United States Nootropics Market Size, Share, and COVID-19 Impact Analysis, By Product (Natural and Synthetic), By Form (Powder, Drinks, Gummies, Capsules/Tablets, and Others), By Application (Cognitive Enhance, Mood & Stress Management, Sleep Optimization, Energy & Physical Performance, and Others), and U.S. Nootropics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Nootropics Market Insights Forecasts to 2033

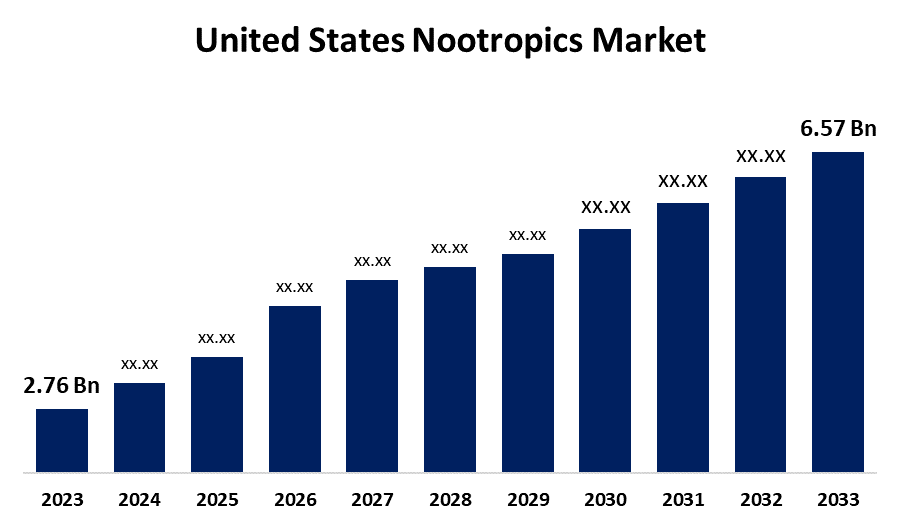

- The United States Nootropics Market Size Was Estimated at USD 2.76 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.06% from 2023 to 2033

- The USA Nootropics Market Size is Expected to Reach USD 6.57 Billion by 2033

Get more details on this report -

The United States Nootropics Market Size is expected to reach USD 6.57 Billion by 2033, growing at a CAGR of 9.06% from 2023 to 2033.

Market Overview

The market for cognitive-enhancing vitamins and drugs intended to enhance memory, focus, brain function, and general mental performance is referred to as the U.S. nootropics market. This market covers both synthetic and natural nootropics, which come in a variety of formats like beverages, gummies, and powders. The need for cognitive health enhancements and growing consumer awareness are the main drivers of this rise, especially among professionals and students looking to increase their productivity and focus. Consumers are increasingly using nootropics to maintain brain health and enhance mental performance as they grow more health-conscious. Additionally, the market's growth has been further stimulated by the convenience of accessing these supplements via internet platforms. Moreover, technology integration in the nootropics sector, such as customized supplement recommendations and cognitive evaluations, is also propelling market expansion by providing customers with more individualized and efficient solutions. Furthermore, government initiatives aid in market expansion, such as the U.S. government monitoring the rise of nootropics, including cognitive enhancers, through programs like NDEWS, despite no direct federal initiatives promoting these substances.

Report Coverage

This research report categorizes the market for the U.S. nootropics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US nootropics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA nootropics market.

United States Nootropics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.76 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.06% |

| 2033 Value Projection: | USD 6.57 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Form, By Application |

| Companies covered:: | Reckitt Benckiser Group PLC (Schiff RB Health (US) LLC), Unilever Onnit Labs, Inc., Amway, Natural Stacks, BrainMD Health, Nootropics Depot, GNC Holdings, LLC, NeuroGum, Inc., Qualia Life Sciences, LLC, NOW Foods., Performance Lab USA Corp., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US nootropics market is experiencing steady growth due to there is growing interest in nootropics as a possible instrument to improve cognitive functions in the face of high stress and work responsibilities, since cognitive health is becoming more widely acknowledged as being essential for overall wellbeing. Additionally, the U.S. nootropics industry is advancing with novel compounds, sophisticated delivery mechanisms, and synergistic formulations, focusing on targeted cognitive benefits derived from neuroscience and nutritional science. In addition, the U.S. nootropics market is experiencing moderately robust merger and acquisition activity, driven by larger supplement and wellness companies expanding offerings and diversifying into specialized niches.

Restraining Factors

The market for nootropics in the United States is hampered due to the lack of strong clinical research and the possibility of cognitive benefits. The market for nootropics is constrained by a lack of scientific evidence, which also affects consumer views, industry growth, and regulatory considerations.

Market Segmentation

The U.S. nootropics market share is classified into product, form, and application.

- The natural segment accounted for the largest market share of 77.19% in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on the product, the U.S. nootropics market is classified into natural and synthetic. Among these, the natural segment accounted for the largest market share of 77.19% in 2023 and is estimated to grow at a significant CAGR during the projected period. The market for natural nootropics is expanding due to consumer demand for natural and organic products. With the growing popularity of herbal nootropics like ginkgo biloba, this trend is in line with changes in health and wellness. Market domination is influenced by accessibility through retail channels and cultural changes.

Based on the form, the U.S. nootropics market is divided into powder, drinks, gummies, capsules/tablets, and others. Among these, the drinks segment accounted for the highest market share of 32.25% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to functional beverages being a convenient and appealing choice for consumers looking for mental clarity and focus, since they mix delicious flavors with cognitive advantages. In addition, the popularity of internet marketing and e-commerce platforms has made these items more visible and accessible, making it simple for customers to buy and consume nootropic drinks.

- The cognitive enhance segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the application, the U.S. nootropics market is divided into cognitive enhance, mood & stress management, sleep optimization, energy & physical performance, and others. Among these, the cognitive enhance segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period. There is an increasing need for goods that boost mental clarity, memory, and focus, especially among educators and learners looking to increase performance and productivity. In addition, the use of nootropics for cognitive enhancement has increased dramatically as a result of growing awareness of the significance of mental health and cognitive health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. nootropics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

- Reckitt Benckiser Group PLC (Schiff RB Health (US) LLC)

- Unilever Onnit Labs, Inc.

- Amway

- Natural Stacks

- BrainMD Health

- Nootropics Depot

- GNC Holdings, LLC

- NeuroGum, Inc.

- Qualia Life Sciences, LLC

- NOW Foods.

- Performance Lab USA Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Matador Energy revealed that it will begin nationwide distribution in Circle K locations around the United States, expanding the market for its functional energy shots. The purpose of the energy shot was to offer cleaner, more useful energy options. It was made with 185 mg of natural caffeine from coffee bean extract, a nootropic blend that included 200 mg of Alpha GPC, and the complete daily value of vital B vitamins.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. nootropics market based on the below-mentioned segments:

U.S. Nootropics Market, By Product

- Natural

- Synthetic

U.S. Nootropics Market, By Form

- Powder

- Drinks

- Gummies

- Capsules/Tablets

- Others

U.S. Nootropics Market, By Application

- Cognitive Enhance

- Mood & Stress Management

- Sleep Optimization

- Energy & Physical Performance

- Others

Need help to buy this report?