United States Plasma Fractionation Market Size, Share, and COVID-19 Impact Analysis, By Product (Albumin, Immunoglobulin, Coagulation Factors, Protease Inhibitors, and Others), By Application (Immunology & Neurology, Haematology, Critical Care, Pulmonology, and Others), By End-user (Hospitals & Clinics, Clinical Research Laboratories, and Others), and United States Plasma Fractionation Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Plasma Fractionation Market Insights Forecasts to 2033

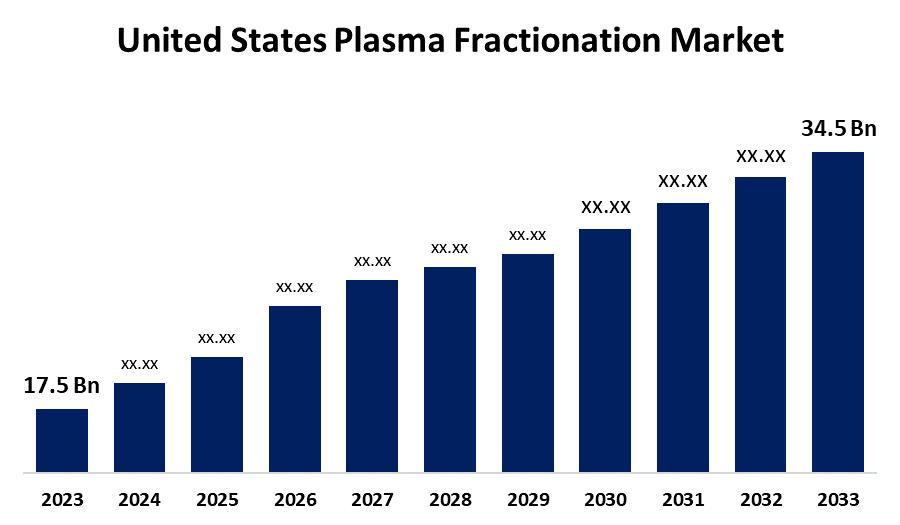

- The U.S. Plasma Fractionation Market Size Was valued at USD 17.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.02% from 2023 to 2033

- The U.S. Plasma Fractionation Market Size is expected to reach USD 34.5 Billion by 2033

Get more details on this report -

The United States Plasma Fractionation Market Size is anticipated to exceed USD 34.5 Billion by 2033, Growing at a CAGR of 7.02% from 2023 to 2033. The growing prevalence of immunodeficiency disorder and rising demand for plasma-derived products for treatment are driving the growth of the plasma fractionation market in the US.

Market Overview

Plasma fractionation is the process of separating components of blood plasma to manufacture valuable products from plasma. Biologic medications, such as burns, shocks, immunological problems, congenital metabolic abnormalities, and other potentially fatal ailments, are effectively treated by the plasma fractionated products. Plasma fractionation is an essential part of the treatment of life-threatening diseases. The increasing prevalence of various conditions like immunodeficiency disorders, bleeding disorders, lung & liver disorders, and blood clot disorders that may be life-threatening surges the need for plasma-derived therapies that ultimately lead to drive the demand for blood fractionation with advanced technologies. The growing emphasis on the development of novel plasma-derived products for the treatment along with the growing number of government awareness-raising initiatives about the significance of plasma and blood donation are driving the market expansion of plasma fractionation in the United States.

Report Coverage

This research report categorizes the market for the US plasma fractionation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States plasma fractionation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US plasma fractionation market.

United States Plasma Fractionation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.02% |

| 023 – 2033 Value Projection: | USD 34.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By End-user |

| Companies covered:: | , CSL Plasma, Grifols, Takeda Pharmaceutical Company, BioLife (Shire), Kedrion S.p.A., Octapharma, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

According to an article in the AACI Journal, there is an increased number of diagnosed and treated patients with primary immunodeficiency (PI). Between 2013 and 2021, the number of patients with PI reported by physicians grew; in the US, this rise was 96.3% and patients identified with a particular PI deficiency increased by 46.6% in the US. The increased prevalence of immunodeficiency disorder surges the demand for plasma fractionation due to the increasing need for plasma-derived products for treatment.

Restraining Factors

The advantages of recombinant therapy over plasma-derived products lead to increasing adoption of recombinant products resulting in hampering the market growth for plasma fractionation.

Market Segmentation

The United States Plasma Fractionation Market share is classified into product, application, and end-user.

- The immunoglobulin segment dominates the US plasma fractionation market with the largest share in 2023.

The United States plasma fractionation market is segmented by product into albumin, immunoglobulin, coagulation factors, protease inhibitors, and others. Among these, the immunoglobulin segment dominates the US plasma fractionation market with the largest share in 2023. Immunoglobulins such as polyclonal/polyvalent (IgG), and hyperimmune (H-IgG) are plasma-derived medicinal products (PDMPs) produced by fractionation. The rising number of patients with auto-immune diseases such as systemic lupus erythematosus (SLE), IVIG, and Guillain-Barré Syndrome, as well as the clinical effectiveness of immunoglobulin in treating these problems are driving the market demand.

- The pulmonology segment dominates the market with a significant CAGR growth during the forecast period.

The United States plasma fractionation market is segmented by application into immunology & neurology, haematology, critical care, pulmonology, and others. Among these, the pulmonology segment dominates the market with a significant CAGR growth during the forecast period. The FDA approved CSL Behring's 4g and 5g vial sizes of Zemaira, a plasma-derived Alpha-1 proteinase inhibitor, in April 2019 for use as a maintenance treatment for people with AAT deficiency, a genetic that can cause lung damage. The accessibility of medical care, new product launches, and diagnostic advances are contributing to driving the market growth.

- The clinical research laboratories segment is anticipated to grow at the fastest pace in the US plasma fractionation market during the forecast period.

Based on the end-user, the U.S. plasma fractionation market is divided into hospitals & clinics, clinical research laboratories, and others. Among these, the clinical research laboratories segment is anticipated to grow at the fastest pace in the US plasma fractionation market during the forecast period. The increased R&D efforts to produce new PDMP products for clinical applications as well as the rising need for plasma therapy in uncommon diseases are driving the market in the clinical research laboratories segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. plasma fractionation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CSL Plasma

- Grifols

- Takeda Pharmaceutical Company

- BioLife (Shire)

- Kedrion S.p.A.

- Octapharma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Grifols, a global leader in plasma medicines, announced it had received approval from the U.S. Food and Drug Administration (FDA) for its new immunoglobulin (Ig) purification and filling facility at its Clayton manufacturing campus, for producing plasma-derived medicines.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Plasma Fractionation Market based on the below-mentioned segments:

US Plasma Fractionation Market, By Product

- Albumin

- Immunoglobulin

- Coagulation Factors

- Protease Inhibitors

- Others

US Plasma Fractionation Market, By Application

- Immunology & Neurology

- Haematology

- Critical Care

- Pulmonology

- Others

US Plasma Fractionation Market, By End-user

- Hospitals & Clinics

- Clinical Research Laboratories

- Others

Need help to buy this report?