United States Pet Wheelchair Market Size, Share, and COVID-19 Impact Analysis, By Pet (Dogs and Cats), By End-Use (Pet Owners and Veterinary Clinics), and by the United States Pet Wheelchair Market Insights Forecasts to 2033

Industry: HealthcareUnited States Pet Wheelchair Market Insights Forecasts to 2033

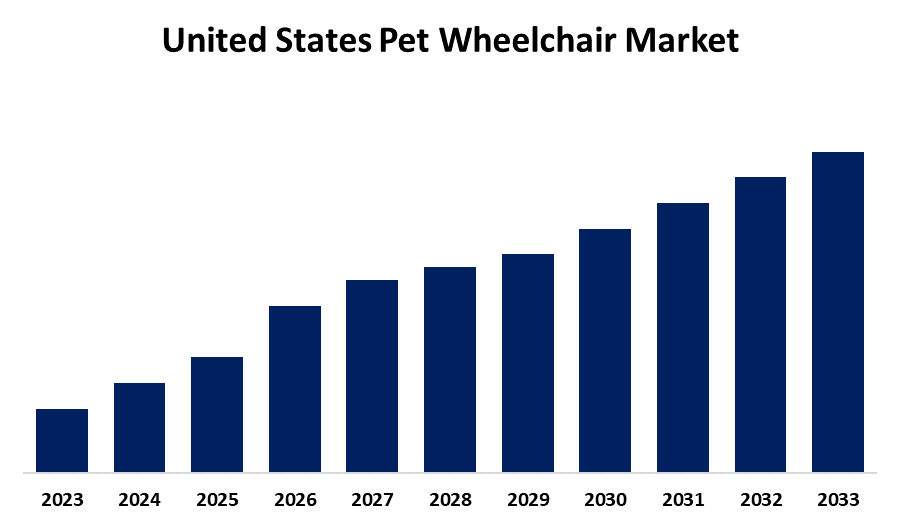

- The United States Pet Wheelchair Market Size is Growing at a CAGR of 6.7% from 2023 to 2033

- The United States Pet Wheelchair Market Size is Expected to Hold a Significant Share By 2033

Get more details on this report -

The United States Pet Wheelchair Market Size is Anticipated to Hold a Significant Share By 2033, Growing at a CAGR of 6.7% from 2023 to 2033.

Market Overview

The United States pet wheelchair market refers to the industry dedicated to the design, manufacturing, and distribution of mobility aids for pets with disabilities, injuries, or age-related mobility issues. Pet wheelchairs are specialized devices that provide support and enhanced mobility for animals suffering from paralysis, degenerative diseases, or limb amputations. These wheelchairs are primarily used for dogs and cats but are also available for other animals, including rabbits and larger pets. The market includes various product types, such as adjustable and custom-built wheelchairs, designed to cater to different sizes and mobility needs. Several factors drive the growth of the United States pet wheelchair market. The increasing pet adoption rate, coupled with rising awareness regarding pet healthcare and mobility solutions, significantly contributes to market expansion. Advancements in veterinary care and prosthetic technologies have led to improved designs and better accessibility of pet wheelchairs. Additionally, the growing number of pet insurance policies covering assistive devices encourages pet owners to opt for such solutions. The increasing disposable income and willingness to invest in pet well-being further stimulate market demand. Government initiatives supporting veterinary healthcare advancements play a crucial role in market growth. Policies promoting animal welfare, funding for veterinary research, and support for pet rehabilitation programs contribute to the widespread adoption of mobility aids for pets.

Report Coverage

This research report categorizes the market for the United States pet wheelchair market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pet wheelchair market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States pet wheelchair market sub-segment.

United States Pet Wheelchair Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Pet, By End-Use |

| Companies covered:: | Doggon Wheels, Eddie’s Wheels for Pets, K9 Carts, Pfaff Tierorthopädie, Best friend Mobility, Walkin’ Pets, Mintbowl Inc., LaraCart Dog Wheelchairs, Orthopets, Animal Ortho Care, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States pet wheelchair market is driven by several key factors. The increasing pet adoption rate and growing awareness of pet mobility solutions have significantly contributed to market expansion. Advances in veterinary medicine and prosthetic technologies have led to the development of lightweight, adjustable, and more efficient pet wheelchairs. The rising prevalence of age-related mobility issues, injuries, and degenerative diseases among pets has further fueled demand. Additionally, the growing availability of pet insurance policies that cover assistive devices encourages pet owners to invest in mobility aids. Increasing disposable income and the willingness to spend on pet healthcare further support market growth.

Restraining Factors

The United States pet wheelchair market faces challenges such as high product costs, limited awareness in certain regions, and a lack of standardized regulations. Additionally, customization complexities and veterinary approval requirements may hinder market adoption.

Market Segment

The U.S. pet wheelchair market share is classified into pets and end-use.

- The dogs segment is expected to hold the largest market share through the forecast period.

The US pet wheelchair market is segmented by pets into dogs and cats. Among these, the dogs segment is expected to hold the largest market share through the forecast period. This dominance is attributed to the higher adoption rate of dogs as pets compared to cats and the greater prevalence of mobility-related issues among dogs due to aging, injuries, and genetic disorders. Large and medium-sized dog breeds are particularly susceptible to conditions such as hip dysplasia, degenerative myelopathy, and arthritis, increasing the demand for mobility aids.

- The pet owners segment is expected to hold the largest market share through the forecast period.

The US pet wheelchair market is segmented by end-use into pet owners and veterinary clinics. Among these, the pet owners segment is expected to hold the largest market share through the forecast period. This dominance is driven by the increasing awareness among pet owners regarding mobility solutions for disabled or aging pets, coupled with a growing willingness to invest in pet healthcare. The rising prevalence of conditions such as arthritis, spinal injuries, and degenerative diseases in pets has further accelerated the adoption of pet wheelchairs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pet wheelchair market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Doggon Wheels

- Eddie's Wheels for Pets

- K9 Carts

- Pfaff Tierorthopädie

- Best friend Mobility

- Walkin' Pets

- Mintbowl Inc.

- LaraCart Dog Wheelchairs

- Orthopets

- Animal Ortho Care

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States pet wheelchair market based on the below-mentioned segments:

United States Pet Wheelchair Market, By Pet

- Dogs

- Cats

United States Pet Wheelchair Market, By End-Use

- Pet Owners

- Veterinary Clinics

Need help to buy this report?