United States Plastic Bottles Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Polyethylene Terephthalate (PET), Poly Propylene (PP), Low-density Polyethylene (LDPE), High-density Polyethylene (HDPE), and Others), By End User (Beverage, Food, Cosmetics, Pharmaceutical, Household Care, and Others), and United States Plastic Bottles Market Insights Forecasts to 2033

Industry: Consumer GoodsUnited States Plastic Bottles Market Insights Forecasts to 2033

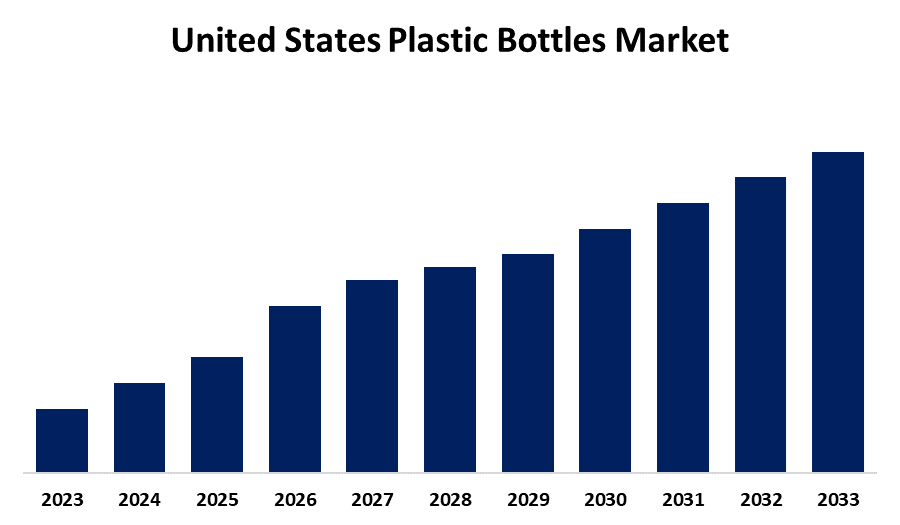

- The Market is Growing at a CAGR of 4.2% from 2023 to 2033

- The US Plastic Bottles Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Plastic Bottles Market is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 4.2% from 2023 to 2033.

Market Overview

A plastic bottle is a bottle that is made from high-density or low-density plastic. Most of the liquids, among them water, soft drinks, motor oil, cooking oil, medicine, shampoo, milk, and ink, will use plastic bottles. The range starts with very small bottles to large carboys. The demand for packaged beverages and pharmaceutical drugs has been rising strongly. Consumers have become more health conscious, leading to an increase in demand for healthy beverages. This has made bottled water more easily available to people, thus aiding the market growth. According to a report published in March 2023 by the Beverage Marketing Corporation and the International Bottled Water Association, bottled water stands out as the most consumed beverage in the United States in 2022, making up about 25% of all beverage consumption. The demand for plastic bottles soared in the carbonated soft drinks (CSD) segment that has nearly matured in America. Pepsi, Coca-Cola, and Keurig Dr Pepper all reported flat sales from their carbonated soft drink division in America. According to the estimates from the annual report by Coca-Cola, these three companies presently dominate the American market share of over 80%. Thus, the demand for plastic bottles in CSD drinks is the primary driver of growth in this market.

Report Coverage

This research report categorizes the market for United States plastic bottles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States plastic bottles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States plastic bottles market.

United States Plastic Bottles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Raw Material, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Berry Global Inc, ALPLA Group, Container Corporation of Canada, Plastikpak Holding Inc., Amcor Group GmbH, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Plastic bottles are manufactured from various raw plastic materials, but PET ones are widely used due to their strength and flexibility at a relatively low price. Due to the rapid growth and innovation of end-user industries like food, beverages, and pharmacy, the demand for plastic bottle packaging will also grow exponentially. The industry will continue to introduce new drinks with different flavors and packaging formats, and thus the requirement of rigid plastic bottles will remain steady. PET has emerged as an essential packaging material for the bottle industry. The technology trend to use lightweight resins with high tensile strength and toughness, good abrasion and heat resistance, low creep at elevated temperatures, good chemical resistance, and other desirable properties makes PET resins ideal for the bottle manufacturers.

Restraining Factors

PET bottles lead the market, as they comprise approximately 65% of post-consumer bottles in the United States. However, only 30% of plastic bottles and jugs enter the recycling process. The plastic bottle recycling market thus remains highly dependent on the recycling infrastructure. This is expected to hinder the growth of the market in the region over the forecast period.

Market Segment

The U.S. plastic bottles market share is classified into raw material and end user .

- The polyethylene terephthalate (PET) segment is expected to hold the largest market share through the forecast period.

The US plastic bottles market is segmented by raw material into polyethylene terephthalate (PET), polypropylene (PP), low-density polyethylene (LDPE), high-density polyethylene (HDPE), and others. Among these, the polyethylene terephthalate (PET) segment is expected to hold the largest market share through the forecast period. Its excellent barrier, lightweight nature, recyclability, and of course, increasing consumer demand for sustainable solutions regarding packaging also make it a favorite for packaging beverages and foods.

- The beverage segment is expected to hold the largest market share through the forecast period.

The US plastic bottles market is segmented by end user into beverage, food, cosmetics, pharmaceutical, household care, and others. Among these, the beverage segment is expected to hold the largest market share through the forecast period. This segment benefits from the demand for bottled beverages like water, soft drinks, and juices. The ease of carrying and convenience provided by plastic bottles has led them to be highly in demand among consumers, thus increasing the growth of this category positively. Also, innovation in bottle design and sustainability initiatives on beverage packaging has contributed to the appeal of plastic bottles in this market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States plastic bottles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Berry Global Inc

- ALPLA Group

- Container Corporation of Canada

- Plastikpak Holding Inc.

- Amcor Group GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States plastic bottles market based on the below-mentioned segments:

United States Plastic Bottles Market, By Raw Material

- Polyethylene Terephthalate (PET)

- Poly Propylene (PP)

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Others

United States Plastic Bottles Market, By End User

- Beverage

- Food

- Cosmetics

- Pharmaceutical

- Household Care

- Others

Need help to buy this report?