United States Pressure Washer Market Size, Share, and COVID-19 Impact Analysis, By Type (Electric Pressure Washers, Gas-Powered Pressure Washers, and Battery-Powered Pressure Washers), By Application (Commercial and Residential/Household), By Distribution Channel (Online and Offline), and U.S. Pressure Washer Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Pressure Washer Market Insights Forecasts to 2033

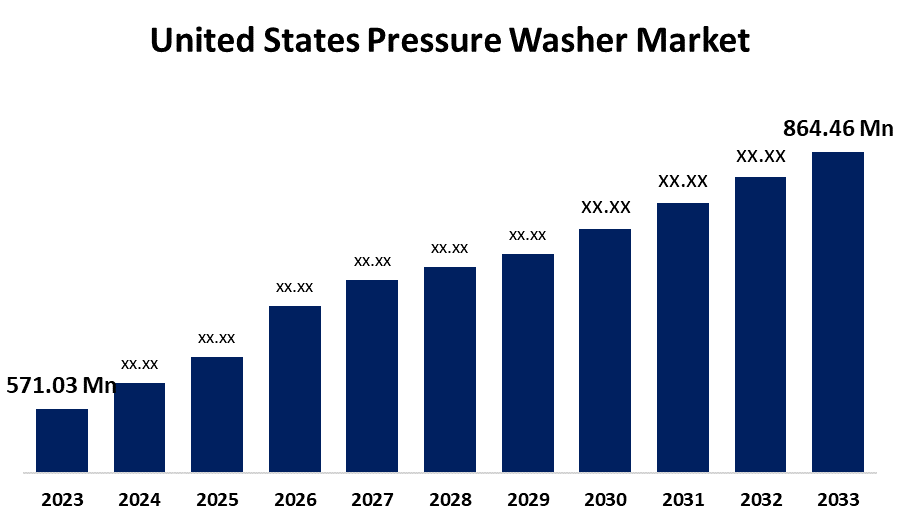

- The United States Pressure Washer Market Size Was Estimated at USD 571.03 Million in 2023.

- The Market Size is Growing at a CAGR of 4.23% from 2023 to 2033

- The USA Pressure Washer Market Size is Expected to Reach USD 864.46 Million by 2033

Get more details on this report -

The United States Pressure Washer Market Size is Expected to reach USD 864.46 Million by 2033, growing at a CAGR of 4.23% from 2023 to 2033

Market Overview

The manufacturing, marketing, and use of pressure washers for a range of cleaning purposes in the commercial, industrial, and residential sectors in the US are all included in the US pressure washer market. This market expansion is ascribed to the increasing demand for high-efficiency cleaning products in the commercial, industrial, and residential sectors. Pressure washers are becoming essential for jobs such as cleaning industrial equipment, automobiles, and residential exteriors since they are convenient and save time. Additionally, the market is shifting towards eco-friendly models, offering opportunities for innovation and differentiation, potentially capturing a larger share of the market through enhanced brand reputation and consumer trust. In addition, the market for pressure washers is being impacted by government laws on water use and environmental preservation, which are driving manufacturers to develop more effective models that satisfy a range of cleaning requirements. Also, government initiatives aid in market expansion. For instance, in January 2023, the U.S. Department of Commerce (Commerce) declared that it has begun investigating gas-powered pressure washers from China and the Socialist Republic of Vietnam (Vietnam) for antidumping duties (AD) and China-made gas-powered pressure washers for countervailing duties (CVD).

Report Coverage

This research report categorizes the market for the U.S. pressure washer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US pressure washer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA pressure washer market.

United States Pressure Washer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 571.03 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.23% |

| 2033 Value Projection: | USD 864.46 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By Application, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Greenworks North America LLC, Deere & Company, Alfred Kärcher SE & Co. KG,, AR North America, Simpson & Company LimitedDEWALT, DEWALT, RYOBI Limited, Sun Joe (Shop Joe/Joe Brands), Stanley Black & Decker, Inc., CRAFTSMAN, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US pressure washer market is experiencing steady growth due to rising demand for outdoor cleaning solutions, driven by increased investment in driveways, decks, patios, and vehicles. In addition, the increasing trend in outdoor aesthetics and hygiene necessitates the use of high-performance cleaning equipment as more people upgrade their outdoor spaces. Additionally, the US market is growing rapidly as a result of pressure washers' sophisticated features, cordless operation, and high-efficiency pumps, which are becoming more and more popular in sectors including construction, automotive, and agriculture.

Restraining Factors

The market for pressure washers in the United States is hampered by issues like the high initial cost of pressure washers, particularly industrial-grade machines, which remains a significant obstacle despite growing demand.

Market Segmentation

The U.S. pressure washer market share is divided into type, application, and distribution channel.

- The gas-powered segment accounted for the largest market share of 37.24% in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on the type, the U.S. pressure washer market is classified into electric pressure washers, gas-powered pressure washers, and battery-powered pressure washers. Among these, the gas-powered segment accounted for the largest market share of 37.24% in 2023 and is estimated to grow at a significant CAGR during the projected period. This segment is propelled by their exceptional power, robustness, adaptability, and effectiveness, they are perfect for demanding cleaning jobs in both residential and commercial environments. Furthermore, the growing popularity of do-it-yourself home renovation projects has raised demand for effective and potent cleaning products. Their popularity has also been boosted by the rise in both residential and non-residential construction projects.

- The commercial segment accounted for the highest market share of 57.12% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the U.S. pressure washer market is divided into commercial and residential/household. Among these, the commercial segment accounted for the highest market share of 57.12% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to commercial organizations that require high-efficiency cleaning solutions to maintain hygiene, aesthetics, and adherence to cleanliness requirements including cleaning services, hospitality enterprises, and retail outlets. In addition, pressure washers save time and money when used for cleaning driveways, sidewalks, parking lots, and building exteriors.

- The offline segment anticipated the largest market share of 65.90% in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the U.S. pressure washer market is divided into online and offline. Among these, the offline segment anticipated the largest market share of 65.90% in 2023 and is estimated to grow at a significant CAGR during the forecast period. Pressure washer sales have always been dominated by offline channels, which let buyers visually examine and contrast items before making a purchase. Their appeal has been influenced by this tactile feeling as well as the opportunity to consult sales professionals face-to-face.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. pressure washer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Greenworks North America LLC

- Deere & Company

- Alfred Kärcher SE & Co. KG,

- AR North America

- Simpson & Company LimitedDEWALT

- DEWALT

- RYOBI Limited

- Sun Joe (Shop Joe/Joe Brands)

- Stanley Black & Decker, Inc.

- CRAFTSMAN

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, the 40V max XGT 1300 PSI 1.5 GPM Pressure Washer (GWH01), introduced by Makita U.S.A., Inc., offers portable, high-performance cleaning that is perfect for jobs like patio furniture, gardening equipment, and car detailing; it guarantees flexible use. The GWH01 increases efficiency and is compatible with more than 125 XGT tools. It is powered by 40V max batteries. Makita's revolutionary design, which aims to redefine home and workspace cleaning with user-friendly functionality, was highlighted by Tyler Brown.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. pressure washer market based on the below-mentioned segments

U.S. Pressure Washer Market, By Type

- Electric Pressure Washers

- Gas-Powered Pressure Washers

- Battery-Powered Pressure Washers

U.S. Pressure Washer Market, By Application

- Commercial

- Residential/Household

U.S. Pressure Washer Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?