United States Private Banking Market Size, Share, and COVID-19 Impact Analysis, By Type (Asset Management Service, Insurance Service, Trust Service, Tax Consulting & Planning, and Real Estate Consulting), By Application (Personal and Enterprise), and United States Private Banking Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Private Banking Market Insights Forecasts to 2033

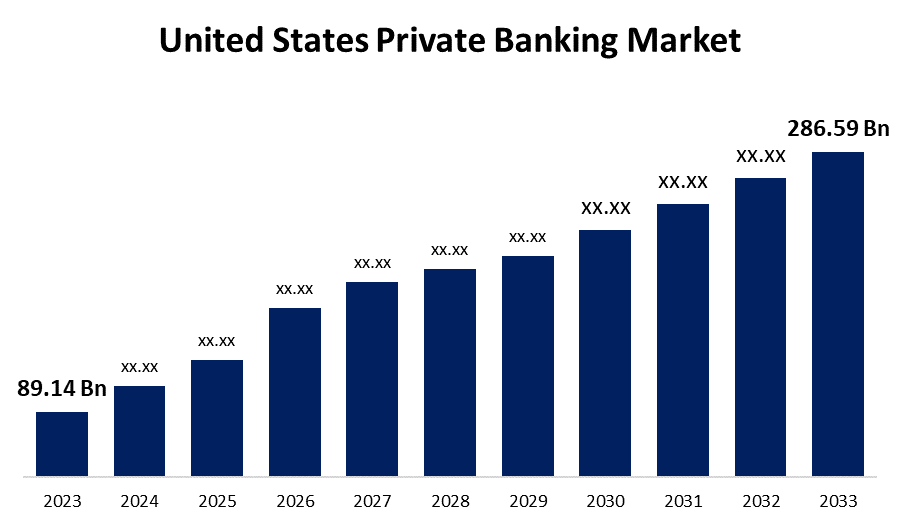

- The United States Private Banking Market Size was valued at USD 89.14 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.39 % from 2023 to 2033

- The United States Private Banking Market Size is expected to reach USD 286.59 Billion by 2033

Get more details on this report -

The United States Private Banking Market is anticipated to exceed USD 286.59 Billion by 2033, growing at a CAGR of 12.39 % from 2023 to 2033.

Market Overview

A private banking offering individualized financial services and products to high-net-worth individuals (HNWIs) who are registered customers of retail banks or other financial institutions. It provides a broad range of wealth management services, including insurance, tax services, investment and portfolio management, and trust and estate planning. In addition, private banking offers customers a range of advantages, rights, and individualized care a commodity that has grown in value in an automated, digital banking environment. For example, entrance to a hedge fund, private equity partnership, or other alternative investment may be restricted to high-net-worth individuals. Therefore, it is anticipated that shortly, the market growth of the private banking sector can be boosted by advantageous rates, discounted charges, and easy accessibility to financing services. The expansion of the private banking sector in the US is largely due to globalization. As cross-border wealth management and international business activity grow, high-net-worth individuals are turning to financial services.

Report Coverage

This research report categorizes the market for the United States private banking market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States private banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States private banking market.

United States Private Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 89.14 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 12.39 % |

| 023 – 2033 Value Projection: | USD 286.59 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Morgan Stanley, U.S. Bancorp, Citigroup, Wells Fargo & Company, Charles Schwab, JP Morgan Chase & Co, The Goldman Sachs Group, Inc., Bank of America Corporation, Raymond James, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Increasing demand for private equity, rising transparency due to the increased use of digitalization in the financial segment, and the need for better customer experience propel the growth of the market. Furthermore, the increase in the number of start-ups and businesses in the United States focused on accelerating their income and profitability provides great market expansion opportunities. Moreover, Private banks serve a wide range of clients with assets dispersed throughout the United States, due to their proficiency in navigating the intricate financial system. These factors drive the growth of the private banking market.

Restraining Factors

One of the major barriers affecting the private banking industry is market volatility. The performance of investment portfolios handled by private banks can be impacted by changes in market dynamics and economic conditions because they rely on investment activity. Additionally, evolving and strict regulations can hinder the growth of the private banking market.

Market Segmentation

The United States private banking market share is classified into type and application.

- The asset management service segment is expected to hold the largest market share through the forecast period.

The United States private banking market is segmented by type into asset management service, insurance service, trust service, tax consulting & planning, and real estate consulting. Among these, the asset management service segment is expected to hold the largest market share through the forecast period. The rising need for diversification is a main factor driving asset management services in the private banking market. High-net-worth customers search for investment portfolios that extend a diversity of asset classes to alleviate risk. Asset management services provide to this demand by offering access to a wide range of investment prospects, such as fixed income, equities, real estate, and alternative investments.

- The personal segment dominates the market with the largest market share over the predicted period.

The United States private banking market is segmented by application into personal and enterprise. Among these, the personal segment dominates the market with the largest market share over the predicted period. The start of the private banking service for HNWIs is boosting the expansion of the market. By spreading services to previously underserved areas, financial institutions are catching new customs with important wealth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States private banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Morgan Stanley

- U.S. Bancorp

- Citigroup

- Wells Fargo & Company

- Charles Schwab

- JP Morgan Chase & Co

- The Goldman Sachs Group, Inc.

- Bank of America Corporation

- Raymond James

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, Wells Fargo & Company announced a new $30 billion program for the repurchase of common stock and increases the dividend on common stock.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States private banking market based on the below-mentioned segments:

United States Private Banking Market, By Type

- Asset Management Service

- Insurance Service

- Trust Service

- Tax Consulting & Planning

- Real Estate Consulting

United States Private Banking Market, By Application

- Personal

- Enterprise

Need help to buy this report?