United States Power Transformer Market Size, Share, and COVID-19 Impact Analysis, By Type (Oil-Insulated and Air-Insulated), By Phase (Single-Phase and Three-Phase), and United States Power Transformer Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerUnited States Power Transformer Market Insights Forecasts to 2033

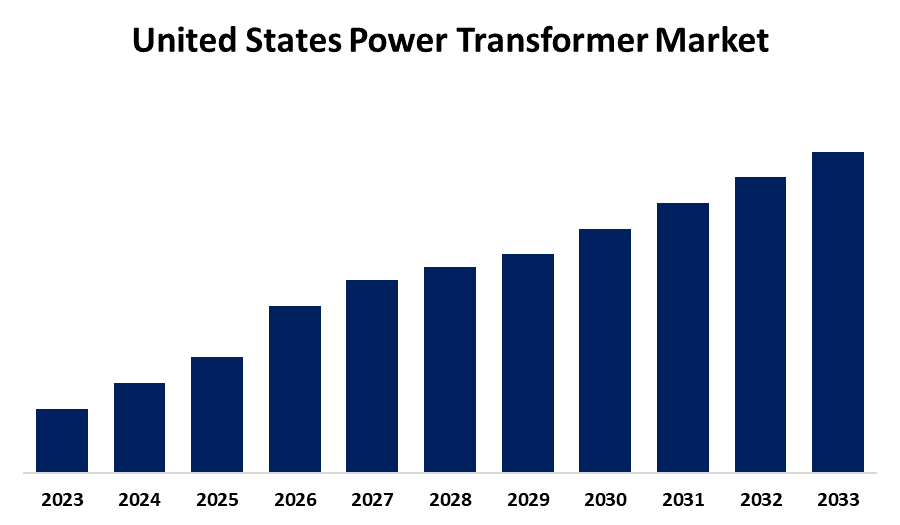

- The Market is Growing at a CAGR of 0.94% from 2023 to 2033

- The United States Power Transformer Market Size is Anticipated to hold a significant share by 2033.

Get more details on this report -

The United States Power Transformer Market is Anticipated to hold a significant share by 2033, growing at a CAGR of 0.94% from 2023 to 2033. The market is rapidly expanding due to the modernization of the power grid, surging electricity demand, and integrating renewable energy resources. Investments in high-voltage and energy-efficient transformers drive expansion and ensure safe power transmission and distribution.

Market Overview

The United States power transformer market refers to the manufacturing, distribution, and utilization of high-capacity transformers for voltage regulation and power transmission. Such transformers enable efficient electricity transfer in grids, which is driven by grid modernization, renewable energy integration, and growing electricity demand in the industrial, commercial, and residential sectors. Moreover, The United States power transformer market is critical to future expansion due to increased electricity demand, modernization efforts within the grid, and renewable energies. In addition to aging infrastructure in dire need of upgrades and replacement, continued innovation thrives on smart transformers and more energy-efficient technologies. More investment into power transmission and distribution networks continues to expand the market. Additionally, the change towards sustainable energy solutions and the need for high-voltage transformers to support long-distance power transmission contribute to the market's long-term growth and development.

Report Coverage

This research report categorizes the market for the United States power transformer market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States power transformer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States power transformer market.

United States Power Transformer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 0.94% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Phase |

| Companies covered:: | ABB Ltd., Kirloskar Electric Co. Ltd., Schneider Electric SA, Siemens AG, Eaton Corporation PLC, MGM Transformer Company, Emerson Electric Company, Hyundai Heavy Industries Co. Ltd., Hitachi Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The United States power transformer market is driven by increasing energy consumption, growing industrialization, and the need for reliable power transmission. Government initiatives for grid stability and electrification boost demand, while renewable energy projects require advanced transformers. Technological advancements in high-voltage and smart transformers, along with investments in modernizing aging power infrastructure, further accelerate market growth, ensuring efficient energy distribution across industrial, commercial, and residential sectors. For instance, in May 2022, Northern Transformer Corporation announced that it had purchased the North American brand, products, and designs of VRT Power Ltd. of Tel Aviv, Israel. Utility clients praise the best-in-class technology from VRT Power that includes low noise, compact footprints, customized solutions, and proven reliability. Over 300 utility-grade power transformers and mobile substations have been constructed in North America.

Restraining Factors

The high initial costs, complicated installation, and long manufacturing lead times limit the U.S. power transformer market. Supply chain disruptions, changes in raw material prices, and stringent environmental legislation also hinder market growth and adoption rates.

Market Segmentation

The United States power transformer market share is classified into type and phase.

- The oil-insulated segment accounted for the largest share of the United States power transformer market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of type, the United States power transformer market is divided into oil-insulated and air-insulated. Among these, the oil-insulated segment accounted for the largest share of the United States power transformer market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to greater efficiency, effective cooling, and superior insulation characteristics. These types of transformers find wide applications in high-voltage transmission and distribution networks. With a long operating life, the reliability and carrying capacity of this transformer are well above that of an air-insulated transformer.

- The three-phase segment accounted for a substantial share of the United States Power Transformer market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of phase, the United States power transformer market is divided into single-phase and three-phase. Among these, the three-phase segment accounted for a substantial share of the United States power transformer market in 2023 and is anticipated to grow at a rapid pace during the projected period. The segmental growth is due to their greater efficiency, higher power transmission capability, and large-scale applications in industries and utilities. They are vital for high-voltage distribution of electricity to ensure stable energy transfer across power grids. They are the best option over single-phase transformers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States power transformer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- Kirloskar Electric Co. Ltd.

- Schneider Electric SA

- Siemens AG

- Eaton Corporation PLC

- MGM Transformer Company

- Emerson Electric Company

- Hyundai Heavy Industries Co. Ltd.

- Hitachi Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, The U.S. Department of Energy (DOE) also proposed new energy efficiency standards, which would mandate almost all new distribution transformers add amorphous steel cores instead of the traditional grain-oriented electrical steel, as they are much more efficient.

Market Segment

- This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States power transformer market based on the below-mentioned segments

United States Power Transformer Market, By Type

- Oil-Insulated

- Air-Insulated

United States Power Transformer Market, By Phase

- Single Phase

- Three Phase

Need help to buy this report?