing infrastructure and public health surveillance, supplemented by a quick turnaround of approvals for diagnostic tests. Finally, advancements in the swab materials and design that make them more accurate and comfortable for patients provide additional impetus for increased adoption of nasopharyngeal swabs in clinical and home testing applications.

Restraining Factors

Covariant deterrents in the nasopharyngeal swabs market include the pains and discomfort associated with collecting samples that may deter patient compliance. Higher costs of making, issues with the supply chain, regulatory challenges, and also limited accessibility of testing infrastructure to well into rural or underserved areas restrain the market.

Market Segment

The U.S. nasopharyngeal swabs market share is classified into product type and end-user.

- The UTM/VTM kits segment is expected to hold the largest market share through the forecast period.

The US nasopharyngeal swabs market is by product type into swabs, transport media, and UTM/VTM kits. Among these, the UTM/VTM kits segment is expected to hold the largest market share through the forecast period. This is attributed to the kits through the fact that they offer a streamlined solution, therefore, making it more convenient for practitioners. Further driving the development and acceptance of VTM/UTM kits could be increased emphasis on point-of-care testing and telemedicine.

- The hospitals & clinics segment is expected to hold the largest market share through the forecast period.

The US nasopharyngeal swabs market is segmented by end-users into clinical laboratories, hospitals & clinics, and others. Among these, the tablets segment is expected to hold the largest market share through the forecast period. This is attributed to the growth of viral and infectious diseases, along with the increasing demand for precise respiratory infection diagnosis in hospitals and clinics, which is driving the demand for these swabs, which further contributes to this segment's growth in the coming years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States nasopharyngeal swabs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific Inc.

- Copan Diagnostics Inc.

- BD (Becton, Dickinson and Company)

- Puritan Medical Products Company LLC

- Medical Wire & Equipment Co. Ltd.

- Hardy Diagnostics

- Mölnlycke Health Care

- Roche Diagnostics Corporation

- Abbott Laboratories

- Qiagen N.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, Thermo Fisher Scientific Inc. announced its collaboration with Devyser to promote laboratory services and support development projects.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States nasopharyngeal swabs market based on the below-mentioned segments:

United States Nasopharyngeal Swabs Market, By Product Type

- Swab

- Transport Media

- UTM/VTM Kits

United States Nasopharyngeal Swabs Market, By End-User

- Clinical Laboratories

- Hospitals & Clinics

- Others

Need help to buy this report?