United States Online Food Delivery Market Size, Share, and COVID-19 Impact Analysis, By Platform Type (Mobile Applications and Websites), By Business Model (Order Focused Food Delivery System, Logistics Based Food Delivery System, and Full-Service Food Delivery System), and United States Online Food Delivery Market Insights, Industry Trend, Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Online Food Delivery Market Insights Forecasts to 2033

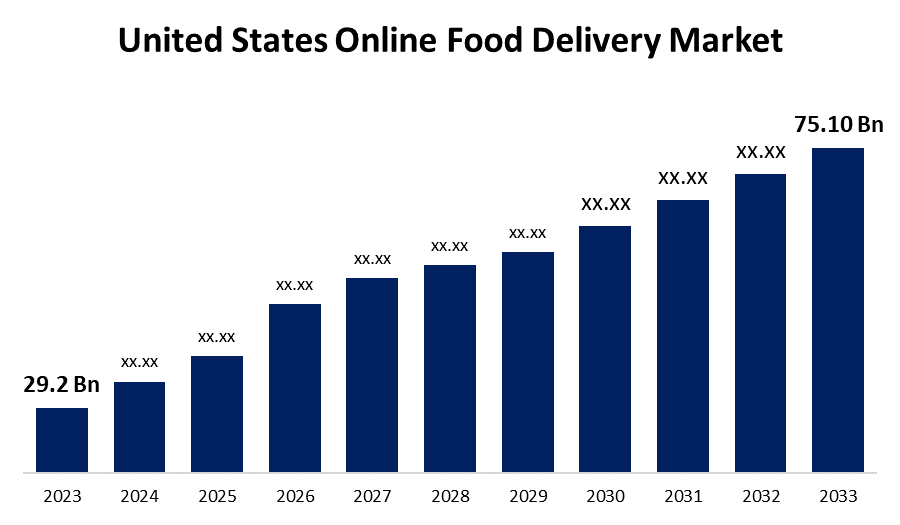

- The United States Online Food Delivery Market Size was valued at USD 29.2 Billion in 2023.

- The Market Size is growing at a CAGR of 9.91% from 2023 to 2033

- The United States Online Food Delivery Market Size is expected to reach USD 75.10 Billion by 2033

Get more details on this report -

United States Online Food Delivery Market is anticipated to exceed USD 75.10 Billion by 2033, growing at a CAGR of 9.91% from 2023 to 2033.

Market Overview

Consumers are able to engage with various restaurants and food suppliers through the digital platform provided by online food delivery services. Due to these platforms, customers can easily order and have their favorite meals delivered to their homes without the need to go out. Many customers opt for online meal delivery because of its convenience and user-friendly features. The convenience and growing popularity of online meal ordering have led to a notable increase in the US online food delivery market in recent years. This market is the act of placing online or mobile application orders for food from different restaurants or food companies. Clients can peruse menus, choose their favorite items, and have them delivered right to their door. Online meal delivery is becoming more and more popular among working people and families who would rather not cook or eat out because of its convenience and time-saving features. People might conveniently order food from their favorite restaurants and have it delivered to their homes via websites and smartphone apps. Customers can discover new eating experiences and a vast array of food selections due to the huge diversity of online restaurants and cuisine options that cater to a wide range of tastes.

Report Coverage

This research report categorizes the market for the United States online food delivery market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the online food delivery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the online food delivery market.

United States Online Food Delivery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 29.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.91% |

| 2033 Value Projection: | USD 75.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Platform Type, By Business Model |

| Companies covered:: | Grubhub, Doordas, Uber Eats, Postmates, Domino’s Pizza Inc., Kroger Co., Blue Apron Holdings, HelloFresh, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

People's ordering experiences are getting more seamless due to mobile applications and user-friendly interfaces. Furthermore, the sector is changing due to the integration of AI and ML, which optimizes delivery routes, predicts demand, and customizes recommendations based on user preferences. The rise of the online meal delivery sector in the United States is mostly driven by the growing emphasis on strategic alliances and acquisitions. Additionally, partnering with well-known occasions or influencers at particular seasons of the year boosts brand awareness and human engagement. These marketing techniques work particularly well at converting conventional diners who order in person to online delivery customers.

Restraining Factors

Many competitors are fighting for market share in this very competitive industry. Pricing wars and shrinking profit margins for individual service providers might result from this fierce rivalry. The regulatory environment in which the online meal delivery sector operates varies depending on the state and locality. Complying with labor rules, food safety regulations, and licensing requirements increases the intricacy of running a business.

Market Segmentation

The United States online food delivery market share is classified into platform type and business model.

- The mobile applications segment is expected to hold the largest market share through the forecast period.

The United States online food delivery market is segmented by platform type into mobile applications and websites. Among them, the mobile applications segment is expected to hold the largest market share through the forecast period. The market is expanding as a result of the rising demand for mobile applications for online meal delivery, which offer inherent advantages in terms of accessibility, customization, and real-time engagement. Apart from that, customers might find a variety of dining options regardless of their location due to smartphone applications, which provide quick access to a large selection of restaurants and cuisines. By letting users select and alter their orders according to dietary requirements, allergies, and portion sizes, these platforms also offer tailored experiences to their users. A sense of control and transparency is fostered by real-time communication between customers, restaurants, and delivery personnel via notifications and tracking systems, which enhances the overall customer experience.

- The order focused food delivery system segment dominates the market with the largest market share over the predicted period.

The United States online food delivery market is segmented by business model into order focused food delivery system, a logistics based Food delivery system, and full service food delivery system. Among them, the order focused food delivery system segment dominates the market with the largest market share over the predicted period. Order-focused food delivery systems are becoming more and more necessary as a result of efforts to boost customer satisfaction, reduce errors, and increase efficiency. By minimizing misunderstandings between patrons and eateries, these technologies enhance the ordering process and produce more precise and error-free orders. Customers' increasing demand is met by the platform's ability to immediately adjust their meals, which significantly reduces the likelihood of miscommunication and makes dining more enjoyable.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States online food delivery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Grubhub

- Doordas

- Uber Eats

- Postmates

- Domino’s Pizza Inc.

- Kroger Co.

- Blue Apron Holdings

- HelloFresh

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Uber Eats and Instacart partnered to provide meal delivery services in the US. Through the Instacart app, customers can place orders from hundreds of thousands of restaurants.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Online Food Delivery Market based on the below-mentioned segments:

United States Online Food Delivery Market, By Platform Type

- Mobile Applications

- Websites

United States Online Food Delivery Market, By Business Model

- Order Focused Food Delivery System

- Logistics Based Food Delivery System

- Full-Service Food Delivery System

Need help to buy this report?