United States Osteoarthritis Injectables Market Size, Share, and COVID-19 Impact Analysis, By Injection Type (Hyaluronic Acid Injections, Corticosteroid Injections, Platelet-Rich Plasma (PRP) Injections, Placental Tissue Matrix (PTM) Injections, Acetylsalicylic Acid (ASA) Injections, and Others), By Anatomy (Knee Osteoarthritis, Hip Osteoarthritis, Hand Osteoarthritis, and Others), By End-Use (Hospital Pharmacies, Retail Pharmacies, and Others), and United States Osteoarthritis Injectables Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Osteoarthritis Injectables Market Insights Forecasts to 2033

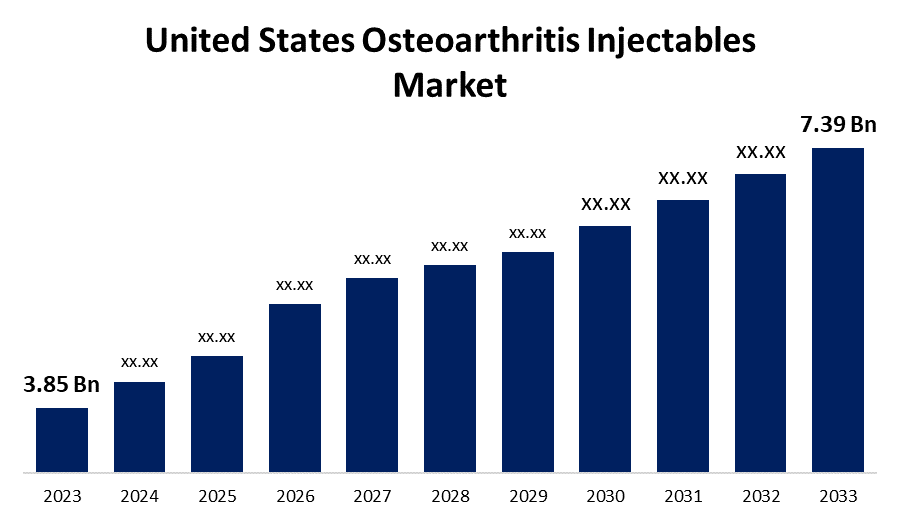

- The U.S. Osteoarthritis Injectables Market Size was valued at USD 3.85 Billion in 2023.

- The Market is growing at a CAGR of 6.74% from 2023 to 2033

- The U.S. Osteoarthritis Injectables Market Size is expected to reach USD 7.39 Billion by 2033

Get more details on this report -

The United States Osteoarthritis Injectables Market is anticipated to exceed USD 7.39 Billion by 2033, growing at a CAGR of 6.74% from 2023 to 2033. The growing incidence of osteoarthritis, geriatric population, R&D activities, and rising awareness of personalized medicine are driving the growth of the osteoarthritis injectables market in the US.

Market Overview

Osteoarthritis injectables, including corticosteroids and hyaluronic acid, help to treat painful knee osteoarthritis (OA), also known as degenerative arthritis which is the most prevalent chronic joint ailment. Approximately 1 in 5 adults in the United States, or 53.2 million people, have arthritis, according to CDC data released in June 2023. Prominent pharmaceutical corporations and research institutes are actively engaged in research and development (R&D) to create innovative medications, particularly disease-modifying OA therapies, to manage OA symptoms and prevent their structural progression. Hyaluronic acid and platelet-rich plasma are two examples of biologic injectables that have become very popular in the treatment of osteoarthritis. There are ongoing R&D activities to develop novel medicines and improved formulations that provide longer-lasting and more effective relief from osteoarthritis. Furthermore, the new developments in injectable therapy are focusing on relief from inflammation and pain in the joints.

Report Coverage

This research report categorizes the market for the US osteoarthritis injectables market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States osteoarthritis injectables market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US osteoarthritis injectables market.

United States Osteoarthritis Injectables Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.85 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.74% |

| 2033 Value Projection: | USD 7.39 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Injection Type, By Anatomy, By End-Use |

| Companies covered:: | Anika Therapeutics, Inc., Bioventus, Sanofi S.A., Flexion Therapeutics, Inc., Ferring Pharmaceuticals Inc., Zimmer Biomet, Arthrex, Inc., Teva Pharmaceutical Industries Ltd., Royal Biologics, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Osteoarthritis (OA), which affects 32.5 million adults in the US, is the most prevalent type of arthritis, though there are thought to be more than 100 varieties and the major contributor to disability in the elderly population. Further, obesity and age are also responsible for enhancing the prevalence of osteoarthritis. The increased incidence of arthritis is responsible for driving the market. The nation's research and academic institutions, along with pharmaceutical businesses, are working to develop tailored treatment plans and cell-based therapeutics for OA. Thus, the rising development of personalized medicine along with its awareness is driving the market growth. In addition, the rising R&D activities for the development of injectable drugs and the growing awareness regarding personalized medicine as well as the development of personalized treatment and cell-based therapies are also contributing to drive the US osteoarthritis injectables market.

