United States Organic Food Market Size, Share, and COVID-19 Impact Analysis, By Type (Organic Fruits and Vegetables, Organic Meat, Poultry and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, and Others), BY Application (Bakery and Confectionery, Ready-To-Eat Food Products, Breakfast Cereals, and Others), and United States Organic Food Market Insights Forecasts 2023 - 2033.

Industry: Food & BeveragesUnited States Organic Food Market Insights Forecasts to 2033

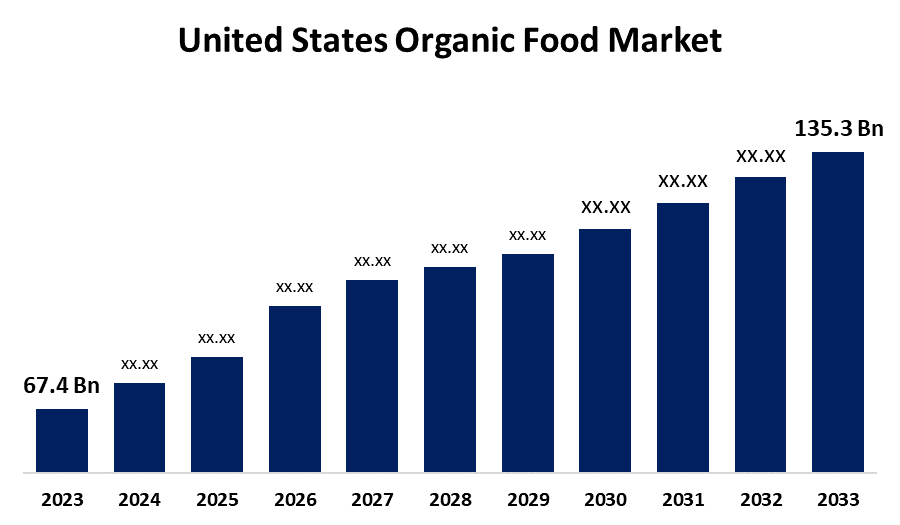

- The United States Organic Food Market Size was valued at USD 67.4 Billion in 2023

- The Market Size is Growing at a CAGR of 7.22% from 2023 to 2033.

- The United States Organic Food Market Size is Expected to Reach USD 135.3 Billion by 2033.

Get more details on this report -

The United States Organic Food Market size is Expected to reach USD 135.3 Billion by 2033, at a CAGR of 7.22% during the forecast period 2023 to 2033.

Market Overview

Organic food refers to a range of agricultural products grown and processed following strict guidelines set by organic farming practices. These guidelines prohibit the use of synthetic pesticides, fertilizers, genetically modified organisms (GMOs), and other artificial substances. Organic farming focuses on natural and sustainable practices to improve soil health, conserve water, and promote biodiversity. Organic food production involves minimizing environmental impact and prioritizing animal welfare. Consumers often choose organic products for their health benefits and environmental responsibility. As a result, the growing demand for healthier and more ethically produced alternatives is driving the growth of the organic food market. Growing consumer awareness and demand for healthier and more sustainable food options are among the major factors driving the United States organic food market. In addition, growing consumer preference for products free from synthetic chemicals and pesticides has increased the demand for organic food products, creating a favorable outlook for market growth. In addition, growing concern about environmental sustainability and willingness to support ethical farming practices are contributing to the expansion of the organic food market. Furthermore, significant advancements in distribution and retail channels have made organic products more accessible to a wider audience, creating lucrative market opportunities.

Report Coverage

This research report categorizes the market for the United States organic food market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States organic food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States organic food market.

United States Organic Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 67.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.22% |

| 2033 Value Projection: | USD 135.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel, BY Application |

| Companies covered:: | Newman’s Own, Inc., Whole Foods Market IP. L.P., Dole Food Co., Inc., Clif Bar & Company, Organic Valley., Dean Foods, the Kroger Co., Inc., Frito-Lay, Dairy Farmers of America, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The ever-increasing demand for healthier and more nutritious food choices is driving the growth of the organic food market. Consumers are becoming more aware of their dietary habits and are looking for products that align with their health and wellness goals. Another important growth-driving factor fueling the growth of the organic food market in the United States is the urgent and necessary emphasis on environmental sustainability. As concerns about climate change and environmental degradation gain importance, consumers look for ways to align their purchasing decisions with their environmental values. Furthermore, the introduction of several favorable government regulations and certifications supporting organic farming practices has created consumer confidence, and strengthened the credibility and quality of organic products, thereby strengthening market growth.

