United States Non Invasive Prenatal Testing Market Size, Share, and COVID-19 Impact Analysis, By Gestation Period (0-12 weeks, 13-24 weeks, and 25-35 weeks), By Risk (High & Average Risk and Low Risk), By Method (Biochemical Screening Tests and Cell-free DNA in Maternal Plasma Tests), By Technology (NGS, Array Technology, PCR, and Others), By Product (Consumables & Reagents and Instruments), By Application (Trisomy, Microdeletion Syndrome, and Others), By End-use (Hospitals & Clinics and Diagnostic Laboratories), and United States Non Invasive Prenatal Testing Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Non Invasive Prenatal Testing Market Insights Forecasts to 2033

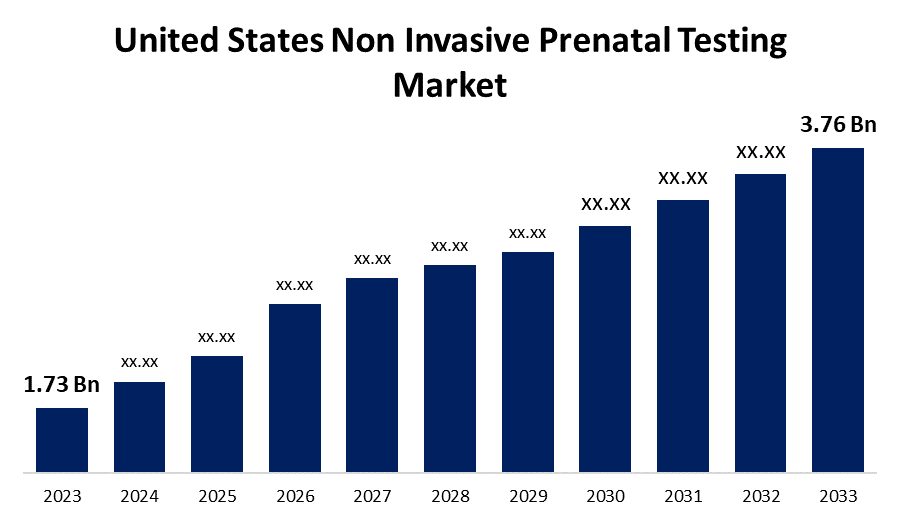

- The U.S. Non Invasive Prenatal Testing Market Size was valued at USD 1.73 Billion in 2023.

- The Market is growing at a CAGR of 8.07% from 2023 to 2033

- The U.S. Non Invasive Prenatal Testing Market Size is expected to reach USD 3.76 Billion by 2033.

Get more details on this report -

The United States Non Invasive Prenatal Testing Market is anticipated to exceed USD 3.76 Billion by 2033, growing at a CAGR of 8.07% from 2023 to 2033. The growing prevalence of chromosomal disorders, rising average maternal age, and increased adoption of early non invasive prenatal testing (NIPT) are driving the growth of the non invasive prenatal testing market in the US.

Market Overview

Non invasive prenatal testing is a blood test of a pregnant woman to examine certain genetic abnormalities, usually chromosomal disorders. It is a method of determining the risk of congenital abnormalities such as Down syndrome, trisomy 13, and spina bifida in the fetus. As per the CDC, trisomy 21, also known as Down syndrome, accounts for around 1 in 700 births in the United States, and approximately 6,000 newborns are born with Down syndrome every year. It is the most prevalent chromosomal anomaly. This surges the demand for effective tools for prenatal tests. Government and corporate entities are actively seeking out research centers and startups to create novel testing protocols for non-invasive prenatal testing that can identify important genetic abnormalities.

Report Coverage

This research report categorizes the market for the US non invasive prenatal testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States non invasive prenatal testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US non invasive prenatal testing market.

United States Non Invasive Prenatal Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.73 Billion |

| Forecast Period: | 2023-2033 |

| 2033 Value Projection: | USD 3.76 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Gestation Period, By Risk, By Method, By Technology, By Product, By Application, By End-use |

| Companies covered:: | Illumina, Inc., Natera, Inc., Ariosa Diagnostics (Roche), QIAGEN, Laboratory Corporation of America Holdings, Myriad Women’s Health, Inc., Quest Diagnostics Incorporated, Eurofins Scientific, Invitae Corporation, BioReference Health, LLC (Subsidiary of OPKO Health, Inc.), and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As per the article in the NLM database, A total of 2.3% of NICU admissions were caused by congenital defects, of which 59 newborn infants (39.3%) had abnormalities in their chromosomes. With 4,222/1,000 live births, the prevalence rate of chromosomal abnormalities was 0.42%. The growing prevalence of chromosomal disorders surges the need for proper diagnosis and treatment which ultimately leads to drive the market demand for non invasive prenatal testing. The risk of having a child with a chromosomal condition increases with maternal age, rising exponentially after a woman reaches age 35. The increasing average age of women giving birth is thus responsible for driving the market demand. The increasing adoption and application of early non invasive prenatal testing (NIPT) are propelling the market growth.

Restraining Factors

The high cost of NIPT and the lack of awareness about genetic abnormalities risks may hamper the market for non invasive prenatal testing. Further, lower per capita healthcare expenditure and lack of adequate reimbursement policies are further limiting the market growth.

Market Segmentation

The United States Non Invasive Prenatal Testing Market share is classified into gestation period, risk, method, technology, product, application, and end-use.

