United States Orthopedic Surgical Planning Software Market Size, Share, and COVID-19 Impact Analysis, By Software Delivery (Cloud-Based and On-Premise), By Software Type (Pre-Operative and Post-Operative), and U.S. Orthopedic Surgical Planning Software Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareU.S. Orthopedic Surgical Planning Software Market Insights Forecasts to 2033

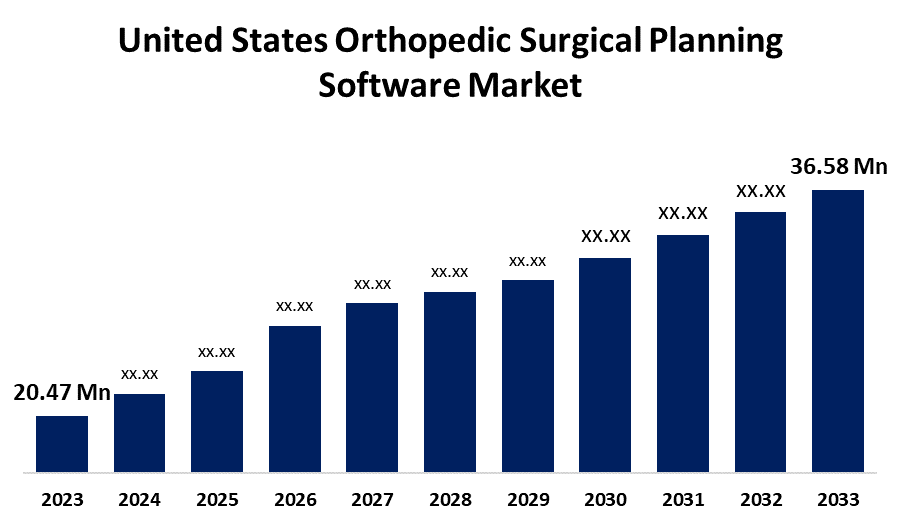

- The United States Orthopedic Surgical Planning Software Market Size Was Estimated at USD 20.47 Million in 2023.

- The Market Size is Growing at a CAGR of 5.98% from 2023 to 2033

- The USA Orthopedic Surgical Planning Software Market Size is Expected to Reach USD 36.58 Million by 2033

Get more details on this report -

The US Orthopedic Surgical Planning Software Market Size is expected to reach USD 36.58 Million by 2033, Growing at a CAGR of 5.98% from 2023 to 2033

Market Overview

The orthopedic surgical planning software market in the United States refers to the market of software tools that assist orthopedic surgeons in planning and executing surgeries more efficiently. These software solutions provide 3D modeling, simulation, and preoperative planning for orthopedic procedures, including joint replacements (such as hip and knee surgeries), spine surgeries, trauma surgeries, and more. The use of surgical planning software helps in reducing surgical errors, optimizing outcomes, and improving recovery times for patients. The growing use of digital solutions in pre- and postoperative care, along with improvements in medical imaging technology, are driving the market. The need for these treatments is fueled by the increasing incidence of orthopedic conditions such as rheumatoid arthritis, osteoarthritis, and traumatic injuries as well as the rising frequency of joint replacement and spinal procedures. The main drivers of adoption are better patient outcomes, shorter operating times, and increased surgical precision.

Report Coverage

This research report categorizes the market for the U.S. orthopedic surgical planning software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US orthopedic surgical planning software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA orthopedic surgical planning software market.

United States Orthopedic Surgical Planning Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 20.47 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.98% |

| 023 – 2033 Value Projection: | USD 36.58 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Software Delivery, By Software Type |

| Companies covered:: | Stryker, Radlink, Inc., Zimmer Biomet, EOS imaging (ATEC Spine Inc.), Formus Labs Ltd, mediCAD, DePuy Synthes (Johnson & Johnson Medical Devices Companies), Enhatch Inc., Brainlab AG, Corin Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The market is expanding due to the demand for cutting-edge technologies, including orthopedic surgical planning software, which is greatly increased by the growing number of orthopedic surgeries. In addition, the market for orthopedic surgery planning software is growing as a result of the combination of AI, machine learning, and sophisticated imaging methods, which enhance surgeon accuracy and visualize virtual procedures. Additionally, the growth rate of the orthopedic surgery planning software market in North America over the last few years has been significantly influenced by the distribution of funds for medical research and development. The market is anticipated to grow as a result of the numerous health efforts that different institutions and organizations have undertaken.

Restraining Factors

The USA orthopedic surgical planning software market faces challenges due to the advanced orthopedic surgical planning software, which can be expensive to implement, particularly for smaller clinics or hospitals. The expense of setting up these systems and instructing staff how to utilize them could prevent their broad deployment. In addition, experts with the ability to decode complicated data and operate the software efficiently are needed for orthopedic surgical planning software. The market's expansion may be hampered by the lack of skilled workers, especially in neglected areas.

Market Segmentation

The U.S. orthopedic surgical planning software market share is classified into the software delivery and software type.

- The cloud-based segment accounted for the largest share of 60.39% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the software delivery, the U.S. orthopedic surgical planning software market is divided into cloud-based and on-premises. Among these, the cloud-based segment accounted for the largest share of 60.39% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by the development of surgical planning software, which is being propelled by recent advancements in virtual reality (VR), artificial intelligence (AI), and sophisticated medical imaging technology. In addition, the development of comprehensive 3D models of patient anatomy made possible by these technologies enables more precise preoperative evaluations and individualized treatment protocols.

- The pre-operative segment accounted for the highest share of 72.25% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the software type, the U.S. orthopedic surgical planning software market is divided into pre-operative and post-operative. Among these, the pre-operative segment accounted for the highest share of 72.25% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The increase is ascribed to growing awareness of the advantages of using pre-operative surgical planning software. In addition, the market for pre-operative surgical planning software has expanded over the last ten years as a result of improvements in orthopedic surgery and healthcare professionals' need for more efficient surgical procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. orthopedic surgical planning software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stryker

- Radlink, Inc.

- Zimmer Biomet

- EOS imaging (ATEC Spine Inc.)

- Formus Labs Ltd

- mediCAD

- DePuy Synthes (Johnson & Johnson Medical Devices Companies)

- Enhatch Inc.

- Brainlab AG

- Corin Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, the Apollo platform and ApolloKnee surgical application for robotic-assisted total knee arthroplasty have been launched globally, according to Corin Group, an orthopedic robotics and AI innovator.

Market Segment

- This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. orthopedic surgical planning software market based on the below-mentioned segments

U.S. Orthopedic Surgical Planning Software Market, By Software Delivery

- Cloud-Based

- On-Premise

U.S. Orthopedic Surgical Planning Software Market, By Software Type

- Pre-Operative

- Post-Operative

Need help to buy this report?