United States Pharmaceutical Filtration Market Size, Share, and COVID-19 Impact Analysis, By Product (Membrane filters, Prefilter & depth media, Single-use systems, Cartridges & capsules, Filter holders, Filtration accessories, and Others), By Technique (Microfiltration, Ultrafiltration, Cross flow filtration, Nanofiltration, and Others), By Type (Sterile and Non-sterile), By Application (Final product processing, Raw material filtration, Cell separation, Water purification, and Air purification), By Scale of Operation (Manufacturing scale, Pilot scale, and Research & development scale), and United States Pharmaceutical Filtration Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Pharmaceutical Filtration Market Insights Forecasts to 2033

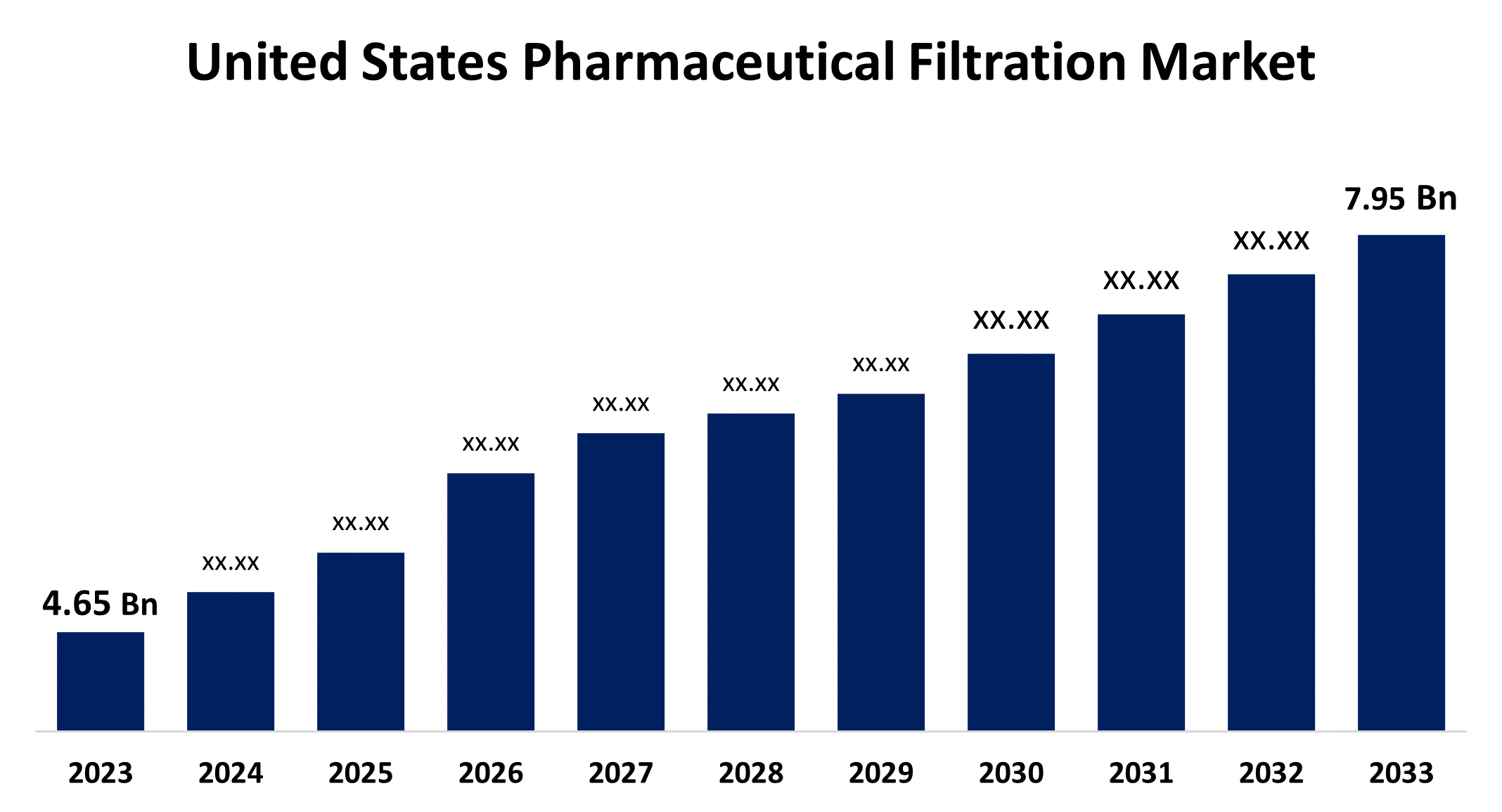

- The U.S. Pharmaceutical Filtration Market Size was valued at USD 4.65 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.51% from 2023 to 2033

- The U.S. Pharmaceutical Filtration Market Size is Expected to reach USD 7.95 Billion by 2033

Get more details on this report -

The United States Pharmaceutical Filtration Market is anticipated to exceed USD 7.95 Billion by 2033, growing at a CAGR of 5.51% from 2023 to 2033. The growing technological advancements for pharmaceutical filtration, government initiatives for R&D activities, and the presence of major pharmaceutical & biopharmaceutical companies are driving the growth of the pharmaceutical filtration market in the US.

Market Overview

Pharmaceutical filtration is a mechanical or physical operation for separating solids from fluids which can be either liquids or gas via a semipermeable membrane medium through which only fluid can pass. The membrane used in this filtration process removes the solid particulate matter from a fluid. This process is used in the manufacturing of active pharmaceutical ingredients (API) and finished dosage form formulations in the pharmaceutical industry. In 2023, the United States held a 39% share of the worldwide pharmaceutical filtration market. Pharmaceutical businesses are being forced to invest in cutting-edge filtering technology in order to match the expectations of end users due to the increased awareness and demand for purity. The introduction of cutting-edge membrane filters and high-capacity filter cartridges as novel filtration solutions by companies to meet the changing demands of the pharmaceutical sector is creating market opportunities.

Report Coverage

