United States Private Equity Market Size, Share, and COVID-19 Impact Analysis, By Investment Type (Large-Cap, Mid-Cap, and Small-Cap), By Fund Type (Buyouts, Venture Capital, Real Estate, Infrastructure, and Others), and United States Private Equity Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUnited States Private Equity Market Insights Forecasts to 2033

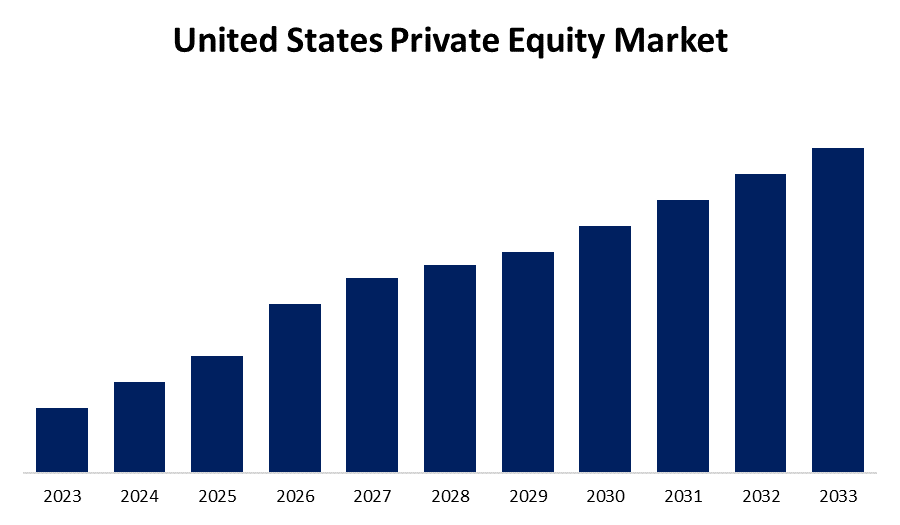

- The Market is growing at a CAGR of 10.86% from 2023 to 2033

- The United States Private Equity Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The United States Private Equity Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 10.86% from 2023 to 2033. The consistent inflow of cash from institutional investors, endowments, pension funds, and high-net-worth individuals powers the US private equity market.

Market Overview

Private equity is a type of investment in which assets are pooled from a variety of sources, including institutional investors, high-net-worth individuals, and pension funds, to purchase ownership holdings in private enterprises. Unlike publicly traded firms, these investments are not traded on stock markets. Private equity firms use these funds to acquire a major piece or all of a company, to increase its value over time through active management tactics. They collaborate closely with the acquired company's management to make operational improvements, strategic adjustments, and growth plans that will maximize its performance and, eventually, provide returns for investors. Private equity covers a wide range of business phases, from startups to existing enterprises, and frequently entails restructuring, expansion, or turnaround initiatives that reveal the company's maximum potential before exiting the investment through channels such as IPOs or sales. Cross-border deals, collaborations, and portfolio diversification provide access to new markets, various income streams, and potential synergies, hence driving growth and profitability in the US private equity market.

Report Coverage

This research report categorizes the market for the United States private equity market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States private equity market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States private equity market.

United States Private Equity Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.86% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Investment Type, By Fund Type |

| Companies covered:: | Carlyle Group, Gottenberg Associates, Chicago Capital, Vista Equity Partners, Blackstone, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The US private equity market is driven by the steady flow of capital from institutional investors, pension funds, endowments, and high-net-worth individuals. Due to the abundance of funds, private equity firms are able to explore investment opportunities in a wide range of industries and corporate growth phases. The diversified landscape of sectors and businesses in the United States creates several chances for private equity investment. Market segmentation enables private equity companies to specialize in specific industries, employing their knowledge to uncover undervalued assets and add value through operational changes or strategic initiatives.

Restraining Factors

Financial market volatility and economic unpredictability offer major risks to private equity investments. Sudden downturns can lower asset values, raise financing costs, and disrupt exit options, affecting investment returns and portfolio performance.

Market Segmentation

The United States private equity market share is classified into investment type and fund type.

- The large-cap segment is expected to hold a significant market share through the forecast period.

The United States private equity market is segmented by investment type into large-cap, mid-cap, and small-cap. Among these, the large-cap segment is expected to hold a significant market share through the forecast period. Large-cap private equity transactions require huge sums of capital and target established companies with high market capitalizations. Large-cap transactions frequently include high-profile acquisitions and strategic collaborations aimed at increasing operational effectiveness and unlocking value for investors.

- The buyouts segment is expected to hold a significant share of the United States private equity market during the forecast period.

Based on the fund type, the United States private equity market is divided into buyouts, venture capital, real estate, infrastructure, and others. Among these, the buyouts segment is expected to hold a significant share of the United States private equity market during the forecast period. The increased desire for buyout funds, which involves acquiring a well-established company with significant expansion potential, is driving the rise of this market. Buyout funds allow investors to acquire the majority of market share, take command of companies, simplify operations, and stimulate wealth creation through hands-on management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States private equity market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carlyle Group

- Gottenberg Associates

- Chicago Capital

- Vista Equity Partners

- Blackstone

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, A definitive agreement was signed by Cvent Holding Corp., a prominent provider of hospitality, events, and meeting technologies, to be purchased by a Blackstone-managed private equity fund affiliate. The transaction is estimated to have an enterprise value of about USD 4.6 billion.

Market Segment

This study forecasts revenue at the US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Private Equity Market based on the below-mentioned segments:

United States Private Equity Market, By Investment Type

- Large-Cap

- Mid-Cap

- Small-Cap

United States Private Equity Market, By Fund Type

- Buyouts

- Venture Capital

- Real Estate

- Infrastructure

- Others

Need help to buy this report?