United States Offshore Drilling Market Size, Share, and COVID-19 Impact Analysis, By Type (Jackups, Semisubmersible, Drill Ships, Others), By Depth (Shallow Water, Deepwater & Ultra-deepwater), and United States Offshore Drilling Market Insights Forecasts to 2033

Industry: Energy & PowerUnited States Offshore Drilling Market Insights Forecasts to 2033

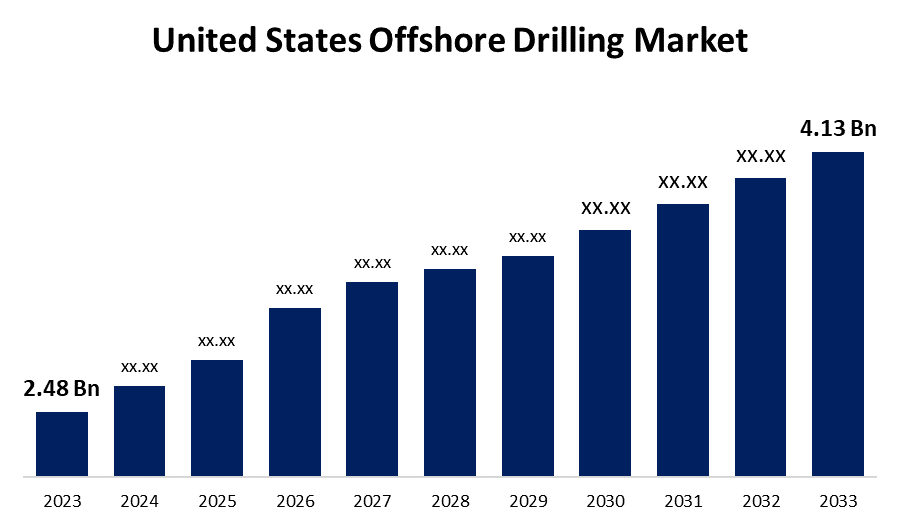

- The United States Offshore Drilling Market Size was valued at USD 2.48 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.23% from 2023 to 2033.

- The United States Offshore Drilling Market Size is Expected to Reach USD 4.13 Billion by 2033.

Get more details on this report -

The United States Offshore Drilling Market Size is expected to reach USD 4.13 Billion by 2033, at a CAGR of 5.23% during the forecast period 2023 to 2033.

Market Overview

Offshore drilling extracts petroleum and gas reserves from beneath the oceans rather than on land. Offshore oil platforms have recently been developed for this purpose, increasing acceptance of the process due to the high demand for oil and petroleum products. It is a critical activity in the energy industry, facilitating the exploitation of valuable hydrocarbon reserves located offshore. This process necessitates complex engineering and technology to access and extract these resources from the ocean floor. The United States derives the majority of its energy, particularly oil and natural gas, from wells drilled on the ocean floor, which contributes to market growth. The market's dynamism is driven by a combination of factors, including government policies promoting energy independence, the search for diverse energy sources, and the need for increased production efficiency. However, the sector operates in the face of environmental concerns, necessitating a fine line between energy exploration and sustainable practices. The trajectory of the United States offshore drilling market is shaped by the interaction of market forces, technological advancements, regulatory frameworks, and environmental considerations, establishing it as a critical contributor to the country's energy landscape.

Report Coverage

This research report categorizes the market for United States offshore drilling market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States offshore drilling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States offshore drilling market.

