United States Oligonucleotide Synthesis Market Size, Share, and COVID-19 Impact Analysis, By Product & Services (Oligonucleotides, Equipment/Synthesizer, Reagents, and Services), By Application (PCR Primers, PCR Assays & Panels, Sequencing, DNA Microarrays, Fluorescence In Situ Hybridization (FISH), Antisense Oligonucleotides, and Others), By End-Use (Academic Research Institutes, Diagnostic Laboratories, and Pharmaceutical & Biotechnology Companies), and United States Oligonucleotide Synthesis Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Oligonucleotide Synthesis Market Insights Forecasts to 2033

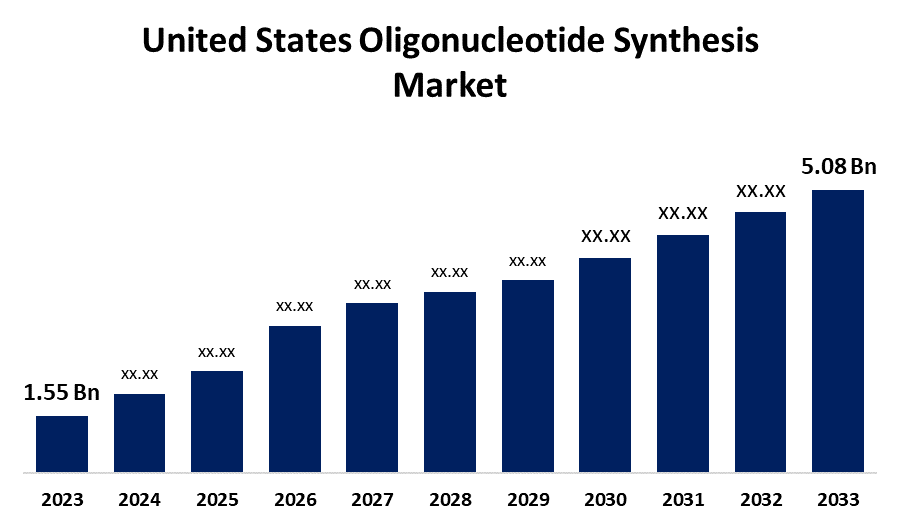

- The United State Oligonucleotide Synthesis Market Size Was valued at USD 1.55 Billion in 2023.

- The Market is growing at a CAGR of 12.6% from 2023 to 2033

- The United State Oligonucleotide Synthesis Market Size is expected to reach USD 5.08 Billion by 2033

Get more details on this report -

The United States Oligonucleotide Synthesis Market Size is anticipated to exceed USD 5.08 Billion by 2033, growing at a CAGR of 12.6% from 2023 to 2033.

The Growing advancements in biotechnology, personalized medicine, high investment in R&D, and widespread application of oligonucleotides are driving the growth of the oligonucleotide synthesis market in the US.

Market Overview

Oligonucleotide synthesis is the chemical synthesis of relatively small nucleic acid fragments with a predetermined chemical structure (sequence). Short nucleotide sequences called oligonucleotides are crucial for genetic testing, research, and the creation of new medicines. It is a sector of biotechnology market dedicated to producing small, single-stranded DNA or RNA molecules. Numerous applications, including gene therapy, drug development, and diagnostics, make use of these compounds. Oligonucleotide-based treatments are increasingly being employed for purposes other than cancer, cardiovascular conditions, and neurological illnesses. Further, the use of oligonucleotides in diagnostic and research applications, like CRISPR-based gene editing and next-generation sequencing (NGS), is growing quickly. The creation of increasingly complex oligonucleotides has been made possible by the advancement of new technologies like next-generation sequencing.

Report Coverage

This research report categorizes the market for the US oligonucleotide synthesis market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States oligonucleotide synthesis market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US oligonucleotide synthesis market.

