United States Orphan Drugs Market Size, Share, and COVID-19 Impact Analysis, By Therapy Area (Oncology, Hematology, Neurology, Endocrinology, Cardiovascular, Respiratory, Immunotherapy, and Others), By Drug Type (Biologics and Non-Biologics), and US Orphan Drugs Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Orphan Drugs Market Insights Forecasts to 2033

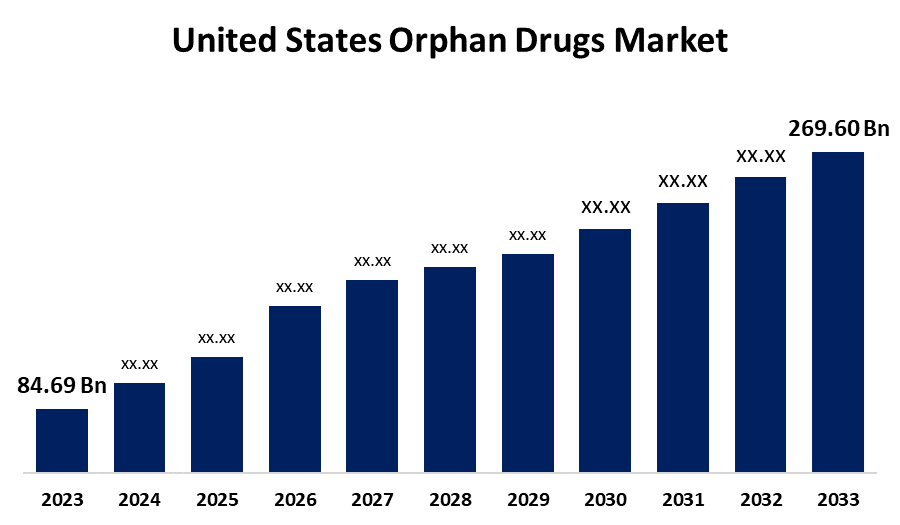

- The U.S. Orphan Drugs Market Size was valued at USD 84.69 Billion in 2023.

- The Market is Growing at a CAGR of 12.28% from 2023 to 2033

- The U.S. Orphan Drugs Market Size is Expected to Reach USD 269.60 Billion by 2033

Get more details on this report -

The U.S. Orphan Drugs Market Size is Anticipated to Exceed USD 269.60 Billion by 2033, Growing at a CAGR of 12.28% from 2023 to 2033.

Market Overview

Orphan drugs are proposed to be used in the treatment of rare diseases. Based on published articles and national databases, the U.S. FDA has approved more orphan drugs than non-orphan drugs in the last five years. With the constantly rising patient population suffering from rare diseases, the demand for effective therapeutics is increasing in the country. According to the data published last year, 2022, by the FDA, it contains more than 7,000 known rare diseases that affect more than 30 million people in the U.S. Such a huge number of untreated patients encourages the manufacturers to invest more vigorously in research and development activities in order to enhance the treatment portfolio of orphan drugs. The sudden outbreak of COVID-19 has positively influenced the market growth. This positive growth was due to increased regulatory approvals for the product. The growing patient population, being treated for rare diseases such as spinal muscular atrophy, myelofibrosis, multiple myeloma, B-cell lymphoma, and many more, increases the pressure to discover more potent and curative treatments.

Report Coverage

This research report categorizes the market for the US orphan drugs market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States orphan drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. orphan drugs market.

United States Orphan Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 84.69 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 12.28% |

| 2033 Value Projection: | USD 269.60 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 221 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Therapy Area, By Drug Type and COVID-19 Impact Analysis. |

| Companies covered:: | Amgen Inc., Bayer AG, F. Hoffmann-La Roche Ltd, Alexion Pharmaceuticals Inc., Novo Nordisk A/S, Novartis AG, Bristol-Myers Squibb Company, AstraZeneca, DAIICHI SANKYO COMPANY, LIMITED, GlaxoSmithKline plc, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Market players are investing in R&D to prove the efficacy of potential candidates in treating different diseases. According to various published articles and press releases, Eisai and Biogen's drug, lecanemab, is expected to gain approval from the U.S. FDA at the end of 2023 to treat Alzheimer's disease. Over the past years, many drugs have been approved by the FDA. In 2021 alone, there were 40 specialty drugs approved by the FDA. This means that it represented 75% of all the drugs approved. For this year, 2022, a total of 22 new medications are sanctioned by the FDA, and 16 more are expected to be approved until the close of 2022.

Restraining Factors

One of the significant challenges that are delaying the adoption rate of orphan drugs, especially cell and gene therapies, is their high cost.

Market Segmentation

The US orphan drugs market share is classified into therapy area and drug type.

- The oncology segment is expected to hold a significant market share through the forecast period.

The United States orphan drugs market is segmented by therapy area into oncology, hematology, neurology, endocrinology, cardiovascular, respiratory, immunotherapy, and others. Among these, the oncology segment is expected to hold a significant market share through the forecast period. The market in the U.S. for orphan drugs in the sector of oncology is the largest mainly because of the increasing prevalence of cancer across the country. Several major manufacturers have prepared various drugs to be used in the treatment of these cancers, most of which turn out to be orphan drugs.

- The biologics segment is expected to dominate the US market during the projected period.

Based on the drug type, the United States orphan drugs market is divided into biologics and non-biologics. Among these, the biologics segment is expected to dominate the US orphan drugs market during the projected period. Biologics continue to be the largest segment of the U.S. market, at least for 2022. In fact, the biologics segment leads the market because many such drugs are getting approved for various indications across the country.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States orphan drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

ist of Key Companies

- Amgen Inc.

- Bayer AG

- F. Hoffmann-La Roche Ltd

- Alexion Pharmaceuticals Inc.

- Novo Nordisk A/S

- Novartis AG

- Bristol-Myers Squibb Company

- AstraZeneca

- DAIICHI SANKYO COMPANY, LIMITED

- GlaxoSmithKline plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Biogen received approval from the FDA for QALSODY, otherwise referred to as tofersen, to treat ALS-associated mutation of the superoxide dismutase 1 gene.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States orphan drugs market based on the below-mentioned segments:

United States Orphan Drugs Market, By Therapy Area

- Oncology

- Hematology

- Neurology

- Endocrinology

- Cardiovascular

- Respiratory

- Immunotherapy

- Others

United States Orphan Drugs Market, By Drug Type

- Biologics

- Non-Biologics

Need help to buy this report?