United States Optical Retail Chain Market Size, Share, and COVID-19 Impact Analysis, By Product (Spectacles, Sunglasses, and Contact Lenses), Distribution Channel (Offline and Online), and United States Optical Retail Chain Market Insights Forecasts to 2033

Industry: Consumer GoodsUnited States Optical Retail Chain Market Insights Forecasts to 2033

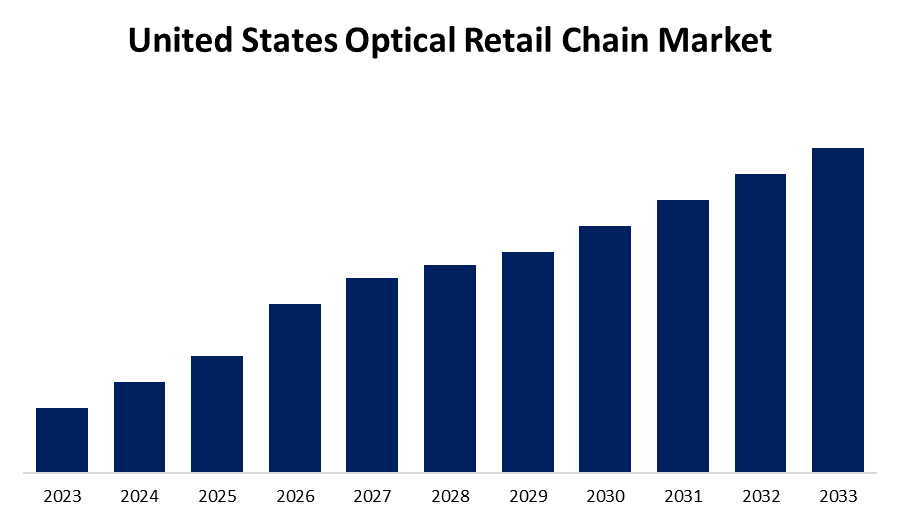

- The Market Size is Growing at a CAGR of 4.2% from 2023 to 2033.

- The United States Optical Retail Chain Market Size is Expected to Hold a Significant Share by 2033.

- The United States Optical Retail Chain Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 4.2% during the forecast period 2023 to 2033.

Get more details on this report -

The United States Optical Retail Chain Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 4.2% during the forecast period 2023 to 2033.

Market Overview

The optical retail chain market refers to the industry sector composed of businesses selling eyeglasses, contact lenses, sunglasses, and related visual products through retail stores. These chains typically operate multiple locations, offering consumers a wide range of eyewear products and services. Optical retail chains usually offer diverse eyewear products, including prescription glasses, sunglasses, contact lenses, and accessories such as cases and cleaning solutions. Many optical retail chains provide additional services such as eye exams conducted by licensed optometrists or opticians, eyeglasses adjustments and repairs, and assistance selecting frames or lenses. Changing demographics, fashion trends, and lifestyle preferences impact consumer demand for eyewear products and services. Increasing awareness of eye health, fashion-conscious consumers, and the rise of digital device usage may influence purchasing decisions. Many optical retail chains have an online presence, allowing customers to browse products, schedule appointments, and even purchase eyewear remotely. Integrating online and offline channels is becoming increasingly important in the optical retail sector.

Report Coverage

This research report categorizes the market for United States optical retail chain market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Optical retail chain market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States optical retail chain market.

United States Optical Retail Chain Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 145 |

| Segments covered: | By Product |

| Companies covered:: | Luxottica Group S.p.A., Essilor International SAS, Johnson & Johnson Vision Care Inc., Safilo Group S.p.A., Alcon Vision LLC, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The occurrence of eye diseases like cataracts, glaucoma, and age-related macular degeneration is increasing. These situations affect eyesight and may result in serious consequences if not managed. Consequently, the increasing need for vision care items like glasses and prescription lenses is fueling the expansion of the traditional optical chain market. The need for vision care services and products increases as populations age. Older individuals typically require more frequent eye check-ups and treatments, leading to a rise in sales for brick-and-mortar optical stores.

Restraining Factors

Factors such as price sensitivity, counterfeit eyewear, and the emergence of online marketplaces are restraining the United States optical retail chain market.

Market Segment

The U.S. optical retail chain market share is classified into product and distribution channel.

- The spectacles segment is expected to hold the largest market share through the forecast period.

The US optical retail chain market is segmented by product into spectacles, sunglasses, and contact lenses. Among these, the spectacles segment is expected to hold the largest market share through the forecast period. This is due to the growing demand for products caused by the rising number of cases of computer vision syndrome (CVS). The increase in cases of Computer Vision Syndrome (CVS) among children, especially during the pandemic, has led to a surge in the use of anti-fatigue and anti-glare glasses for online learning. Moreover, there is a growing need for eyeglasses because of the increasing trend for clear and bright transparent frames.

- The offline segment is expected to hold the largest market share through the forecast period.

The US optical retail chain market is segmented distribution channel into offline and online. Among these, the offline segment is expected to hold the largest market share through the forecast period. The increase in knowledge about the significance of regular eye check-ups and wearing glasses has led to a rise in the sales of glasses in brick-and-mortar stores. Multiple companies are concentrating on enlarging their retail locations in order to increase their competitive advantage in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States optical retail chain market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Luxottica Group S.p.A.

- Essilor International SAS

- Johnson & Johnson Vision Care Inc.

- Safilo Group S.p.A.

- Alcon Vision LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, Johnson & Johnson finalized the transaction of selling its Blink product line, consisting of non-prescription eye and contact lens drops, to Bausch + Lomb for $106.5 million. Johnson & Johnson strategically decided to divest from the consumer business.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States optical retail chain market based on the below-mentioned segments:

United States Optical Retail Chain Market, By Product

- Spectacles

- Sunglasses

- Contact Lenses

United States Optical Retail Chain Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?