United States Offshore Drilling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.48 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.13 |

| 2033 Value Projection: | USD 4.13 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Depth |

| Companies covered:: | Transocean Ltd., Diamond Offshore Drilling, Inc., Noble Corporation plc, Seadrill Limited, EnscoRowan plc (now Valaris plc), Pacific Drilling S.A., Shelf Drilling Holdings, Ltd., Borr Drilling Limited, Maersk Drilling, Vantage Drilling International, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Technological innovation continues to drive the growth and evolution of the US offshore drilling market. The industry has seen a transformative shift in drilling technologies, reshaping exploration and extraction capabilities. Advanced seismic imaging techniques have enabled more precise detection of potential reserves beneath the ocean floor. Furthermore, directional drilling innovations allow wells to be drilled at an angle, increasing reach and accessing previously untapped reservoirs. Enhanced reservoir modeling techniques help to predict and optimize production rates, reducing operational uncertainties. Extended reach drilling (ERD), managed pressure drilling (MPD), and subsea processing technologies have all made it easier to extract oil from deeper and more complex offshore reserves. The integration of robotics, automation, and data analytics has improved operational efficiency by reducing downtime and increasing output.

Restraining Factors

Offshore drilling has serious environmental consequences, including oil spills and marine pollution. These operations prioritize staff safety and environmental risk reduction. Drilling rigs follow strict safety and environmental regulations and have specific features to reduce these risks. The oil produced during this type of drilling is a major source of several air pollutants, including carbon dioxide, hydrogen sulfide, particulate matter, and sulfur dioxide. Some of the chemicals released during the refining process are known carcinogens. This drilling releases toxic pollutants into the atmosphere and water.

Market Segment

- In 2023, the jackups segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States offshore drilling market is segmented into jackups, semisubmersible, drill ships, and others. Among these, the jackups segment has the largest revenue share over the forecast period. Jackup rigs, which are distinguished by their mobile drilling platforms with retractable legs, have been a staple of offshore drilling operations in the United States. These rigs are popular for a variety of offshore drilling projects due to their versatility, operational flexibility, and low cost. Their ability to operate in moderate water depths and withstand harsh offshore conditions while maintaining stability during drilling operations has contributed to their market dominance. Furthermore, advancements in jackup rig designs, which incorporate cutting-edge technologies and safety features, have increased their appeal to industry operators. The availability of jackup rigs to a wide range of drilling locations, combined with their relative ease of deployment and lower operational costs when compared to other segments, has solidified their dominance in the United States offshore drilling market.

- In 2022, the deepwater & ultra-deepwater segment accounted for the largest revenue share over the forecast period.

Based on the depth, the United States offshore drilling market is segmented into shallow water and deepwater & ultra-deepwater. Among these, the deepwater & ultra-deepwater segment has the largest revenue share over the forecast period. This segment's prominence represents a strategic shift toward tapping deeper offshore reserves, as technological advancements have made access to these difficult terrains possible. The allure of the deepwater and ultra-deepwater segment stems from the vast untapped potential of these reserves, which provide significant hydrocarbon resources to meet the nation's energy needs. Operators' increased emphasis on exploring and extracting resources from these deeper waters is motivated by declining production from shallower reserves and advancements in drilling technologies that allow for operations in more extreme conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States offshore drilling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Transocean Ltd.

- Diamond Offshore Drilling, Inc.

- Noble Corporation plc

- Seadrill Limited

- EnscoRowan plc (now Valaris plc)

- Pacific Drilling S.A.

- Shelf Drilling Holdings, Ltd.

- Borr Drilling Limited

- Maersk Drilling

- Vantage Drilling International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, Frontier Energy, a leading energy company specializing in offshore drilling, announced the successful deployment of its next-generation drilling rig, which includes cutting-edge drilling technologies and environmental features. The rig's design incorporates advanced automation, reducing operational complexities and optimizing drilling processes, while also minimizing environmental impact through lower emissions and better waste management practices. Frontier Energy's investment in environmentally friendly drilling solutions demonstrates the industry's commitment to sustainable practices and technological innovation in offshore exploration and production.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States offshore drilling market based on the below-mentioned segments:

United States Offshore Drilling Market, By Type

- Jackups

- Semisubmersible

- Drill Ships

- Others

United States Offshore Drilling Market, By Depth

- Shallow Water

- Deepwater & Ultra-deepwater

Need help to buy this report?