United States Nutraceuticals Market Size, Share, and COVID-19 Impact Analysis, By Type (Dietary Supplements, Functional Beverages, Functional Food, and Personal Care), By Form (Capsules, Liquid & Gummies, Tablets & Soft Gels, Powder, and Others), By Sales Channel (Offline and Online), and United States Nutraceuticals Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited States Nutraceuticals Market Insights Forecasts to 2033

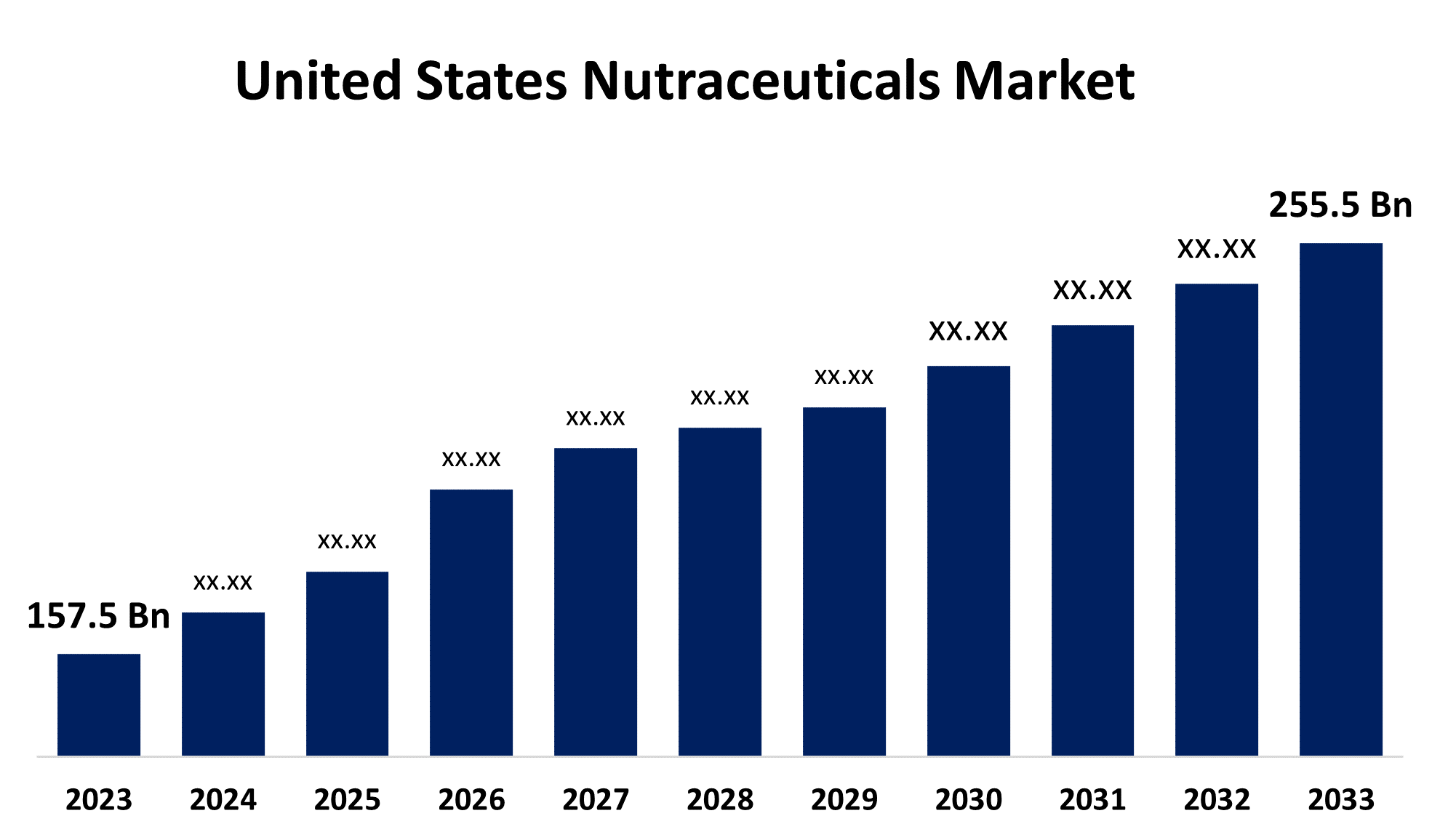

- The United States Nutraceuticals Market Size was valued at USD 157.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.96% from 2023 to 2033

- The U.S. Nutraceuticals Market Size is Expected to reach USD 255.5 Billion by 2033

Get more details on this report -

The United States Nutraceuticals Market is anticipated to exceed USD 255.5 billion by 2033, growing at a CAGR of 4.96% from 2023 to 2033. The growing need for preventative healthcare strategies and the growing prevalence of chronic diseases are driving the growth of the nutraceuticals market in the United States.