This research report categorizes the market for the US pharmaceutical filtration market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pharmaceutical filtration market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US pharmaceutical filtration market.

United States Pharmaceutical Filtration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 4.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.51% |

| 2033 Value Projection: | USD 7.95 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technique, By Type, By Scale of Operation |

| Companies covered:: | Merck KGaA, Eaton., Amazon Filters Ltd., Parker Hannifin Corp., Thermo Fisher Scientific Inc., 3M, Graver Technologies, Sartorius AG., Meissner Filtration Products, Inc, Danaher, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing technological advancements in pharmaceutical filtration for achieving high purity levels in drug manufacturing are contributing to market growth. According to the data by the Congressional Budget Office, the pharmaceutical sector invested $83 billion in research and development in 2019. That sum, after accounting for inflation, is roughly ten times the annual expenditure of the industry in the 1980s. The increased spending on R&D activities is driving market growth. Pharmaceutical companies are concentrating on putting in place cutting-edge filtration technologies due to the rising complexity of drug formulations, especially biological medicine formulations. This surges the demand for advanced filtration technology that leads to drive the pharmaceutical filtration market.

Restraining Factors

The high cost associated with filtration systems due to sophisticated filtration systems and their maintenance costs are hampering the market for pharmaceutical filtration.

Market Segmentation

The United States Pharmaceutical Filtration Market share is classified into product, technique, type, application, and scale of operation.

- The membrane filters segment dominates the US pharmaceutical filtration market with the largest share in 2023.

The United States pharmaceutical filtration market is segmented by product into membrane filters, prefilter & depth media, single-use systems, cartridges & capsules, filter holders, filtration accessories, and others. Among these, the membrane filters segment dominates the US pharmaceutical filtration market with the largest share in 2023. Consistent filtering quality is ensured by the membrane filter's ability to distribute pore sizes precisely and uniformly. The increasing technological advancements in membrane materials and filtration systems for developing innovative and improved performance filtration systems drive the market.

