United States Octadecanedioic Acid Market Size, Share, and COVID-19 Impact Analysis, By Application (Personal Care & Cosmetics, Lubricants, Plastics & Polymers, Food & Beverages, and Pharmaceuticals), By End-Use (Automotive, Construction, Electrical & Electronics, Industrial Manufacturing, and Medical), and By United States Octadecanedioic Acid Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Octadecanedioic Acid Market Insights Forecasts to 2033

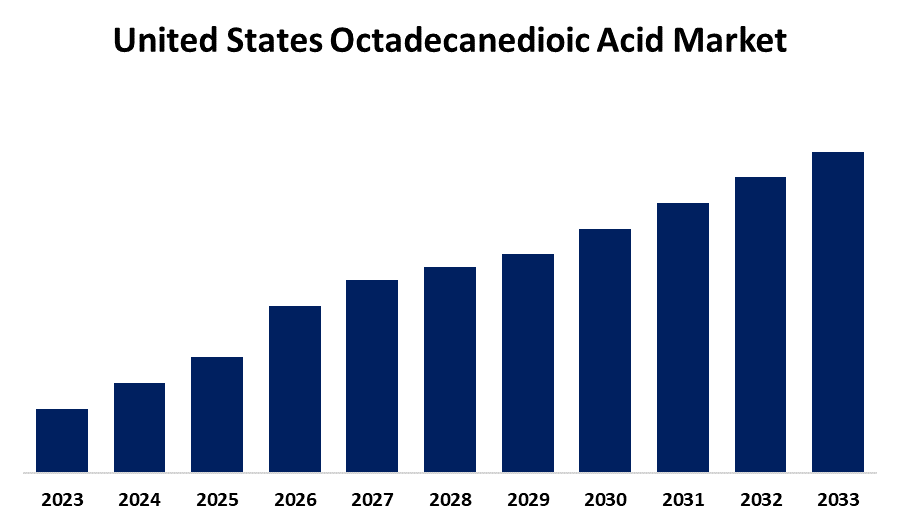

- The United States Octadecanedioic Acid Market Size is Growing at a CAGR of 4.7% from 2023 to 2033

- The United States Octadecanedioic Acid Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The United States Octadecanedioic Acid Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.7% from 2023 to 2033.

Market Overview

The United States octadecanedioic acid (ODA) market encompasses the production, distribution, and consumption of ODA, a long-chain dicarboxylic acid used in various applications, including polyamides, lubricants, and surfactants. ODA is primarily utilized in the manufacturing of high-performance materials and chemicals, offering superior properties such as enhanced thermal stability, corrosion resistance, and biodegradability. The market is experiencing steady growth due to the increasing demand for sustainable and high-quality materials across diverse industries, including automotive, textiles, and industrial lubricants. The growing demand for eco-friendly and sustainable chemicals is a key driver of market growth. The shift toward bio-based feedstocks and the rising adoption of ODA in the production of high-performance polyamides and biodegradable polymers have contributed to increased market penetration. Additionally, technological advancements in ODA production processes have led to cost reductions, further promoting its use in various industrial applications. The expanding automotive sector, along with the increasing need for lightweight, durable materials, is also fueling demand for ODA. The United States government’s commitment to environmental sustainability and reducing reliance on petrochemical-based products has spurred interest in bio-based alternatives such as ODA. Federal and state-level initiatives aimed at promoting green chemistry and renewable materials further support the adoption of ODA in a variety of applications. These policies, alongside industry efforts to reduce carbon footprints, are expected to drive the growth of the ODA market in the coming years.

Report Coverage

This research report categorizes the market for the United States Octadecanedioic Acid market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States octadecanedioic acid market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States octadecanedioic acid market sub-segment.

United States Octadecanedioic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By End-Use |

| Companies covered:: | Larodan AB, Procter & Gamble, Cathay Biotech Inc., Tokyo Chemical Industry (India) Pvt. Ltd., INDOFINE Chemical Company, Inc., XIAMEN SINOPEG BIOTECH CO., LTD., Hunan Huateng Pharmaceutical Co., Ltd, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The United States octadecanedioic acid (ODA) market is driven by the increasing demand for sustainable and high-performance materials across industries. The shift toward bio-based feedstocks and eco-friendly chemicals has fueled the adoption of ODA in the production of biodegradable polymers and high-performance polyamides, which are increasingly used in automotive and textiles. Technological advancements in ODA production have led to cost reductions, enhancing its market competitiveness. The automotive industry’s need for lightweight, durable materials has further propelled the use of ODA, as it offers improved thermal stability and corrosion resistance, meeting evolving material demands.

Restraining Factors

High production costs, limited availability of raw materials, and competition from alternative chemicals restrict market growth. Additionally, the need for significant investments in research and development hinders the widespread adoption of ODA.

Market Segment

The U.S. Octadecanedioic Acid market share is classified into application and end-use.

- The plastics & polymers segment is expected to hold the largest market share through the forecast period.

The US octadecanedioic acid market is segmented by application into personal care & cosmetics, lubricants, plastics & polymers, food & beverages, and pharmaceuticals. Among these, the plastics & polymers segment is expected to hold the largest market share through the forecast period. ODA is widely used in the production of high-performance polyamides and biodegradable polymers, which are essential for various industrial applications, including automotive, electronics, and packaging. The increasing demand for lightweight, durable, and sustainable materials in these sectors is driving the adoption of ODA.

- The automotive segment is expected to hold the largest market share through the forecast period.

The US octadecanedioic acid market is segmented by end-use into automotive, construction, electrical & electronics, industrial manufacturing, and medical. Among these, the automotive segment is expected to hold the largest market share through the forecast period. ODA is increasingly used in the production of high-performance polyamides and lightweight, durable materials required for automotive applications. The growing demand for fuel-efficient vehicles and lightweight automotive components is driving the use of ODA-based materials, which offer enhanced thermal stability and corrosion resistance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States octadecanedioic acid market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Larodan AB

- Procter & Gamble

- Cathay Biotech Inc.

- Tokyo Chemical Industry (India) Pvt. Ltd.

- INDOFINE Chemical Company, Inc.

- XIAMEN SINOPEG BIOTECH CO., LTD.

- Hunan Huateng Pharmaceutical Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

- This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States Octadecanedioic Acid market based on the below-mentioned segments

United States Octadecanedioic Acid Market, By Application

- Personal Care & Cosmetics

- Lubricants

- Plastics & Polymers

- Food & Beverages

- Pharmaceuticals

United States Octadecanedioic Acid Market, By End-Use

- Automotive

- Construction

- Electrical & Electronics

- Industrial Manufacturing

- Medical

Need help to buy this report?