United States Optical Transceiver Market Size, Share, and COVID-19 Impact Analysis, By Transmission Rate (Less than 10 Gbps, 10 Gbps to 40 Gbps, 41 Gbps to 100 Gbps, and Beyond 100 Gbps), By Application (Telecommunication, Data Centers, Enterprise Networking, and Others), and US Optical Transceiver Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Optical Transceiver Market Insights Forecasts to 2033

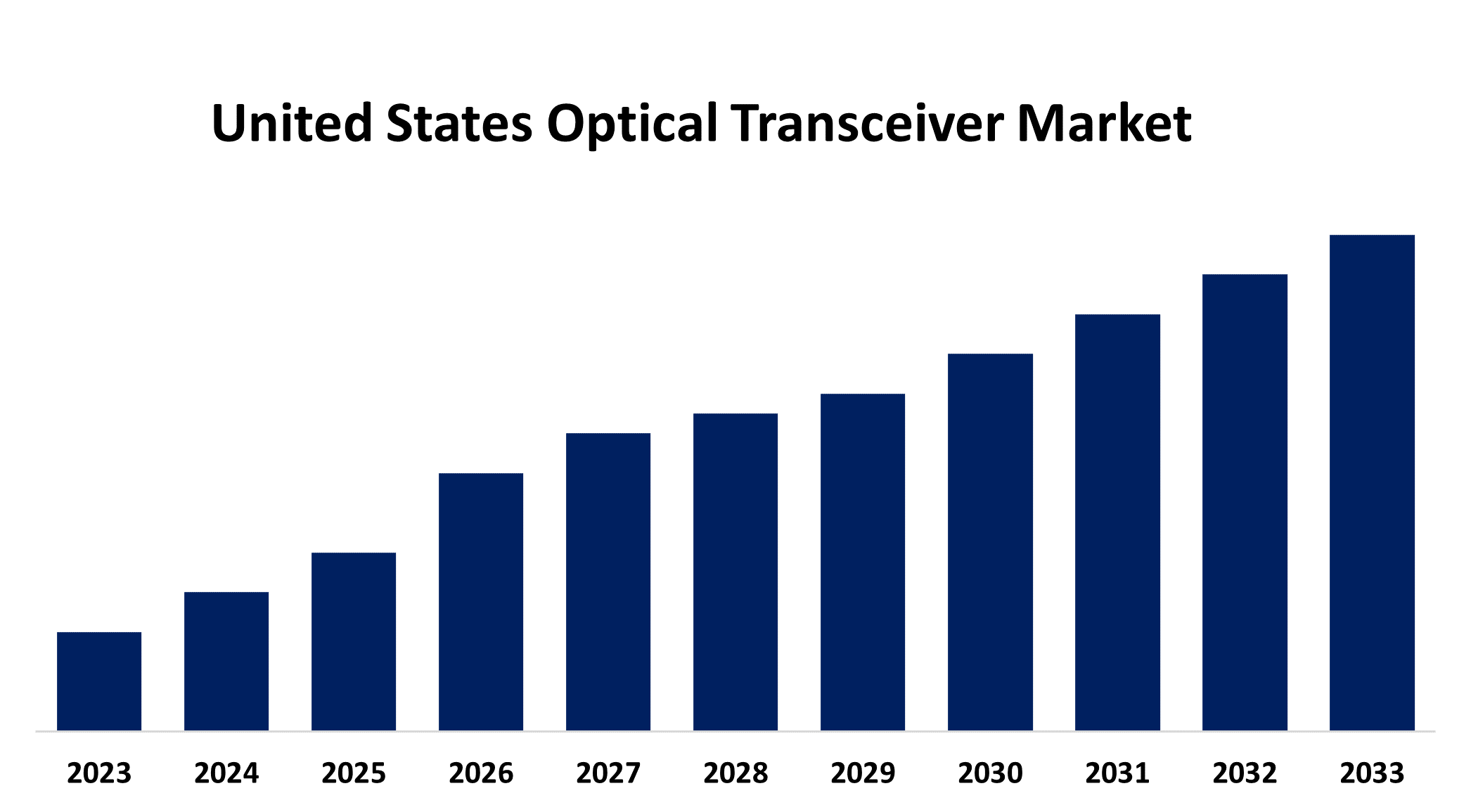

- The Market Size is Growing at a CAGR of 14.2% from 2023 to 2033

- The U.S. Optical Transceiver Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.S. Optical Transceiver Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 14.2% from 2023 to 2033.

