United States Phoropter Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Manual and Automated), By End User (Hospitals, Ophthalmic Clinics, and Others), and United States Phoropter Market Insights Forecasts to 2033

Industry: HealthcareUnited States Phoropter Market Insights Forecasts to 2033

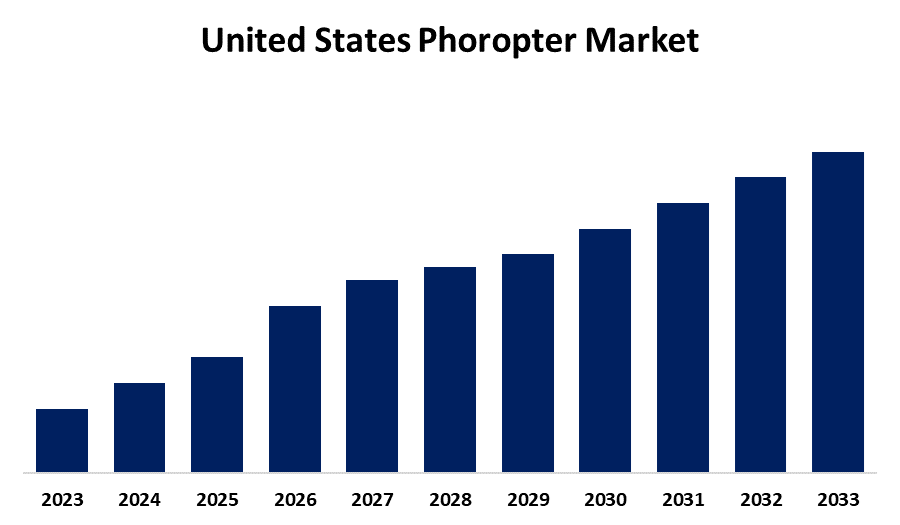

- The Market is growing at a CAGR of 4.8% from 2023 to 2033

- The US Phoropter Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Phoropter Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.8% from 2023 to 2033.

Market Overview

A phoropter is an ophthalmic instrument used by optometrists and ophthalmologists to determine the refractive error of an individual and arrive at a prescription for corrective lenses. It consists of lenses, one after another, which are placed before the eyes to determine the vision acuity and to diagnose myopia, hyperopia, astigmatism, or presbyopia. The phoropter is therefore important in examinations so that a practitioner can arrive at the best possible lens. The main factor for the growth of the US phoropter market is due to the rising prevalence of ophthalmological disorders, coupled with the increasing size of the geriatric population and increased awareness of eye health. Technological innovation, like the digital phoropter, also accelerates the advancement of the market. Digital phoropters allow high precision as well as ease of use over manual devices, so they are continually accepted by ophthalmic practitioners. The scope of the market is increasing because demand for vision correction solutions is growing in both urban and rural areas. In terms of government initiatives, funding for vision health programs as well as public awareness programs are on the growth trajectory of the market. Policies that enhance access to eye care to those underserved will also provide an impetus for the demand for phoropters. Additionally, the health care reforms that promote the preventive mode of care as well as encourage routine eye exams contribute to the expansion of this market.

Report Coverage

This research report categorizes the market for the United States phoropter market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States phoropter market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States phoropter market sub-segment.

United States Phoropter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.8% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Carl Zeiss Vision, Nidek Co., Ltd., Topcon Corporation, Rexxam Co., Ltd., Huvitz Co., Ltd., Canon Inc., Sonomed Escalon, Keeler Instruments, Ins and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States phoropter market is growing significantly, propelled by several factors. Foremost among these is the growth in prevalence of refractive errors and other conditions related to vision. As people grow older, presbyopia, myopia, hyperopia, and astigmatism are rising more frequently, and greater demands are placed on eye examinations and proper vision diagnostics. With age, there is bound to be an increase in the requirement for corrective eyewear, and the prescriptions are done more accurately by eye care professionals using phoropters.

Restraining Factors

The high cost of advanced digital phoropters, limited awareness in rural areas, and the need for specialized training to operate sophisticated equipment are key restraining factors. Additionally, the slow adoption of new technologies in some regions hampers overall market growth.

Market Segment

The U.S. phoropter market share is classified into product type and end user.

- The automated segment is expected to hold the largest market share through the forecast period.

The US phoropter market is by product type into manual and automated. Among these, the automated segment is expected to hold the largest market share through the forecast period. This is attributed to the automated phoropters offer enhanced precision, faster testing times, and improved patient comfort compared to manual versions. These devices are increasingly favored by ophthalmic practices due to their ability to integrate with electronic health records (EHR) systems, streamline the eye exam process, and reduce the likelihood of human error.

- The ophthalmic clinics segment is expected to hold the largest market share through the forecast period.

The US phoropter market is segmented by end user into hospitals, ophthalmic clinics, and others. Among these, the ophthalmic clinics segment is expected to hold the largest market share through the forecast period. This is attributed to the ophthalmic clinics are the primary settings for vision exams and prescriptions, as they specialize in eye care services. The growing demand for specialized vision diagnostics and treatments, coupled with the rising number of optometrists and ophthalmologists, makes ophthalmic clinics the leading end-user segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Phoropter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carl Zeiss Vision

- Nidek Co., Ltd.

- Topcon Corporation

- Rexxam Co., Ltd.

- Huvitz Co., Ltd.

- Canon Inc.

- Sonomed Escalon

- Keeler Instruments, Inc Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, AMETEK, Inc., acquired Navitar, Inc., a designer and manufacturer of customized, fully integrated optical imaging systems, components, and software.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States Phoropter market based on the below-mentioned segments:

United States Phoropter Market, By Product Type

- Manual

- Automated

United States Phoropter Market, By End User

- Hospitals

- Ophthalmic Clinics

- Others

Need help to buy this report?