United States Pet Food Market Size, Share, and COVID-19 Impact Analysis, By Pet Type (Dog, Cat, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Channel, Specialty Stores, and Others), and U.S. Pet Food Market Insights, Industry Trend, Forecasts to 2033

Industry: Specialty & Fine ChemicalsUnited States Pet Food Market Insights Forecasts to 2033

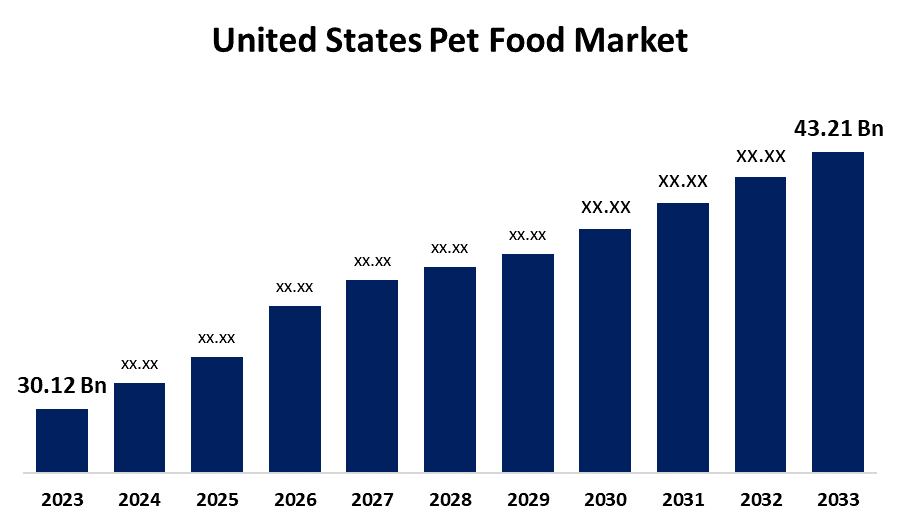

- The United States Pet Food Market Size Was Estimated at USD 30.12 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.67% from 2023 to 2033

- The USA Pet Food Market Size is Expected to Reach USD 43.21 Billion by 2033

Get more details on this report -

The United States Pet Food Market Size is Expected to reach USD 43.21 Billion by 2033, Growing at a CAGR of 3.67% from 2023 to 2033.

Market Overview

The market devoted to creating and supplying food specially made to satisfy the dietary requirements of domesticated animals, including dogs, cats, and other pets like rodents and reptiles, is referred to as the U.S. pet food market. This market offers a wide range of goods, like as snacks, wet and dry food, and specialized diets for the health and well-being of pets. Additionally, it includes retail sales channels that are both online and offline. The market is anticipated to increase rapidly over the forecast period due to rising pet humanization. Additionally, due to the rise of online shopping and the significant influence of e-commerce on the development of the U.S. pet business, pet products have seen significant demand in recent years. In addition, the introduction of novel technologies, treats, online private brands, and new food products are some of the trends driving the pet industry's expansion. Furthermore, the U.S. pet food market is expected to gain from pet parents' preference for fresher, frozen, and made-to-order meals for their animals.

Additionally, the market is strict rules regulate the market to assess ingredients, advertising language, promotional materials, and public education. The U.S. Food and Drug Administration (FDA), and state regulatory partners conduct a thorough evaluation to guarantee that pet food is produced, packaged, and processed free of adulteration or contamination.

Report Coverage

This research report categorizes the market for the U.S. pet food market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US pet food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA pet food market.

United States Pet Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 30.12 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.67% |

| 2033 Value Projection: | USD 43.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Pet Type, By Distribution Channel |

| Companies covered:: | The J. M. Smucker Company, The Hartz Mountain Corporation, Mars, Incorporated, Simmons Foods, Inc. & Affiliates, SCHELL & KAMPETER, INC., General Mills Inc., WellPet LLC, ALPHIA, Blue Buffalo Company, Ltd., Hill’s Pet Nutrition, Inc., Nestlé Purina, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The US pet food market is primarily driven by the US pet ownership trend is boosting demand for personalized, health-conscious pet food, driven by cultural attitudes and convenience, with an increase in online ordering and delivery services. In addition, the demand for pet food is rising as more households in the United States develop pets. Additionally, there is a growing demand for high-end and specialty pet food products as pet owners treat their animals more like members of the family. The rising demand for premium and health-conscious pet foods is indicative of this trend. Furthermore, pet owners are becoming more conscious of the crucial part food plays in preserving the health of their animals. Purchasing food that promotes better digestive health and weight control is something that many people are willing to do.

Restraining Factors

The market for pet food in the United States is constrained by several reasons, such as the higher cost of premium pet foods can be an obstacle for some pet owners, particularly in times of economic contraction. In addition, consumers may become more price-sensitive and choose less expensive brands as a result of economic concerns. Furthermore, companies may face difficulties due to stringent laws controlling pet food ingredients and production methods, which may restrict the availability and creation of new products.

Market Segmentation

The U.S. pet food market share is classified into pet type and distribution channel.

- The dog segment held the largest market share of 41.78% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the pet type, the U.S. pet food market is divided into dog, cat, and others. Among these, the dog segment held the largest market share of 41.78% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding because growing consumer worries about pet health have led to a further rise in the price of nutritious dog food. In addition, one of the health issues that pet owners worry about the most is dog obesity. Additionally, the demand for premium dog food has been fueled by the growing number of people adopting dogs as pets, especially millennials and Gen Z.

- The supermarkets/hypermarkets segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the U.S. pet food market is categorized into supermarkets/hypermarkets, online channel, specialty stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing because they provide more convenience in terms of options for several brands and pricing, they are more preferred by customers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. pet food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The J. M. Smucker Company

- The Hartz Mountain Corporation

- Mars, Incorporated

- Simmons Foods, Inc. & Affiliates

- SCHELL & KAMPETER, INC.

- General Mills Inc.

- WellPet LLC

- ALPHIA

- Blue Buffalo Company, Ltd.

- Hill’s Pet Nutrition, Inc.

- Nestlé Purina

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In December 2024, Friends & Family Pet Food Company (FnF), a new pet nutrition company that uses products devoid of animals, announced a new partnership with Novel Farms, a biotech startup that creates ingredients made from produced animal meat. A "new class" of farmed meat pet food items is the goal of the strategic alliance.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. pet food market based on the below-mentioned segments:

U.S. Pet Food Market, By Pet Type

- Dog

- Cat

- Others

U.S. Pet Food Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Online Channel

- Specialty Stores

- Others

Need help to buy this report?