United States Pharmaceutical Cold Chain Packaging Market Size, Share, and COVID-19 Impact Analysis, By Packaging Format (Active and Passive), By Product (Mailers, Pallets, Boxes, and Others), By Application (Clinical Research Organization, Hospitals, Biopharmaceutical Companies, Logistics and Distribution Companies, Research Institutes, and Others), and U.S. Pharmaceutical Cold Chain Packaging Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Pharmaceutical Cold Chain Packaging Market Insights Forecasts to 2033

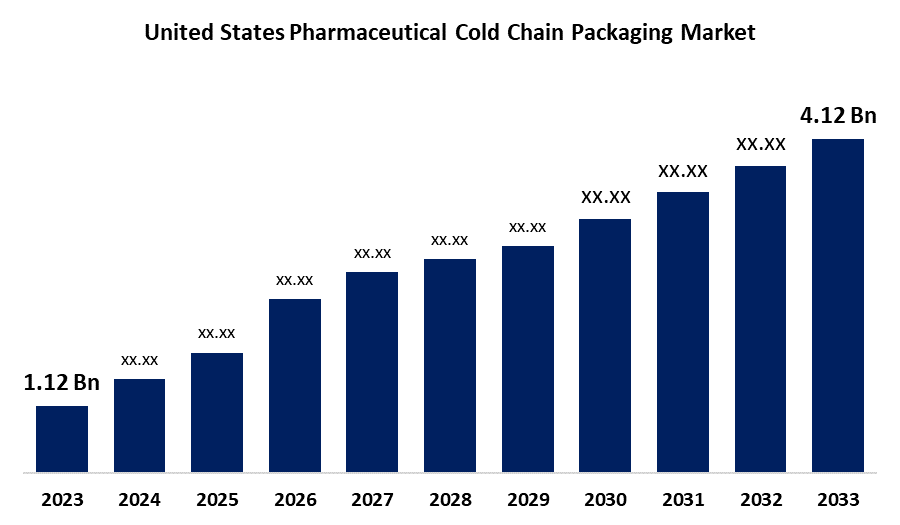

- The United States Pharmaceutical Cold Chain Packaging Market Size Was Estimated at USD 1.12 Billion in 2023.

- The Market is Growing at a CAGR of 13.91% from 2023 to 2033

- The USA Pharmaceutical Cold Chain Packaging Market Size is Expected to Reach USD 4.12 Billion by 2033

Get more details on this report -

The United States Pharmaceutical Cold Chain Packaging Market Size is Expected to reach USD 4.12 Billion by 2033, Growing at a CAGR of 13.91% from 2023 to 2033

Market Overview

The industry concentrated on temperature-controlled packaging and logistics solutions for pharmaceutical products, guaranteeing their quality and safety during storage and transit, is referred to as the pharmaceutical cold chain packaging market in the United States. The growing demand from the food and pharmaceutical industries is driving the market. The growing pharmaceutical industry, which includes biologics, vaccines, and specialized medications, depends significantly on sophisticated cold-chain packaging to preserve product effectiveness. Adoption has also been accelerated by the food and beverage industry's rising need for frozen items, seafood, and fresh produce. Additionally, strict laws, including those established by the FDA and Health US, require companies to adhere to stringent temperature restrictions, which forces them to use cutting-edge packaging technology. The effectiveness of cold chain solutions has been improved by material advancements such as vacuum-insulated panels and phase change materials. Furthermore, the demand for dependable cold-chain packaging has increased owing to the expansion of e-commerce for perishable products. Market expansion is further aided by growing customer awareness of product quality.

Report Coverage

This research report categorizes the market for the U.S. pharmaceutical cold chain packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US pharmaceutical cold chain packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA pharmaceutical cold chain packaging market.

United States Pharmaceutical Cold Chain Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.12 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.91% |

| 2033 Value Projection: | USD 4.12 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Packaging Format, By Product and COVID-19 Impact Analysis. |

| Companies covered:: | Smurfit Kappa, Insulated Products Corporation, Sealed Air, Peli BioThermal Limited, CSafe, Intelsius, SkyCell AG, Inmark Global Holdings, LLC, Sonoco ThermoSafe, Cryoport Systems, LLC and Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The United States pharmaceutical cold chain packaging market due to the U.S. biopharmaceutical industry is experiencing significant growth due to biotechnology advancements and increased research investment. As companies focus on producing temperature-sensitive biologics and therapies, sophisticated cold chain packaging is crucial for safe delivery. Additionally, the pharmaceutical cold chain packaging sector has seen significant technological advancements, including smart solutions with real-time temperature monitoring, improved insulation, and vacuum-insulated panels. These innovations enhance the reliability of cold chain logistics, ensuring the safe transport of pharmaceuticals.

Restraining Factors

The market for pharmaceutical cold chain packaging in the United States is hampered by issues like high operating costs and the energy consumption rate of pharmaceutical cold chain packaging may be too expensive for low-income regions, which could hinder market expansion. In addition, the market presence may be hampered by low-income countries' lack of laws and stabilization.

Market Segmentation

The U.S. pharmaceutical cold chain packaging market share is categorized into packaging format, product, and application.

- The passive segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the packaging format, the U.S. pharmaceutical cold chain packaging market is classified into active and passive. Among these, the passive segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by the passive sector, which uses insulated containers and refrigerants without the need for external power sources. This dominance is explained by its affordability, usability, and extensive use in the transportation of medications that are sensitive to temperature.

- The boxes segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the product, the U.S. pharmaceutical cold chain packaging market is divided into mailers, pallets, boxes, and others. Among these, the boxes segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is expanding because of its extensive use throughout the pharmaceutical supply chain, ease of handling, affordability, and exceptional capacity to provide dependable thermal insulation. Pharmaceutical businesses are using insulated boxes more and more to guarantee the safe shipping and storage of temperature-sensitive medications, biologics, and vaccines as the demand for these vital products rises.

- The biopharmaceutical companies segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the U.S. pharmaceutical cold chain packaging market is classified into clinical research organization, hospitals, biopharmaceutical companies, logistics and distribution companies, research institutes, and others. Among these, the biopharmaceutical companies segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to they are increasingly depending on heat-sensitive biologics, gene and cell therapies, and sophisticated vaccinations. The demand for active cooling systems, high-performance insulation, and real-time monitoring solutions has increased due to the growing necessity of regulatory compliance, worldwide distribution, and smart packaging technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. pharmaceutical cold chain packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smurfit Kappa

- Insulated Products Corporation

- Sealed Air

- Peli BioThermal Limited

- CSafe

- Intelsius

- SkyCell AG

- Inmark Global Holdings, LLC

- Sonoco ThermoSafe

- Cryoport Systems, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, DHL declared its plan to purchase CryoPDP, a division of Cryoport Systems, a pharmaceutical logistics company situated in the United States. The purpose of this calculated action is to increase DHL's market share in the pharmaceutical logistics industry.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. pharmaceutical cold chain packaging market based on the below-mentioned segments:

U.S. Pharmaceutical Cold Chain Packaging Market, By Packaging Format

- Active

- Passive

U.S. Pharmaceutical Cold Chain Packaging Market, By Product

- Mailers

- Pallets

- Boxes

- Others

U.S. Pharmaceutical Cold Chain Packaging Market, By Application

- Clinical Research Organization

- Hospitals

- Biopharmaceutical Companies

- Logistics and Distribution Companies

- Research Institutes

- Others

Need help to buy this report?