Restraining Factors

The alternative treatment options including surgery and oral medications may hamper the market growth. Further, the creation of innovative therapies and their adoption over symptomatic relief is anticipated to restrain the market for osteoarthritis injectables.

Market Segmentation

The United States Osteoarthritis Injectables Market share is classified into injection type, anatomy, and end-use.

- he hyaluronic acid injections segment dominates the market with the largest market share in 2023.

The United States osteoarthritis injectables market is segmented by injection type into hyaluronic acid injections, corticosteroid injections, platelet-rich plasma (PRP) injections, placental tissue matrix (PTM) injections, acetylsalicylic acid (ASA) injections, and others. Among these, the hyaluronic acid injections segment dominates the market with the largest market share in 2023. According to an NCBI article published in March 2022, HA-based hydrogel therapies are the focus of recent developments in HA injectable therapy for osteoarthritis. Hydrogels containing hydroxyapatite (HA) show promise as a therapy for osteoarthritis demonstrating their potential to improve lubrication of joint, cell delivery, and damaged tissue regeneration. The growing investment and novel product lines are anticipated to drive the market.

- The knee osteoarthritis segment held the largest revenue share of the US osteoarthritis injectables market in 2023.

The United States osteoarthritis injectables market is segmented by anatomy into knee osteoarthritis, hip osteoarthritis, hand osteoarthritis, and others. Among these, the knee osteoarthritis segment held the largest revenue share of the US osteoarthritis injectables market in 2023. Growing concerns have been raised about health problems linked to aging and obesity, including osteoarthritis in the knee. As people age, osteoarthritis in the knees can cause excruciating pain and, if addressed, increased disability. The increased prevalence of osteoarthritis in the US drives the need for prevention and treatment, especially in older people which is expected to drive the market demand.

- The hospital pharmacies segment dominates the US osteoarthritis injectables market during the forecast period.

Based on the end-use, the U.S. osteoarthritis injectables market is divided into hospital pharmacies, retail pharmacies, and others. Among these, the hospital pharmacies segment dominates the US osteoarthritis injectables market during the forecast period. Data from a May 2023 NCBI article highlights the role hospital pharmacies play in managing osteoarthritis (OA), showing a noteworthy 112.1% rise in hospital admissions connected to the disease. The importance of hospital pharmacies for effective treatment monitoring and management is propelling the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. osteoarthritis injectables market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anika Therapeutics, Inc.

- Bioventus

- Sanofi S.A.

- Flexion Therapeutics, Inc.

- Ferring Pharmaceuticals Inc.

- Zimmer Biomet

- Arthrex, Inc.

- Teva Pharmaceutical Industries Ltd.

- Royal Biologics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, OrthoTrophix, Inc., a privately held biopharmaceutical company, announced that the company licensed its TPX-100 to American Regent, Inc., a New York based pharmaceutical company specialized in injectable therapeutic products. Under this license, American Regent, Inc. obtains an exclusive right to commercialize TPX-100 in the human therapeutic field in the United States.

- In March 2023, Exothera, a Belgium-based contract development and manufacturing organization (CDMO), and Remedium Bio, a US-based biotechnology company, entered into an agreement under which the two companies collaborate to scale up manufacturing and demonstrate the industrialization potential of Remedium’s lead gene therapy drug candidate, AAV2-FGF18.

- In May 2023, Grünenthal announced that its investigational non-opioid medicine resiniferatoxin (RTX), undergoing clinical Phase III development, received Breakthrough Therapy Designation from the U.S. Food and Drug Administration (FDA) for pain associated with osteoarthritis (OA) of the knee.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Osteoarthritis Injectables Market based on the below-mentioned segments:

US Osteoarthritis Injectables Market, By Injection Type

- Hyaluronic Acid Injections

- Corticosteroid Injections

- Platelet-Rich Plasma (PRP) Injections

- Placental Tissue Matrix (PTM) Injections

- Acetylsalicylic Acid (ASA) Injections

- Others

US Osteoarthritis Injectables Market, By Anatomy

- Knee Osteoarthritis

- Hip Osteoarthritis

- Hand Osteoarthritis

- Others

US Osteoarthritis Injectables Market, By End-Use

- Hospital Pharmacies

- Retail Pharmacies

- Others

Need help to buy this report?