United States Palm Oil Market Size, Share, and COVID-19 Impact Analysis, By Product (Palm kernel and Crude Palm Oil), By End-use (Personal Care & Cosmetics, Food & Beverages, Animal Feed, Biofuels, and Others), and U.S. Palm Oil Market Insights, Industry Trend, Forecasts to 2033.

Industry: Specialty & Fine ChemicalsUnited States Palm Oil Market Insights Forecasts to 2033

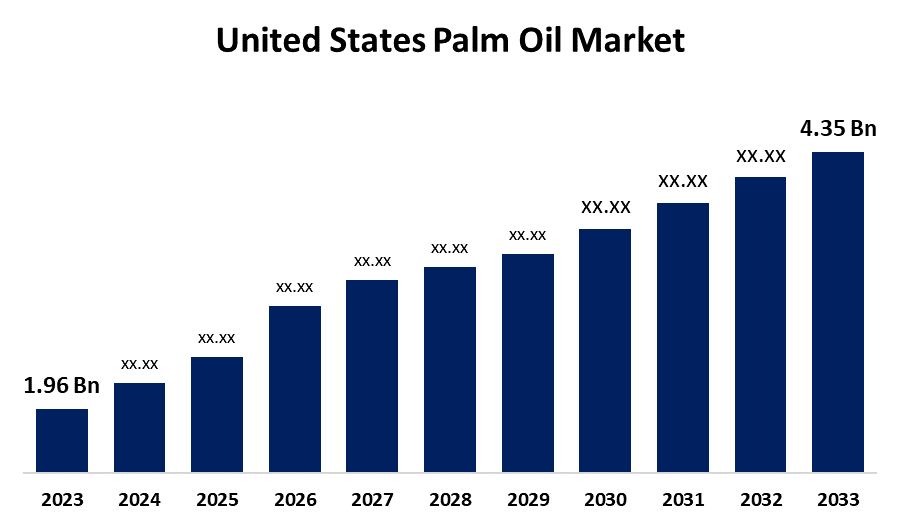

- The United States Palm Oil Market Size Was Estimated at USD 1.96 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.30% from 2023 to 2033

- The USA Palm Oil Market Size is Expected to Reach USD 4.35 Billion by 2033

Get more details on this report -

The United States Palm Oil Market Size is Expected to Reach USD 4.35 billion by 2033, Growing at a CAGR of 8.30% from 2023 to 2033

Market Overview

The United States palm oil market refers to the production, imports, and domestic use within the country. Palm oil is a vegetable oil that is widely utilized because of its many uses. The oil palm plants' fruit is the source of it. In addition to food goods like cooking oils, margarine, and snacks, it is a component of detergents, personal care products, and biofuels. The countrywide market expansion is mostly being driven by the growing middle class and the rising demand for processed cooking oils. Additionally, the market is driven by the rapidly expanding demand from the energy, food, beverage, biofuel, cosmetics, and personal care sectors.

Additionally, the US government aids in the market expansion with programs like the Roundtable on Sustainable Palm Oil (RSPO) and the National Initiatives for Sustainable & Climate Smart Oil Palm Smallholders (NI-SCOPS), the US government, international organizations, and private sector businesses are actively promoting sustainable palm oil production, concentrating on issues like labor rights, deforestation, and supply chain transparency.

Report Coverage

This research report categorizes the market for the U.S. palm oil market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US palm oil market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA palm oil market.

United States Palm Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.96 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.30% |

| 023 – 2033 Value Projection: | USD 4.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product, By End-use |

| Companies covered:: | ADM, Wilmar International Ltd., Cargill, Agrolane, Mehsom Corpl, CIRANDA, PK Chem Industries Ltd, GreenChem Industries, LLC, Colonial Chemical, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The US palm oil market is primarily driven by the growing demand for certified sustainable palm oil (CSPO) due to customer preferences for sustainable palm oil products. Another major factor driving market expansion is the expanding biofuel industry, which uses palm oil as a vital feedstock for the creation of biodiesel. Additionally, demand in the US market is still driven by palm oil's affordability, stability, and adaptability in the food industry, especially in cookies, crackers, and margarine. In addition, palm oil an affordable vegetable oil, is gaining market share owing to its high yield per hectare and production efficiency. Furthermore, the market for certified sustainable palm oil (CSPO), which offers a premium price point and appeals to consumers who care about the environment, is expanding due to the growing demand for sustainable products.

Restraining Factors

The US palm oil market faces challenges due to the high saturated fat content of palm oil raises health concerns, and further restricts its widespread use, especially in the food sector. In addition, both producers and consumers experience uncertainty as a result of price volatility brought on by global market trends, meteorological conditions, and geopolitical considerations. Additionally, the market share of palm oil is also threatened by competition from other vegetable oils including canola and soybean.

Market Segmentation

The U.S. palm oil market share is classified into product and end-use.

- The crude palm oil segment accounted for the largest share of 80.05% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the U.S. palm oil market is divided into palm kernel and crude palm oil. Among these, the crude palm oil segment accounted for the largest share of 80.05% in 2023 and is expected to grow at a significant CAGR during the forecast period. This can be attributed to its significant end-use in the food and beverage sector. In addition, the pharmaceutical and cosmetics end-use sectors also have a high demand for CPO because it is an essential component of many of their products.

- The food & beverage segment accounted for the highest market share of 64.57% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the end-use, the U.S. palm oil market is categorized into personal care & cosmetics, food & beverages, animal feed, biofuels, and others. Among these, the food & beverage segment accounted for the highest market share of 64.57% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment expansion can be attributed to the growing number of products that use palm oil as a raw ingredient and the growing number of industry end-use applications. In addition, these are expanding market categories that are anticipated to grow rapidly over the next several years due to technological advancements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. palm oil market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM

- Wilmar International Ltd.

- Cargill

- Agrolane

- Mehsom Corpl

- CIRANDA

- PK Chem Industries Ltd

- GreenChem Industries, LLC

- Colonial Chemical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

- This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. palm oil market based on the below-mentioned segments

U.S. Palm Oil Market, By Product

- Palm kernel

- Crude Palm Oil

U.S. Palm Oil Market, By End-use

- Personal Care & Cosmetics

- Food & Beverages

- Animal Feed

- Biofuels

- Others

Need help to buy this report?