United States Pharmaceutical Isolators Market Size, Share, and COVID-19 Impact Analysis, By Type (Open Isolator and Closed Isolator), By Product (Positive Pressure and Negative Pressure), and U.S. Pharmaceutical Isolators Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsUnited States Pharmaceutical Isolators Market Insights Forecasts to 2033

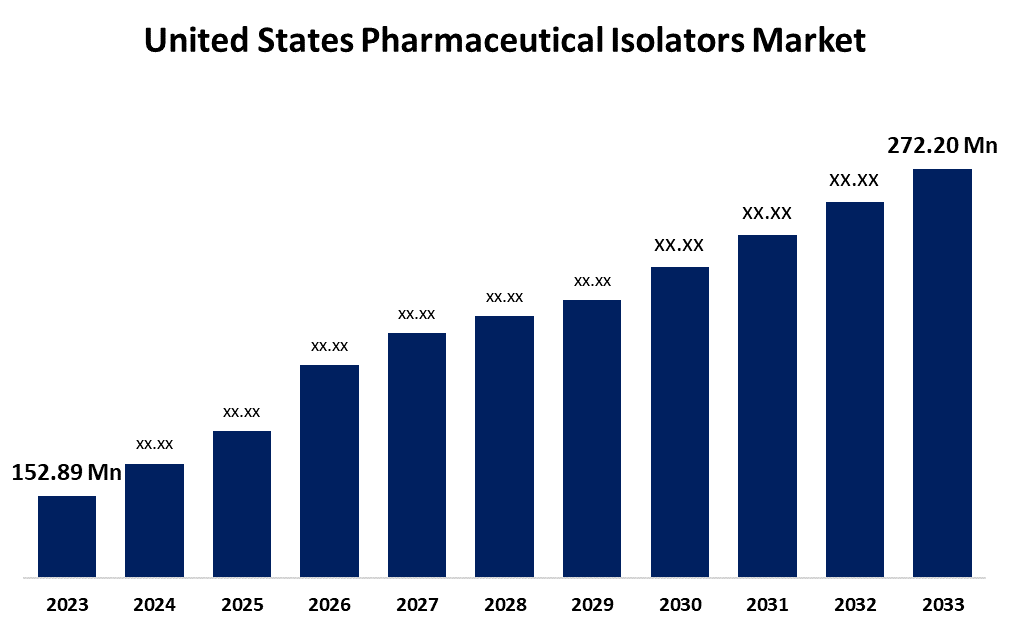

- The United States Pharmaceutical Isolators Market Size Was Estimated at USD 152.89 Million in 2023.

- The Market is Growing at a CAGR of 5.94% from 2023 to 2033

- The USA Pharmaceutical Isolators Market Size is Expected to Reach USD 272.20 Million by 2033

Get more details on this report -

The United States Pharmaceutical Isolators Market Size is Expected to reach USD 272.20 Million by 2033, Growing at a CAGR of 5.94% from 2023 to 2033.

Market Overview

The market for pharmaceutical isolators in the US is a subset of the pharmaceutical sector that specializes in offering regulated handling and processing conditions for pharmaceuticals. Pharmaceutical isolators are enclosed systems intended to preserve aseptic conditions, avoid cross-contamination, and guarantee the security and integrity of pharmaceutical products throughout the processes of production, testing, and packaging. The market expansion can be ascribed to the pharmaceutical industry’s rapid growth, and technological developments are essential because they improve production methods. In addition, the demand for aseptic manufacturing has increased due to the COVID-19 pandemic, which has highlighted the necessity of isolators for ensuring safety and compliance. Furthermore, pharmaceutical companies, especially those in the biotechnology and biopharmaceutical industries, are investing in isolators to reduce the risk of contamination due to worker safety and regulatory requirements. Moreover, innovations in isolator technology brought about by continuous research and development are enhancing the effectiveness and safety of pharmaceutical manufacturing procedures. The capacity of pharmaceutical isolators to efficiently handle hazardous materials becomes increasingly important for preserving product integrity and U.S. safety regulations as healthcare investments grow.

