United States Office Furniture Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Seating, Systems, Tables, Storage Units and File Cabinets, Overhead Bins, and Others), By Distribution Channel (Direct Sales, Specialist Store, Non-Specialist Stores, Online, and Others), and United States Office Furniture Market Insights Forecasts 2023 – 2033

Industry: Consumer GoodsUnited States Office Furniture Market Insights Forecasts to 2033

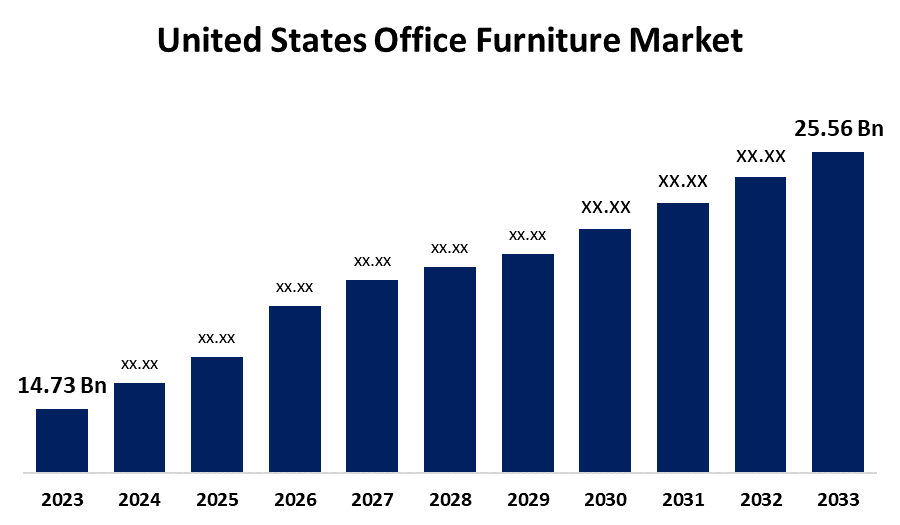

- The United States Office Furniture Market Size was valued at USD 14.73 Billion in 2023

- The Market Size is Growing at a CAGR of 5.67% from 2023 to 2033.

- The United States Office Furniture Market Size is Expected to Reach USD 25.56 Billion by 2033.

Get more details on this report -

The United States Office Furniture Market size is expected to reach USD 25.56 Billion by 2033, at a CAGR of 5.67% during the forecast period 2023 to 2033.

Market Overview

Office furniture refers to movable items used to support various human activities in a professional work environment. This category includes desks, chairs, cabinets, and other furnishings used for seating, writing, storing, or holding objects Its design is strategically optimized to improve comfort, productivity, and ergonomics. The purpose of office furniture is to help create a functional and visually appealing workspace. This entails matching the furniture to the specific needs of the employees and the nature of the tasks they perform, ensuring that the furniture not only serves practical purposes but also contributes to a welcoming and aesthetically pleasing work environment. The United States office furniture market is a dynamic and evolving industry that reflects the changing landscape of professional work environments. This market includes a wide range of movable objects such as desks, chairs, cabinets, and other furnishings designed to support and enhance a variety of human activities in office settings. Furthermore, the materials used to make office furniture range from durable woods and plastics to glass, iron, and marble, ensuring longevity and functionality, which is another significant growth driver.

Report Coverage

This research report categorizes the market for the United States office furniture market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States office furniture market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States office furniture market.

United States Office Furniture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.73 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.67% |

| 2033 Value Projection: | USD 25.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Interior Systems, Inc., Herman Miller, Kimball International Inc., Steelcase, Haworth, Ashley Furniture Industries Inc., Knoll, HNI Corporation, Global Furniture Group, Okamura Corp., and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

One of the primary drivers of market growth is the widespread adoption of the work-from-home (WFH) paradigm as a result of the COVID-19 pandemic. Because of the unexpected spread of the infection and the statewide lockdown, many people worked from home, increasing demand for comfortable and durable office furniture for home offices. Furthermore, to strengthen their distribution network, many key players are entering into agreements with e-commerce retail stores. The demand for office furniture increased in lockstep with the exponential growth of commercial buildings and service-related jobs. Another factor expected to drive market growth is an increase in the number of start-ups and corporate expansions. The increased demand for office space and employment is expected to drive the United States office furniture market growth.

Restraining Factors

The cost of raw materials such as steel, plastics, textiles, wood particleboard, and cartons has risen dramatically. Furthermore, steel, wood, wood-related products, and aluminum are the most common raw materials used in furniture manufacturing. Furthermore, the cost of wood particleboard has risen due to fluctuations in input and transportation costs, as well as ongoing downsizing of furniture manufacturers' production capacities. As a result, such factors impede market growth during the forecast period.

Market Segment

- In 2023, the seating segment accounted for the largest revenue share over the forecast period.

Based on product type, the United States office furniture market is segmented into seating, systems, tables, storage units and file cabinets, overhead bins, and others. Among these, the seating segment has the largest revenue share over the forecast period. Employees spend more than 8-10 hours per day at work, so proper seating has become increasingly important. To reduce illness and fatigue, office chairs should be designed using scientific principles, as the optimal posture while working has a significant impact on health. In the United States, there is a growing demand for ergonomic seats, which help to improve employee productivity, efficiency, and workplace aesthetics. Customers in the United States want to buy high-quality furniture that is not only visually appealing but also made of high-quality materials.

- In 2023, the online segment is witnessing significant growth over the forecast period.

Based on distribution channels, the United States office furniture market is segmented into direct sales, specialist stores, non-specialist stores, online, and others. Among these, the online segment is witnessing significant growth over the forecast period. The segment is being driven by the rise of e-commerce retail channels and online furniture retailers. To expand their customer base, market participants are creating new digital platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States office furniture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Interior Systems, Inc.

- Herman Miller

- Kimball International Inc.

- Steelcase

- Haworth

- Ashley Furniture Industries Inc.

- Knoll

- HNI Corporation

- Global Furniture Group

- Okamura Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Steelcase, Inc. purchased HALCON, a Minnesota-based designer and manufacturer of precision-tailored wood furniture for the office. This acquisition is expected to complement the current portfolio of Steelcase wood products, providing uncompromising design and master craftsmanship to professionals and customers.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Office Furniture Market based on the below-mentioned segments:

United States Office Furniture Market, By Product Type

- Seating

- Systems

- Tables

- Storage Units and File Cabinets

- Overhead Bins

- Others

United States Office Furniture Market, By Distribution Channel

- Direct Sales

- Specialist Store

- Non-Specialist Stores

- Online

- Others

Need help to buy this report?