United States Oligonucleotide Synthesis Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.55 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 12.6% |

| 2033 Value Projection: | USD 5.08 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product & Services, By Application, By End-Use |

| Companies covered:: | Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Agilent Technologies, Dharmacon Inc., Bio-synthesis, LGC Biosearch Technologies, TriLink BioTechnologies, Genscript, Twist Bioscience, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for oligonucleotides has expanded dramatically as a result of biotechnology advancements, particularly in the fields of genomic and proteomic research, which are driving the market for oligonucleotide synthesis in the United States. Another significant factor is personalized medicine, which is driving the demand for customized oligonucleotide sequences due to the growing need for customized medicines. Further, the investment in R&D by the pharmaceutical and biotech companies for the development of drug targets and innovative treatments is propelling market growth. The growing use of oligonucleotides in fields like genetic testing, medicines, and diagnostics is driving the market growth.

Restraining Factors

The low quality of microarray-generated oligonucleotide sequences hinders their adoption which leads to restrain the market growth. In addition, the complexity of oligonucleotide products is further impeding the US oligonucleotide synthesis market.

Market Segmentation

The United States Oligonucleotide Synthesis Market share is classified into product & services, application, and end-use.

- The services segment dominated the market with the largest market share in 2023.

The United States oligonucleotide synthesis market is segmented by product & services into oligonucleotides, equipment/synthesizer, reagents, and services. Among these, the services segment dominated the market with the largest market share in 2023. Researchers and businesses are increasingly outsourcing the synthesis, purification, and customization of oligonucleotide sequences due to the growing complexity of genomic research and therapeutic applications. The intricate design requirements of therapeutic oligonucleotides, the scope of personalized medicine, and the demand for cost-effective and scalable solutions are driving the market.

- The PCR primers segment accounted for the largest revenue share of the US oligonucleotide synthesis market in 2023.

The United States oligonucleotide synthesis market is segmented by application into PCR primers, PCR assays & panels, sequencing, DNA microarrays, fluorescence in situ hybridization (FISH), antisense oligonucleotides, and others. Among these, the PCR primers segment accounted for the largest revenue share of the US oligonucleotide synthesis market in 2023. Labs can identify trace amounts of pathogen DNA or RNA using the PCR technique, which is fueled by particular primers and helps diagnose infectious disorders like bacterial, viral, and parasitic infections.

- The academic research institutes segment dominates the US oligonucleotide synthesis market with the largest market share during the forecast period.

Based on the end-use, the U.S. oligonucleotide synthesis market is divided into academic research institutes, diagnostic laboratories, and pharmaceutical & biotechnology companies. Among these, the academic research institutes segment dominates the US oligonucleotide synthesis market with the largest market share during the forecast period. These organizations are leading the way in novel and cutting-edge genomic research. For more than four years, these organizations have worked together to explore the possibility of combining next-generation sequencing (NGS) with enzymatic DNA synthesis technologies into a single, integrated device.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. oligonucleotide synthesis market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher Corporation

- Agilent Technologies

- Dharmacon Inc.

- Bio-synthesis

- LGC Biosearch Technologies

- TriLink BioTechnologies

- Genscript

- Twist Bioscience

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, Thermo Fisher, Pfizer partnered to boost NGS cancer testing outside U.S. Thermo Fisher Scientific and Pfizer said they will collaborate to expand local access to next-generation sequencing (NGS)-based testing for lung and breast cancer patients in more than 30 countries.

- In April 2023, Agilent Technologies Inc. announced the launch of the Agilent SureSelect Cancer CGP Assay designed for somatic variant profiling for a broad range of solid tumor types.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Oligonucleotide Synthesis Market based on the below-mentioned segments:

US Oligonucleotide Synthesis Market, By Product & Services

- Oligonucleotides

- Equipment/Synthesizer

- Reagents

- Services

US Oligonucleotide Synthesis Market, By Application

- PCR Primers

- PCR Assays & Panels

- Sequencing

- DNA Microarrays

- Fluorescence In Situ Hybridization (FISH)

- Antisense Oligonucleotides

- Others

US Oligonucleotide Synthesis Market, By End-Use

- Academic Research Institutes

- Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

Need help to buy this report?