United States Prefabricated Buildings Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Concrete, Glass, Metal, Timber and Others), By Type of Application (Residential, Commercial, and Others), and United States Prefabricated Buildings Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingUnited States Prefabricated Buildings Market Insights Forecasts to 2033

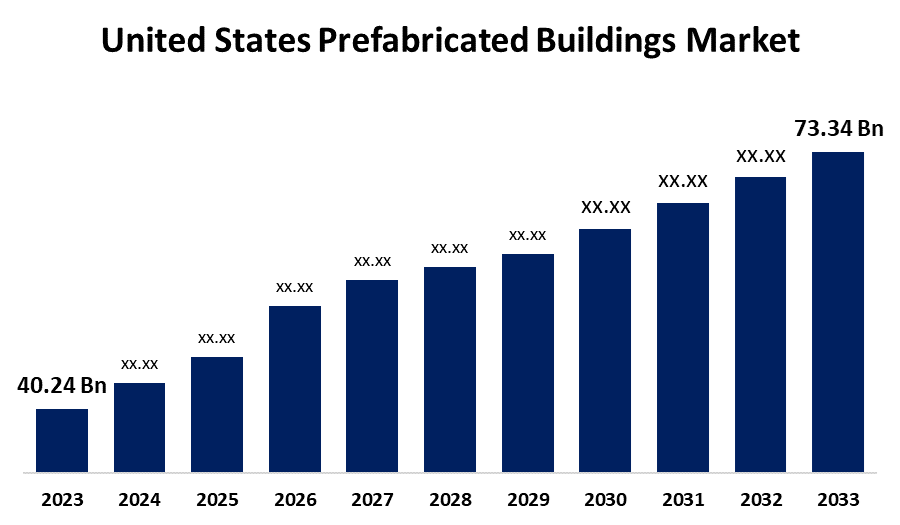

- The U.S. Prefabricated Buildings Market Size was Valued at USD 40.24 Billion in 2023

- The United States Prefabricated Buildings Market Size is Growing at a CAGR of 6.19% from 2023 to 2033

- The US Prefabricated Buildings Market Size is Expected to Reach USD 73.34 Billion by 2033

Get more details on this report -

The US Prefabricated Buildings Market Size is Anticipated to Exceed USD 73.34 Billion by 2033, Growing at a CAGR of 6.19% from 2023 to 2033. Kay players in the U.S. prefabricated buildings market include Plant Prefab, Z Modular, Morton Buildings, and Skyline Champion, driving innovation, sustainability, and efficiency across residential and commercial construction sectors.

Market Overview

The United States prefabricated buildings market encompasses the sector focused on the design, production, and assembly of structures that are manufactured off-site in modules or components and then transported to the construction site for final assembly. These structures are utilized across various sectors, including residential, commercial, industrial, and healthcare, offering advantages such as reduced construction time, cost efficiency, and minimized environmental impact compared to traditional building methods. Moreover, The U.S. prefabricated buildings market is set for steady growth, driven by rising demand for affordable housing, faster construction timelines, and sustainable building solutions. Technological advancements and increased adoption in residential, commercial, and healthcare sectors further boost potential. As urbanization and labor shortages grow, prefabrication offers a cost-effective, efficient alternative to traditional construction methods. For instance, in October 2024, the residential sector, in particular, saw a rise in the popularity of prefabricated homes, including tiny homes and modular units, as cost-effective alternatives to traditional housing. For instance, Amazon has been offering prefabricated tiny homes, such as a 600-square-foot unit priced at USD 39,400, featuring two bedrooms, a living room, a fully equipped kitchen, and a bathroom.

Report Coverage

This research report categorizes the market for the US prefabricated buildings market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. prefabricated buildings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA prefabricated buildings market.

United States Prefabricated Buildings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 40.24 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.19% |

| 2033 Value Projection: | USD 73.34 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Material Type, By Type of Application and COVID-19 Impact Analysis. |

| Companies covered:: | Plant Prefab, Z Modular, Morton Buildings Inc., Affinity Building Systems, SG Modular, Skyline Champion Corporation, Varco Pruden, Homette Corporation, The High Construction Company, American Buildings Company, Westchester Modular Homes Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Drivers of the U.S. prefabricated buildings market include growing urban populations, a push for eco-friendly construction, and rising labour and material costs in traditional building. Government support for sustainable housing and increased investment in infrastructure projects also fuel demand. Additionally, advancements in design technology and off-site manufacturing enhance efficiency, quality, and customization, accelerating market adoption. Moreover, in May 2023, WillScot Mobile Mini made the acquisitions of US-based Hallwood Modular Buildings and Canada-based BRT Structures. The acquisitions will allow it to build its specialty modular fleet and make it a strong leader in North Americas blast-resistant module fleet.

Restraining Factors

The U.S. prefabricated buildings market faces challenges such as negative perceptions, complex regulations, high initial costs, transportation issues, and skilled labor shortages, which can slow adoption and limit market expansion.

Market Segmentation

The U.S. United States prefabricated buildings market share is classified into material type, and application.

- The concrete segment accounted for the largest share of the US prefabricated buildings market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of material type, the United States prefabricated buildings market is divided into concrete, glass, metal, timber and others. Among these, the concrete segment accounted for the largest share of the United States prefabricated buildings market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Its popularity stems from superior strength, fire resistance, and durability, making it ideal for structural components. Concretes adaptability in both residential and commercial applications further supports its widespread use and dominance in prefabricated construction solutions.

- The residential segment accounted for a substantial share of the U.S. prefabricated buildings market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of application, the U.S. prefabricated buildings market is divided into residential, commercial, and others. Among these, the residential segment accounted for a substantial share of the U.S. prefabricated buildings market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is due to the growing demand for affordable, quick-to-build housing. Rising urbanization, labor shortages, and cost-effective construction solutions have boosted the popularity of modular homes and apartment units, making residential applications the leading contributor to market growth and expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA prefabricated buildings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Plant Prefab

- Z Modular

- Morton Buildings Inc.

- Affinity Building Systems

- SG Modular

- Skyline Champion Corporation

- Varco Pruden

- Homette Corporation

- The High Construction Company

- American Buildings Company

- Westchester Modular Homes Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, Morton Buildings grew its operations in a new 67,429-square-foot factory at Pocatello Regional Airport Business Park. The Pocatello facility is Mortons eighth factory. It will inventory the company's building projects in Idaho, Montana, Washington, Wyoming, Colorado, Utah, and other local territories so that current and future building requirements are covered.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US prefabricated buildings market based on the below-mentioned segments:

United States Prefabricated Buildings Market, By Material Type

- Concrete

- Glass

- Metal

- Timber

- Others

United States Prefabricated Buildings Market, By Application

- Residential

- Commercial

- Others

Need help to buy this report?