- The microfiltration segment accounted for the largest market share of the US pharmaceutical filtration market in 2023.

The United States pharmaceutical filtration market is segmented by technique into microfiltration, ultrafiltration, cross flow filtration, nanofiltration, and others. Among these, the microfiltration segment accounted for the largest market share of the US pharmaceutical filtration market in 2023. Microfiltration consists of a membrane that has pores ranging from 0.1 to 10 μm in diameter, used for filtering out bacteria and other impurities from biopharmaceutical products without impacting biological activity and stability. The extensive application of microfiltration in the biopharmaceutical industry is driving the market.

- The sterile segment dominates the market with the largest market share during the forecast period.

The United States pharmaceutical filtration market is segmented by type into sterile and non-sterile. Among these, the sterile segment dominates the market with the largest market share during the forecast period. Sterile filtration is significantly used in pharmaceutical production to ensure safety and to meet the quality standards of the product. The implementation of automated sterile filtering in pharmaceutical applications by strong partnerships with well-known pharmaceutical firms is propelling the market growth.

- The final product processing segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the U.S. pharmaceutical filtration market is divided into final product processing, raw material filtration, cell separation, water purification, and air purification. Among these, the final product processing segment is anticipated to grow at the fastest CAGR during the forecast period. Pharmaceutical filtration is used in final product processing, which guarantees the product's safety, effectiveness, and quality while also satisfying patient and regulatory requirements. The significance of filtration in final product processing is driving the market.

- The manufacturing scale segment accounted for the largest revenue share of the US pharmaceutical filtration market in 2023.

The United States pharmaceutical filtration market is segmented by scale of operation into manufacturing scale, pilot scale, and research & development scale. Among these, the manufacturing scale segment accounted for the largest revenue share of the US pharmaceutical filtration market in 2023. The filtration methods used in drug manufacturing have a direct impact on the quality of the finished product. Manufacturers are required by a number of regulatory standards to follow filtration procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. pharmaceutical filtration market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck KGaA

- Eaton.

- Amazon Filters Ltd.

- Parker Hannifin Corp.

- Thermo Fisher Scientific Inc.

- 3M

- Graver Technologies

- Sartorius AG.

- Meissner Filtration Products, Inc

- Danaher

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, 3M announced that its Board of Directors had approved the planned spin-off of its Health Care business, known as Solventum Corporation. Solventum would be organized into four operating business segments aligned to the markets served, including purification & filtration and others. The Purification & Filtration business would provide filters and membranes intended for life-saving biopharmaceuticals, vaccines, and medical treatments.

- In March 2023, TeraPore Technologies, a developer of advanced nanofiltration membrane systems for biomanufacturing, raised US$10 million in new financing. TeraPore would use the funding to launch its IsoBlock virus filter and expand the use of its core technology into new high-value markets.

- In September 2022, Pall Corporation extended its bioprocessing solution portfolio with the launch of three new Allegro Connect Systems. Solventum will be organized into four operating business segments aligned to the markets served, including purification & filtration and others. The Purification & Filtration business will provide filters and membranes intended for life-saving biopharmaceuticals, vaccines, and medical treatments.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Pharmaceutical Filtration Market based on the below-mentioned segments:

US Pharmaceutical Filtration Market, By Product

- Membrane filters

- Prefilter & depth media

- Single-use systems

- Cartridges & capsules

- Filter holders

- Filtration accessories

- Others

US Pharmaceutical Filtration Market, By Technique

- Microfiltration

- Ultrafiltration

- Cross flow filtration

- Nanofiltration

- Others

US Pharmaceutical Filtration Market, By Type

- Sterile

- Non-sterile

US Pharmaceutical Filtration Market, By Application

- Final product processing

- Raw material filtration

- Cell separation

- Water purification

- Air purification

US Pharmaceutical Filtration Market, By Scale of Operation

- Manufacturing scale

- Pilot scale

- Research & development scale

Need help to buy this report?