Restraining Factors

Obtaining and maintaining organic certification can be expensive for farmers and food producers, adding to the overall cost of organic production. Demand for organic produce has increased over the years, but supply might not always keep up, driving up prices. Organic farming practices are often less productive than conventional farming due to the avoidance of artificial fertilizers and pesticides. Organic farmers use natural methods to control pests, which can be less efficient and require frequent monitoring.

Market Segment

- In 2023, the organic fruits and vegetables segment accounted for the largest revenue share over the forecast period.

Based on type, the United States organic food market is segmented into organic fruits and vegetables, organic meat, poultry and dairy, organic processed food, organic bread and bakery, organic beverages, organic cereal and food grains, and others. Among these, the organic fruits and vegetables segment accounted for the largest revenue share over the forecast period. Growing health consciousness among consumers and an increased focus on sustainable agricultural practices have led to an increase in demand for organic fruits and vegetables. Organic fruits and vegetables are valued for their low pesticide residues and high nutrient content, which encourages consumers to pursue healthier dietary choices. As consumers become more aware of the potential adverse effects of synthetic chemicals on their health and the environment, they opt for organic alternatives. This change in consumer behavior is driving the growth of the organic fruits and vegetables market.

- In 2023, the supermarkets and hypermarkets segment accounted for the largest revenue share over the forecast period.

Based on distribution channels, the United States organic food market is segmented into supermarkets and hypermarkets, specialty stores, convenience stores, online stores, and others. Among these, the supermarkets and hypermarkets segment accounted for the largest revenue share over the forecast period. The presence of recognized organic certifications and clear labeling in retail channels gives consumers confidence in the authenticity and quality of the products they are purchasing. This increasing availability and transparency in mainstream retail settings has contributed significantly to the growing demand for organic food. Consumers seek the benefits of healthier and more eco-friendly options during their regular shopping experiences, driving the market growth.

- In 2023, the ready-to-eat food products segment accounted for the largest revenue share over the forecast period.

Based on application, the United States organic food market is segmented into bakery and confectionery, ready-to-eat food products, breakfast cereals, and others. Among these, the ready-to-eat food products segment accounted for the largest revenue share over the forecast period. Consumers' changing preferences for convenience and healthier eating options have increased the demand for organic ready-to-eat (RTE) food products. RTE foods have grown in popularity due to their convenience and time-saving qualities in the modern lifestyle. Integrating organic ingredients into these products aligns with consumers' growing interest in health-conscious choices, as organic ingredients are considered free of artificial ingredients and pesticides.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States organic food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Newman’s Own, Inc.

- Whole Foods Market IP. L.P.

- Dole Food Co., Inc.

- Clif Bar & Company

- Organic Valley.

- Dean Foods

- the Kroger Co., Inc.

- Frito-Lay

- Dairy Farmers of America, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Straus Family Creamery, a California organic dairy, launched low-fat kefirs to its portfolio of premium organic dairy products.

- In June 2023, McConnell's Fine Ice Creams, a US-based company, unveiled organic fine ice cream flavors. The new products are available in four flavors, including Cookies and Fudge, Brownies, Chocolate Peanut Butter Brownies, Strawberry and Shortbread Cookies, and Golden State Vanilla.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Organic Food Market based on the below-mentioned segments:

United States Organic Food Market, By Type

- Organic Fruits and Vegetables

- Organic Meat

- Poultry and Dairy

- Organic Processed Food

- Organic Bread and Bakery

- Organic Beverages

- Organic Cereal and Food Grains

- Others

United States Organic Food Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

United States Organic Food Market, By Application

- Bakery and Confectionery

- Ready-To-Eat Food Products

- Breakfast Cereals

- Others

Need help to buy this report?