United States Oleochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Glycerol Esters, Specialty Esters, Alkoxylates, Fatty Amines, Fatty Acid Methyl Ester, and Others), By Application (Personal Care & Cosmetics, Industrial, Food Processing, Paints & Inks, Consumer Goods, Healthcare & Pharmaceuticals, Textiles, Polymer & Plastic Additives, and Others), and United States Oleochemicals Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Oleochemicals Market Insights Forecasts to 2033

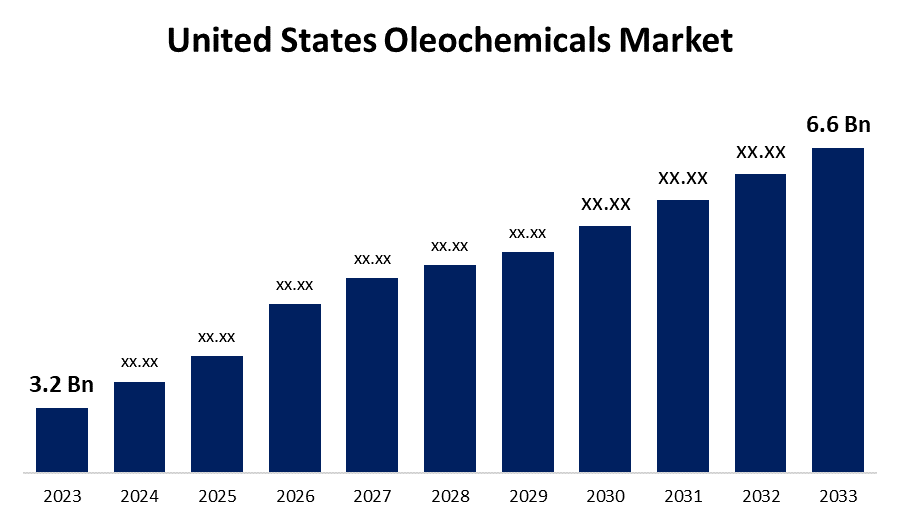

- The U.S. Oleochemicals Market Size was valued at USD 3.2 Billion in 2023.

- The Market is growing at a CAGR of 7.51% from 2023 to 2033

- The U.S. Oleochemicals Market Size is expected to reach USD 6.6 Billion by 2033

Get more details on this report -

The United States Oleochemicals Market is anticipated to exceed USD 6.6 Billion by 2033, growing at a CAGR of 7.51% from 2023 to 2033. The growing need for sustainable products and the development of biodegradable products are driving the growth of the oleochemicals market in the US.

Market Overview

Oleochemical are chemical compounds belong to the chemical class of aliphatic compounds that are industrially derived from animal or vegetable lipids. They are analogs of petrochemical products that are used in many household items, such as soap, laundry detergent, and cosmetics. Oleochemicals such as glycerine, octyl stearate, and polyhexanide are used as ingredients in various personal care and cosmetic products. They are also used in FDA-approved food packaging and sanitizers for food contact surfaces. Further, in the pharmaceutical and nutraceutical industry, oleochemicals can be used as preservatives, thickening agents, and emollients. Greener and more sustainable options, including biofuels, are becoming more popular among customers. In 2018, the biofuels business in the United States generated 2.6 billion gallons of biofuels. It is expected that growing technology advancements and the growing use of sustainable substitutes for petrochemical-based products in the food and beverage and feed industries would present growth opportunities.

Report Coverage

This research report categorizes the market for the US oleochemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States oleochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US oleochemicals market.

United States Oleochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.51% |

| 2033 Value Projection: | USD 6.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Vantage Specialty Chemicals, Godrej Industries, Cargill Incorporated, Oleon NV, Emery Oleochemicals, BASF SE, Apical, Procter & Gamble (P & G Chemicals), Stepan Company, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Oleochemicals provide a renewable and sustainable alternative to traditional chemicals, derived from natural origin like palm oil, rapeseed oil, coconut oil, sunflower oil, and canola oil. Thus, they boast several environmentally friendly qualities, such as biodegradability, low toxicity, and the ability to decompose without causing pollution. Thus, the increasing demand for sustainable products and the development of biodegradable products are driving the oleochemicals market. The widespread application of oleoresins in pharmaceutical and food & beverage products is driving the market expansion.

Restraining Factors

The availability of oleochemical substitutes and the increasing biodiesel prices may hamper the market for oleochemicals. Further, the environmental concerns about the plantations and land availability are restraining the market growth.

Market Segmentation

The United States Oleochemicals Market share is classified into product and application.

- The glycerol esters segment dominates the US oleochemicals market with the largest share in 2023.

The United States oleochemicals market is segmented by product into glycerol esters, specialty esters, alkoxylates, fatty amines, fatty acid methyl ester, and others. Among these, the glycerol esters segment dominates the US oleochemicals market with the largest share in 2023. Glycerol plays a major role in the profitability of the oleochemical sector and its products. Glycerol production is rising due to the growing need for fatty acids, fatty alcohols, and esters for biodiesel as a valuable by-product of numerous prominent oleochemical processes. The rising demand for non-petroleum product alternatives for cosmetics is anticipated to drive the market demand in the glycerol esters segment.

- The personal care & cosmetics segment dominates the market with the largest market share in 2023.

The United States oleochemicals market is segmented by application into personal care & cosmetics, industrial, food processing, paints & inks, consumer goods, healthcare & pharmaceuticals, textiles, polymer & plastic additives, and others. Among these, the personal care & cosmetics segment dominates the market with the largest market share in 2023. Oleochemicals act as emollients (moisturizers), emulsifiers (stabilizers), and solvents in cosmetic formulations, playing a vital role in creating the desired texture, consistency, and application experience of cosmetic products. The increasing consumer preference for natural and sustainable ingredients is driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. oleochemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vantage Specialty Chemicals

- Godrej Industries

- Cargill Incorporated

- Oleon NV

- Emery Oleochemicals

- BASF SE

- Apical

- Procter & Gamble (P & G Chemicals)

- Stepan Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Oleochemicals Market based on the below-mentioned segments:

US Oleochemicals Market, By Product

- Glycerol Esters

- Specialty Esters

- Alkoxylates

- Fatty Amines

- Fatty Acid Methyl Ester

- Others

US Oleochemicals Market, By Application

- Personal Care & Cosmetics

- Industrial

- Food Processing

- Paints & Inks

- Consumer Goods

- Healthcare & Pharmaceuticals

- Textiles

- Polymer & Plastic Additives

- Others

Need help to buy this report?