- The 13-24 weeks segment dominated the US non invasive prenatal testing market with the largest share in 2023.

The United States non invasive prenatal testing market is segmented by gestation period into 0-12 weeks, 13-24 weeks, and 25-35 weeks. Among these, the 13-24 weeks segment dominated the US non invasive prenatal testing market with the largest share in 2023. A maximum number of NIPT procedures are performed in the second trimester. The additional use of NIPT and alpha-fetoprotein tests in conjunction with ultrasound after 12 weeks of pregnancy is driving the market in the 13-24 weeks segment.

- The high & average risk segment dominates the market with the largest market share during the forecast period.

The United States non invasive prenatal testing market is segmented by risk into high & average risk and low risk. Among these, the high & average risk segment dominates the market with the largest market share during the forecast period. Pregnancies among women over 35 are known to be high-risk. The sensitivity of the products that are on the market to identify Down syndrome ranges from 99.0% to 99.9%. The widespread use of NIPT in this risk category drives the market growth.

- The cell-free DNA in maternal plasma tests segment dominates the US non invasive prenatal testing market in 2023.

Based on the method, the U.S. non invasive prenatal testing market is divided into biochemical screening tests and cell-free DNA in maternal plasma tests. Among these, the cell-free DNA in maternal plasma tests segment dominates the US non invasive prenatal testing market in 2023. Cell-free DNA testing technique that looks for naturally occurring fetal DNA in the mother's circulation during pregnancy. Certain malignancies can be identified and characterized and also can track cancer treatment. The widespread acceptance, high test costs, and quick adoption of tests that identify circulating biomarkers, like cell-free DNA fragments are driving the market growth.

- The NGS segment is anticipated to grow at the fastest CAGR during the forecast period.

The United States non invasive prenatal testing market is segmented by technology into NGS, array technology, PCR, and others. Among these, the NGS segment is anticipated to grow at the fastest CAGR during the forecast period. The use of NGS in tests analyzes cfDNA fragments across the whole genome, which has advantages over other NIPT methodologies, including targeted sequencing and array-based tests. Chromosomal aneuploidies, microdeletions, and trisomy disorders are detected by NGS. The high accuracy of the test and expanding technology are driving the market growth.

- The consumables & reagents segment accounted for the largest revenue share of the US non invasive prenatal testing market in 2023.

The United States non invasive prenatal testing market is segmented by product into consumables & reagents and instruments. Among these, the consumables & reagents segment accounted for the largest revenue share of the US non invasive prenatal testing market in 2023. In order to meet the demands of NIPT laboratories and healthcare providers, companies in this market focus on producing consumables and reagents that are of the highest standard, most dependable, and easiest to use. The increasing R&D activities for the detection of genetic disorders are driving the market.

- The trisomy segment dominates the market with a significant market share during the forecast period.

Based on the application, the U.S. non invasive prenatal testing market is divided into trisomy, microdeletion syndrome, and others. Among these, the trisomy segment dominates the market with a significant market share during the forecast period. Trisomy is a genetic condition that results in an extra copy of a chromosome. With the help of NIPT test, a pregnant lady can find out if her unborn child has sex chromosomal or autosomal aneuploidies. The growing awareness of trisomy, the rising incidence of the condition, and encouraging government actions are driving the market growth.

- The diagnostic laboratories segment held the largest revenue share of the US non invasive prenatal testing market in 2023.

Based on the end-use, the U.S. non invasive prenatal testing market is divided into hospitals & clinics and diagnostic laboratories. Among these, the diagnostic laboratories segment held the largest revenue share of the US non invasive prenatal testing market in 2023. Diagnostic labs such as MedGenome Labs Ltd. provide MedGenome Claria NIPT testing for the diagnosis of sex chromosomal abnormalities, including Trisomies 21, 18, and 13, Monosomy X, and others. These labs assist medical professionals and expectant parents with accurate screening test results by providing the necessary equipment, manpower, and technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. non invasive prenatal testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Illumina, Inc.

- Natera, Inc.

- Ariosa Diagnostics (Roche)

- QIAGEN

- Laboratory Corporation of America Holdings

- Myriad Women’s Health, Inc.

- Quest Diagnostics Incorporated

- Eurofins Scientific

- Invitae Corporation

- BioReference Health, LLC (Subsidiary of OPKO Health, Inc.)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Igentify, a digital health company alleviating bottlenecks in the genetic testing process, announced the launch of its Non-Invasive Prenatal Testing (NIPT) and Pharmacogenomics (PGx) offerings via the Digital Genetic Assistant platform.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Non Invasive Prenatal Testing Market based on the below-mentioned segments:

US Non Invasive Prenatal Testing Market, By Gestation Period

- 0-12 weeks

- 13-24 weeks

- 25-35 weeks

US Non Invasive Prenatal Testing Market, By Risk

- High & Average Risk

- Low Risk

US Non Invasive Prenatal Testing Market, By Method

- Biochemical Screening Tests

- Cell-free DNA in Maternal Plasma Tests

US Non Invasive Prenatal Testing Market, By Technology

- NGS

- Array Technology

- PCR

- Others

US Non Invasive Prenatal Testing Market, By Product

- Consumables & Reagents

- Instruments

US Non Invasive Prenatal Testing Market, By Application

- Trisomy

- Microdeletion Syndrome

- Others

US Non Invasive Prenatal Testing Market, By End-use

- Hospitals & Clinics

- Diagnostic Laboratories

Need help to buy this report?