Report Coverage

This research report categorizes the market for the U.S. pharmaceutical isolators market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US pharmaceutical isolators market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA pharmaceutical isolators market.

United States Pharmaceutical Isolators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 152.89 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.94% |

| 2033 Value Projection: | USD 272.20 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Product |

| Companies covered:: | SKAN AG, M. BRAUN INERTGAS-SYSTEME GMBH, I.M.A. SpA, Iso Tech Design, Nuaire, Getinge AB, AZBIL TELSTAR, S.L.U., Syntegon Technologies GmbH, COMECER S.p.A., LAF Technologies, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for pharmaceutical isolators has grown as a result of in the United States the pharmaceutical sector prioritizes worker health and safety, and isolators are being used more and more to protect employees from contaminated products and hazardous medications. In addition, pharmaceutical isolators are demanded by the expanding pharmaceutical sector in the United States to preserve manufacturing standards and avoid contamination. Additionally, pharmaceutical companies are using isolators to ensure contamination-free production settings as demand for biologics, vaccines, and other sterile pharmaceuticals rises. Isolators are essential in aseptic production, which is being driven by the development of diseases like cancer and autoimmune disorders that require complicated therapies.

Restraining Factors

The USA pharmaceutical isolators market faces challenges due to pharmaceutical isolators can be expensive to purchase and set up, particularly for small and medium-sized businesses. The adoption of these systems may be restricted by financial difficulties brought on by their upkeep and operating expenses. Additionally, the growing demand for isolators in some pharmaceutical industries can be hampered by smaller firms' or specialized markets' ignorance of sophisticated contamination control methods.

Market Segmentation

The U.S. pharmaceutical isolators market share is classified into type and product.

- The open isolators segment accounted for the largest market share of 54.84% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the U.S. pharmaceutical isolators market is divided into open isolator and closed isolator. Among these, the open isolators segment accounted for the largest market share of 54.84% in 2023 and is expected to grow at a significant CAGR during the forecast period. This expansion can be ascribed to their adaptability and simplicity in incorporating into current procedures. Additionally, these systems are perfect for small-batch manufacturing, which is becoming more and more popular as personalized medicine gains traction, because they make aseptic compounding and sampling easier.

- The positive pressure segment accounted for the largest market share of 48.37% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the product, the U.S. pharmaceutical isolators market is categorized into positive pressure and negative pressure. Among these, the positive pressure segment accounted for the largest market share of 48.37% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is primarily driven by its capacity to preserve a sterile environment, which is essential for procedures demanding a high level of sterility assurance. These isolators are crucial for avoiding contamination in the production of drugs, especially those that are sensitive.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. pharmaceutical isolators market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SKAN AG

- M. BRAUN INERTGAS-SYSTEME GMBH

- I.M.A. SpA

- Iso Tech Design

- Nuaire

- Getinge AB

- AZBIL TELSTAR, S.L.U.

- Syntegon Technologies GmbH

- COMECER S.p.A.

- LAF Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, groninger and SKAN collaborated to supply Civica, a nonprofit pharmaceutical company, with cutting-edge filling lines that are connected with isolators. The goal of this collaboration is to address medication shortages and reduce the price of necessary medications.

- In October 2023, AST, a pioneer in aseptic fill-finish processing technology, and Germfree Laboratories, a world leader in isolator technology for aseptic processing and containment in the pharmaceutical industry, announced a ground-breaking collaboration. This historic partnership redefined industry norms, ushering in a new era of efficiency and creativity.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. pharmaceutical isolators market based on the below-mentioned segments:

U.S. Pharmaceutical Isolators Market, By Type

- Open Isolator

- Closed Isolator

U.S. Pharmaceutical Isolators Market, By Product

- Positive Pressure

- Negative Pressure

Need help to buy this report?