Market Overview

The optical transceiver, which is essential for optical communication, consists of an optoelectronic device like a functional circuit and optical interface. The main function of this transceiver is to change electrical signals into light signals. In recent years, this transceiver has become an important component of the standard optical module by connecting electronic devices with fiber optic cables. Fiber transceivers are mainly used in B2B settings such as telecommunication, data centers, enterprise networking, and infrastructure applications. The main purpose of the optical transceiver is to change electrical signals into optical signals for sending and back again for receiving. In the transmitting state, the optical transceiver converts electrical signals into optical signals using a light source, usually a laser diode. These optical signals are subsequently sent through optical fibers, moving as bursts of light. While in the receiving mode, the optical transceiver takes in optical signals from the fiber and transforms them into electrical signals using a photodiode or similar optical detector. Some factors driving the market include the ongoing growth of data centers, the rise of 5G networks, the increasing internet traffic, the rapid progress in fiber optic technology, the creation of higher-capacity fibers, improved modulation techniques, and the emergence of edge computing.

Report Coverage

This research report categorizes the market for the US optical transceiver market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States optical transceiver market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. optical transceiver market.

United States Optical Transceiver Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 186 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Transmission Rate, By Application |

| Companies covered:: | Broadcom Inc., Cisco Systems, Inc., Intel Corporation, Lumentum Operations LLC, II-VI Incorporated, Finisar Corporation, JDS Uniphase Corporation (JDSU), and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The high demand for advanced optical communication solutions is a key factor influencing the market in the United States. The market growth is greatly being driven by the expansion of data centers. Optical transceivers, essential in such settings, help with the fast and effective transfer of large data quantities between servers and throughout data center networks. Moreover, the increasing utilization of 5G networks is having a positive impact on the market. With the increasing use of 5G technology, there is a greater need for optical transceivers to manage the higher data speeds, minimal delays, and greater bandwidth needs linked with 5G connections. Additionally, the market expansion is driven by the increased internet traffic, which is fueled by the growth of online activities, streaming services, and the Internet of Things (IoT).

Restraining Factors

Compatibility continues to be a significant hurdle for operators and project managers. When installing new transceivers, it is common for optical fiber infrastructure to need extra investments for network upgrades or modifications.

Market Segmentation

The US optical transceiver market share is classified into transmission rate and application.

- The 10 Gbps to 40 Gbps segment is expected to hold a significant market share through the forecast period.

The United States optical transceiver market is segmented by transmission rate into less than 10 Gbps, 10 Gbps to 40 Gbps, 41 Gbps to 100 Gbps, and beyond 100 Gbps. Among these, the 10 Gbps to 40 Gbps segment is expected to hold a significant market share through the forecast period. Due to the increase in US data traffic, the growth of cloud computing, and the demand for quicker and more dependable data transmission.

- The telecommunication segment is expected to dominate the US optical transceiver market during the projected period.

Based on the application, the United States optical transceiver market is divided into telecommunication, data centers, enterprise networking, and others. Among these, the telecommunication segment is expected to dominate the US optical transceiver market during the projected period. Several factors are fueling the need for transceivers in the telecommunications industry. These factors consist of heightened data traffic, enhancements in optical networks, and swift deployment of 5G networks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States optical transceiver market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Broadcom Inc.

- Cisco Systems, Inc.

- Intel Corporation

- Lumentum Operations LLC

- II-VI Incorporated

- Finisar Corporation

- JDS Uniphase Corporation (JDSU)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Optical Transceiver Market based on the below-mentioned segments:

United States Optical Transceiver Market, By Transmission Rate

- Less than 10 Gbps

- 10 Gbps to 40 Gbps

- 41 Gbps to 100 Gbps

- Beyond 100 Gbps

United States Optical Transceiver Market, By Application

- Telecommunication

- Data Centers

- Enterprise Networking

- Others

Need help to buy this report?