Market Overview

Nutraceuticals are products derived from food sources that provide physiological benefits, protect against chronic diseases, improve health, delay aging, and increase life expectancy. According to forecasts from the American Heart Association, 42% of Americans obese in 2023—a 10% increase from the preceding ten years. Since cardiovascular disease (CVD) continues to be the leading cause of preventable mortality among men and women in every ethnic and racial background in the United States, pharmacists should expect to receive patients seeking advice on the various nutritional supplements promoted for the promotion of cardiovascular health. There is growing recognition of the link between diet and mental well-being. Customers are adopting a more holistic approach to health as they see the link between mental and physical well-being. These trends are benefitting the nutraceutical businesses. The integration of a tailored approach by using digital health platforms is improving the products’ effectiveness and client satisfaction. Thus, the incorporation of digital health platforms is providing market opportunities.

Report Coverage

This research report categorizes the market for the US nutraceuticals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the nutraceuticals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the nutraceuticals market.

United States Nutraceuticals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 157.5 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.96% |

| 2033 Value Projection: | USD 255.5 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 193 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Form, By Sales Channel |

| Companies covered:: | Amway, Pfizer Inc., Nestle, DSM, General Mills Inc., The Hain Celestial Group, Inc., Nature’s Bounty, Danone, Tyson Foods, The Kraft Heinz Company, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for proactive health management among consumers due to rising consciousness about the significance of preserving general health and preventing illnesses is driving the market. The increasing demand for customized nutraceutical goods owing to increasing awareness and technological developments is driving up the market demand. The ease of accessibility and customer convenience of e-commerce platforms lead to drive market growth. The rising interest in fitness and athletic performance has driven the market in the sports segment. Further, the increasing support by government programs and insurance policies as well as the inclination towards natural, organic, and minimally processed goods are driving the market growth for nutraceuticals. In addition, the collaborations of nutraceutical companies with medical professionals are also contributing to driving the market growth.

Restraining Factors

The customers' inability to pay out-of-pocket as a result of this lack of coverage, especially for those with little money or disposable income hampering the accessibility leads to restricting the market growth. Nutraceuticals cannot be extensively accessed and used due to insurance coverage restrictions and pricing issues which are restraining the US nutraceuticals market.

Market Segmentation

The United States Nutraceuticals Market share is classified into type, form, and sales channel.

- The functional food segment dominated the market with the largest market share during the forecast period.

The United States nutraceuticals market is segmented by type into dietary supplements, functional beverages, functional food, and personal care. Among these, the functional food segment dominated the market with the largest market share during the forecast period. Functional food offer simple substitutes for those who wish to improve their health but do not want to drastically alter their diet or lifestyle changes. Yoghurt laced with probiotics, protein bars, and fortified cereals are products designed to accommodate hectic lifestyles.

- The tablets & soft gels segment is dominating the US nutraceuticals market during the forecast period.

Based on the form, the United States nutraceuticals market is divided into capsules, liquid & gummies, tablets & soft gels, powder, and others. Among these, the tablets & soft gels segment is dominating the US nutraceuticals market during the forecast period. Tablets and soft gels are simple to incorporate into everyday routine and possess longer shelf life than others. It includes vitamins, minerals, herbal extracts, and other nutrients.

- The offline segment dominated the United States nutraceuticals market during the forecast period.

Based on the sales channel, the United States nutraceuticals market is divided into offline and online. Among these, the offline segment dominated the United States nutraceuticals market during the forecast period. Personalized shopping experience offered by physical stores, including interaction with staff members and receiving recommendations tailored to their needs. Many consumers place greater trust in physical stores when buying health supplements than in internet retailers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US nutraceuticals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway

- Pfizer Inc.

- Nestle

- DSM

- General Mills Inc.

- The Hain Celestial Group, Inc.

- Nature's Bounty

- Danone

- Tyson Foods

- The Kraft Heinz Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Pharmavite LLC, a California-based subsidiary of Otsuka Pharmaceutical Co., Ltd., announced the acquisition of Bonafide Health, LLC, a company specializing in the creation and sale of products for women's health. Through the acquisition of Bonafide Health, Pharmavite will expand its existing portfolio in the women's health field, comprised of Uqora, a novel urinary tract health brand; and Equelle, the supplement with equol.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Nutraceuticals Market based on the below-mentioned segments:

United States Nutraceuticals Market, By Type

- Dietary Supplements

- Functional Beverages

- Functional Food

- Personal Care

United States Nutraceuticals Market, By Form

- Capsules

- Liquid & Gummies

- Tablets & Soft Gels

- Powder

- Others

United States Nutraceuticals Market, By Sales Channel

- Offline

- Online

Need help to buy this report?