United States Neurovascular Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Stenting Systems, Embolization Devices, Neurothrombectomy Devices, and Support Devices), By Application (Cerebral Aneurysms, Ischemic Stroke, and Others), and US Neurovascular Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Neurovascular Devices Market Insights Forecasts to 2033

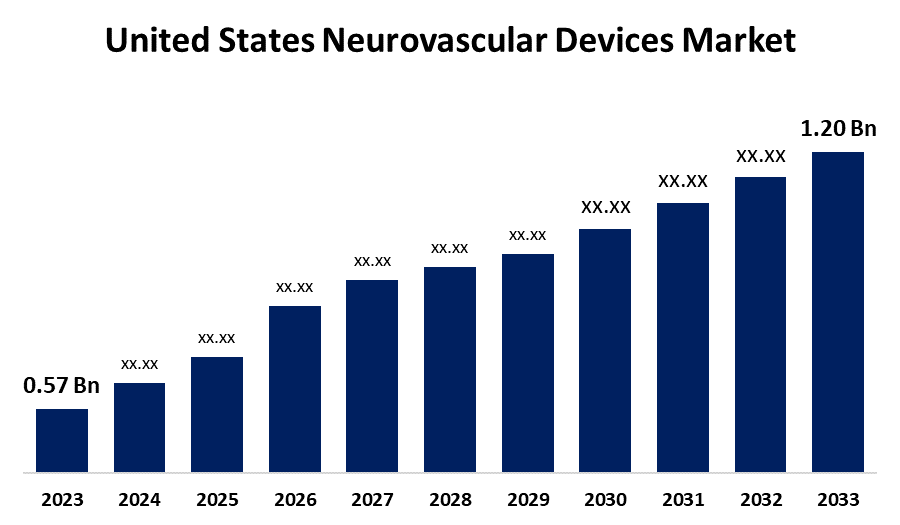

- The U.S. Neurovascular Devices Market Size was valued at USD 0.57 Billion in 2023.

- The Market is Growing at a CAGR of 7.73% from 2023 to 2033

- The U.S. Neurovascular Devices Market Size is Expected to Reach USD 1.20 Billion by 2033

Get more details on this report -

The U.S. Neurovascular Devices Market Size is Anticipated to Exceed USD 1.20 Billion by 2033, growing at a CAGR of 7.73% from 2023 to 2033.

Market Overview

Neurovascular disease is one that causes the arteries to narrow, thus affecting the supply of blood to the brain and spinal cord. Neurovascular diseases are those disorders that lead to brain aneurysms, and vascular malformation, stroke. These diseases can be treated by using several neurovascular devices such as flow diversion stents, neurothrombectomy devices, and others, to prevent aneurysm rupture in patients. Neurovascular devices have seen a rising demand as the burden of neurovascular diseases has been increasing; in turn, this has enhanced the development of the market for neurovascular devices. As per the Brain Aneurysm Foundation, every year, close to 30,000 cases of rupture occur in the U.S. Advancements in neurovascular disorders such as stroke & brain aneurysms along with an increased demand for minimally invasive neurological procedures have been the prime drivers of market growth. Furthermore, well-established health infrastructure and lenient reimbursement and regulatory policies in the country offer substantial opportunities for growth in the market.

Report Coverage

This research report categorizes the market for the US neurovascular devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States neurovascular devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. neurovascular devices market.

United States Neurovascular Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.57 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.73% |

| 2033 Value Projection: | USD 1.20 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Device Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Medtronic, Penumbra, Inc, Stryker, Johnson and Johnson Services, Inc, MicroPort Scientific Corporation, Acandis GmbH, MicroVention, Inc., NeuroVasc Technologies, Inc., ASAHI INTECC USA, INC, Perflow Medical Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Against such open surgeries with the benefits of rapid recovery and relatively shorter stays in hospitals, the demand for minimally invasive procedures has increased. Besides this, the demand for minimally invasive procedures will rise, and therefore, there will be more market players paying attention to the commercialization of neurovascular devices. In September 2022, CERENOVUS, part of Johnson & Johnson Services, Inc., announced minimally invasive CERENOVUS Stroke Solutions. This product is a technology that helps physicians in a procedure known as clot removal.

Restraining Factors

Designing and development of the medical devices which have to be inserted in the human body is quite challenging, mainly because of the sophisticated human body system and anatomical locations. Such medical device designing, developments, and approvals require very high capital investments at all stages from research & development to marketing of approved products.

Market Segmentation

The US neurovascular devices market share is classified into device type and application.

- The embolization devices segment is expected to hold a significant market share through the forecast period.

The United States neurovascular devices market is segmented, by device type into stenting systems, embolization devices, neurothrombectomy devices, and support devices. Among these, the embolization devices segment is expected to hold a significant market share through the forecast period. Major factors for higher adoption in the U.S. include reimbursement policies that are positive for neurovascular devices, coupled with a higher adoption of advanced devices. For instance, all the private and government health insurers that covered Medicare, Medicaid, and others provided favorable reimbursement policies for neurovascular products, all types of embolic, as well as liquid coils.

- The cerebral aneurysms segment is expected to dominate the US neurovascular devices market during the projected period.

Based on the application, the United States neurovascular devices market is divided into cerebral aneurysms, ischemic stroke, and others. Among these, the cerebral aneurysms segment is expected to dominate the US neurovascular devices market during the projected period. This segment is valued, and it attributes the main reasons behind this trend as an increase in cerebral aneurysms and the adequate reimbursement for these devices in the country.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States neurovascular devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Penumbra, Inc

- Stryker

- Johnson and Johnson Services, Inc

- MicroPort Scientific Corporation

- Acandis GmbH

- MicroVention, Inc.

- NeuroVasc Technologies, Inc.

- ASAHI INTECC USA, INC

- Perflow Medical Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Medtronic launched the Neurovascular Co-Lab Platform, to spur innovation in treating and curing stroke, where it is most needed.

- In September 2022, Penumbra, Inc. announced the commercial launch of its RED reperfusion catheters for stroke care in Europe. The launch supports the company's product portfolio for neurovascular devices.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States neurovascular devices market based on the below-mentioned segments:

United States Neurovascular Devices Market, By Device Type

- Stenting Systems

- Embolization Devices

- Neurothrombectomy Devices

- Support Devices

United States Neurovascular Devices Market, By Application

- Cerebral Aneurysms

- Ischemic Stroke

- Others

Need help to buy this report?